Gold prices are skyrocketing in the charts as the XAU/USD index touched an all-time high of $2,125 on Tuesday. The precious metal is now printing new highs every week attracting heavy bullish sentiments from investors across the world. The development is making gold glitter as the sudden spurt in price is delivering handsome returns to traders.

Also Read: Ripple (XRP) Forecasted To Climb Above $1.7: Here’s When

While gold prices were below the $2,125 mark a month ago, things took a U-turn during February end and March. Investors who took an entry position buying the dips last month are currently seeing their portfolios balloon to new highs.

Also Read: BONK Turns $10,000 Investment Into $4 Million in March 2024

Gold Prices To Reach $2,700: Forecast

Now that gold prices hit a high of $2,125, the latest price prediction claims that the precious metal is on the verge of igniting a rally. The XAU/USD charts could kick-start a bull run and hit new highs in the coming months and years.

Also Read: Shiba Inu (SHIB) Forecasted To Surge 300%: Here’s When

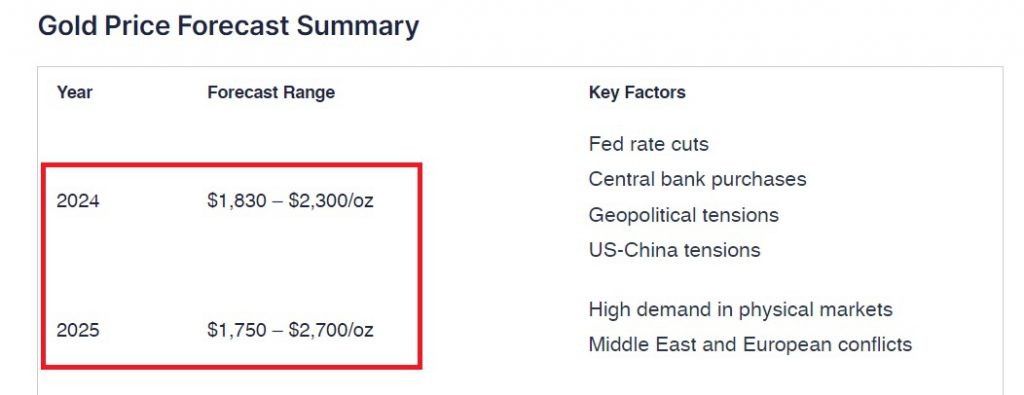

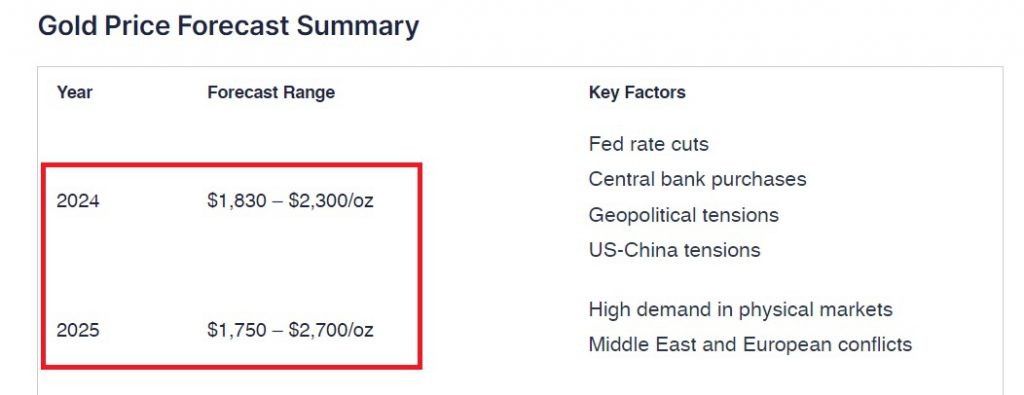

Leading on-chain metrics and price prediction firm Techopedia published a new forecast for gold prices this week. According to the price prediction, gold could climb above the $2,700 mark sometime next year in 2025.

The forecast indicates that gold prices could reach a high of $2,700 in 2025. However, if the market gets impacted by economic headwinds, the downside stands at $1,750. The spike in gold prices could come after high demand in the commodity markets. Also, the conflict in the Middle East and the war in Russia and Ukraine could be the cause of a downturn.

Also Read: Dogecoin Forecasted To Surge 250%

In addition, the estimate also points towards gold ending the year 2024 at a high of $2,300. The key factors that would push the prices up are the Fed rate cuts and gold accumulation from Central Banks.

In conclusion, gold is now seen as a promising investment that could outperform other investments in the market. This puts the precious metal on the bucket list of a ‘strong buy’ call from the price prediction firm.