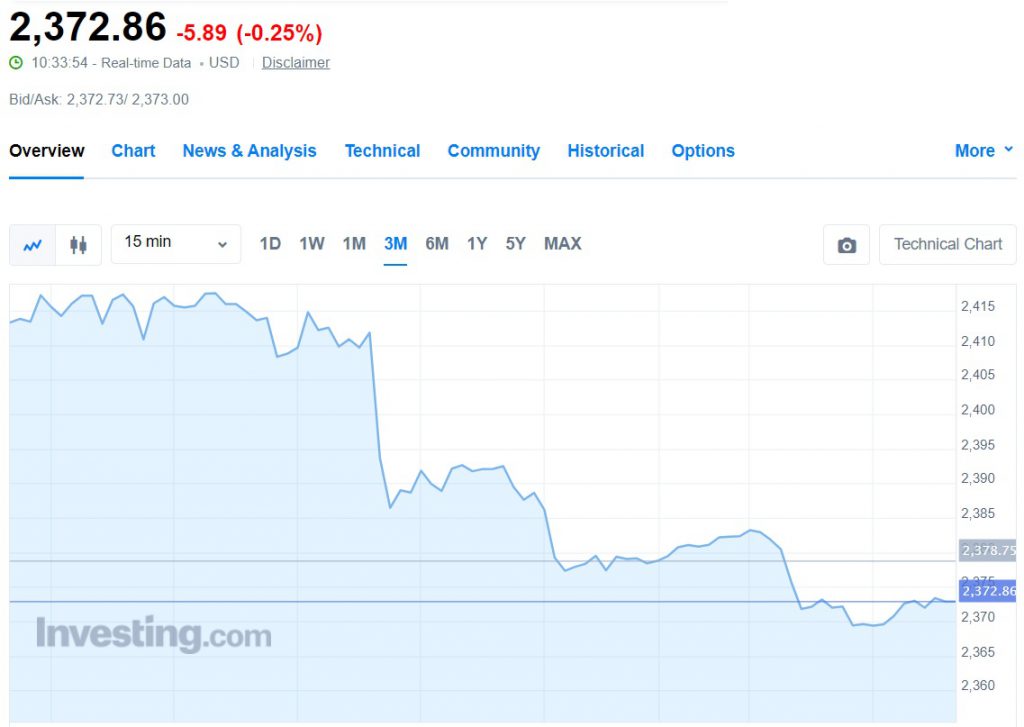

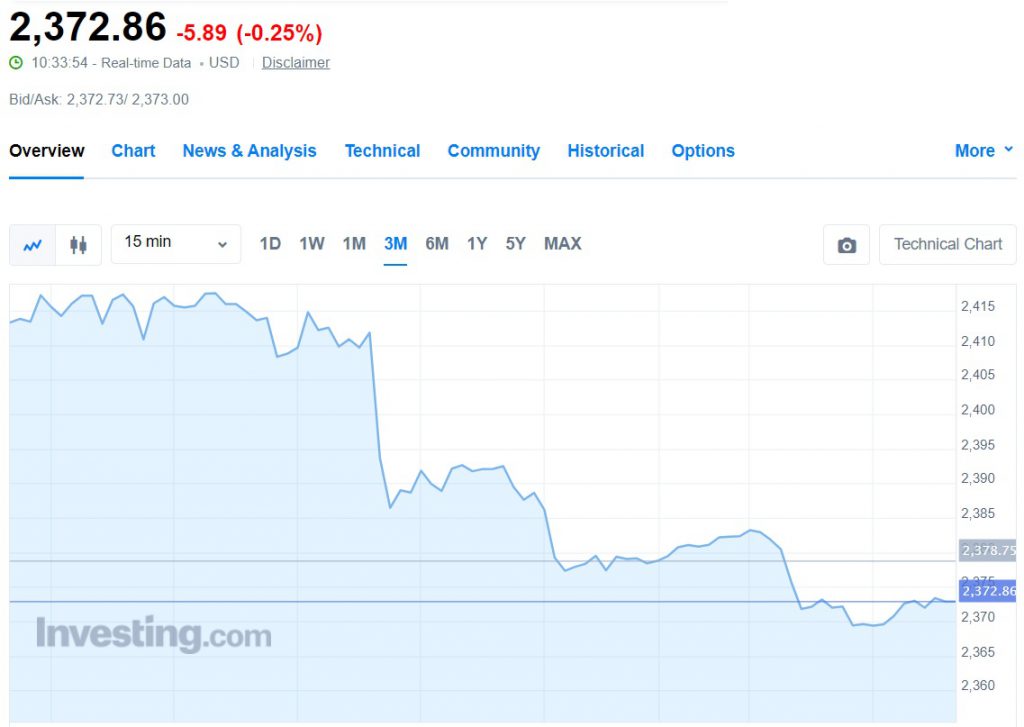

Gold prices were trading at a high of $2,415 on Thursday but experienced a sudden dip falling below the $2,400 mark. The XAU/USD chart, which measures the performance of gold prices shows the precious metal trading at $2,372 today. It dipped by nearly 6 points during the opening bell and is down close to 0.25% in the day’s trade.

Also Read: Nancy Pelosi Makes $10 Million in Just 22 Days in May

The prices of gold dipped today over fears of the Feds’ initiating rate cuts over sticky inflation development. Therefore, the precious metal fell from a high of $2,450 last week to the $2,372 level currently. This puts pressure on the XAU/USD index as it failed to hold on to its resistance level of $2,450.

Also Read: Commodity Market: Silver up 35%, Copper Surges 28%, Gold Rises 18%

Gold Prices Dipping Today: So What’s Next For the Precious Metal?

The slump in gold prices today indicates that traders are initiating sell-offs. The profit bookings from investors are making prices head south before the next Feds’ minute meeting. However, the fall could be temporary as buying activity has not waned from investors across the globe. Read here to know a realistic price prediction on when gold prices could breach the $7,000 threshold.

Also Read: 10 ASEAN Countries To Ditch the U.S. Dollar

Retail holders, institutional funds, and central banks of developing countries are constantly buying the precious metal and accumulating more. A recent forecast suggests that gold prices could breach the $2,500 mark in the next two months. That’s a spike of nearly 6% for the precious metal from today.

Bloomberg’s Commodity Strategist Mike McGlone previously predicted that gold could hit $2,500 this year in 2024. If it holds on to the resistance level, then the next leg for the precious metal is at $2,700. Several experts have also forecasted that gold could breach the $3,000 mark in 2025 or 2026. Therefore, while gold prices are down today, it is providing ample buying opportunity for investors, according to analysts.