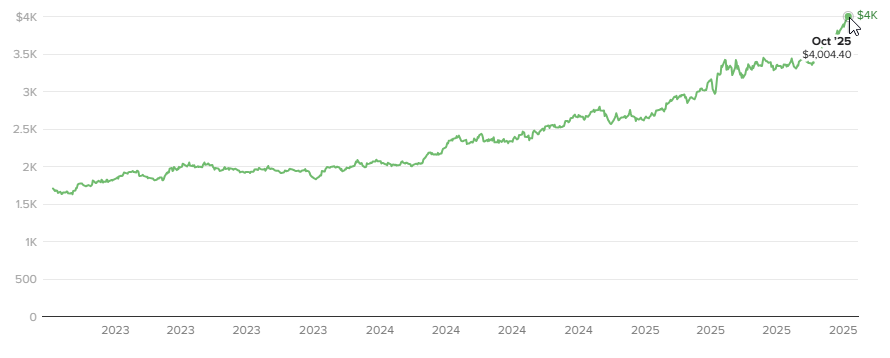

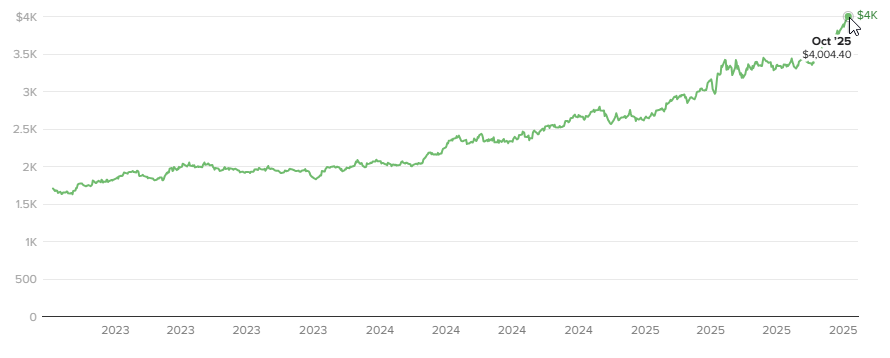

Gold’s price surge has pushed the precious metal above $4,000 per ounce right now, and this milestone is being viewed by many economists as a troubling indicator for what’s ahead. This gold market warning actually reflects growing concerns about a US economy slowdown, with investors turning to gold as an inflation hedge amid shifting Federal Reserve policy decisions. The rally signals deeper anxieties about America’s economic health, and also highlights how uncertain markets have become.

Gold Price Surge Sparks US Economy Slowdown Fears

Record Prices Signal Economic Trouble

The gold price surge to record levels above $4,000 actually reflects some serious concerns about financial stability right now. Goldman Sachs raised its December 2026 forecast to $4,900 per ounce, which highlights how this gold market warning has intensified recently. The Federal Reserve policy approach to interest rates has been weakening the dollar, and this makes gold more attractive to buyers globally.

Also Read: Can XRP Join Gold and Silver in the Safe-Haven Race?

Bret Kenwell (eToro U.S. investment analyst) said:

“$4,000 an ounce seemed far-fetched at the start of the year as gold entered 2025 near $2,800 an ounce. But after a ~50% rally, here we are.”

Joe Cavatoni, a market strategist at the World Gold Council, had this to say on this topic:

“We’re seeing significant inflows into gold-backed exchange-traded funds.”

Why Gold Prices Are Climbing

The US economy slowdown fears are actually being validated by gold’s performance at the time of writing. Investors see gold as an inflation hedge when traditional assets face pressure, and even central banks worldwide are accumulating reserves at unprecedented rates right now. This adds to the gold price surge momentum, along with concerns about currency stability. James Steel, who is also chief precious metals analyst at HSBC Securities, explained how the situation has developed over recent months.

Also Read: Wall Street Buys 1,300+ Tonnes of Gold Before BRICS Currency Launch

Bart Melek (head of commodity strategy at TD Securities) said:

“Gold may be a better safe-haven than Treasuries. Add to that the fact that ore grades are dropping, the increased use of these factors of production suggests that gold would be better at protecting purchasing power.”

What This Means for the Economy

Paolo Pasquariello (professor of finance at the University of Michigan) thinks that:

“There’s no way you can interpret these exploding gold prices as a good sign — they’re a warning sign. There’s clearly a case to be made that these high gold prices are a leading indicator of troublesome times ahead for the U.S. economy.”

This gold market warning actually implies that financial markets are thinking about and planning for some major challenges in the future. The combination of Federal Reserve policy uncertainty and dollar weakness has been a combination in which gold flourishes as a safe haven asset. The US economy slowdown fears also reflected in these prices reflect the fact that investors are planning for long-term economic troubles and they’re using gold as a hedge against inflation and other risks from devaluation of currencies.