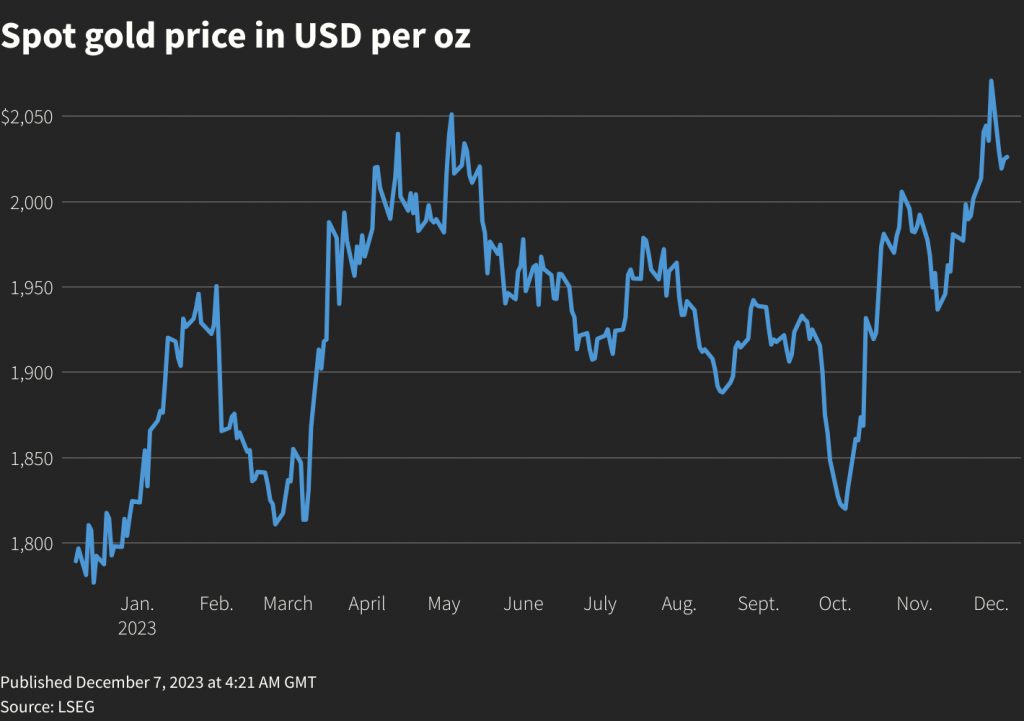

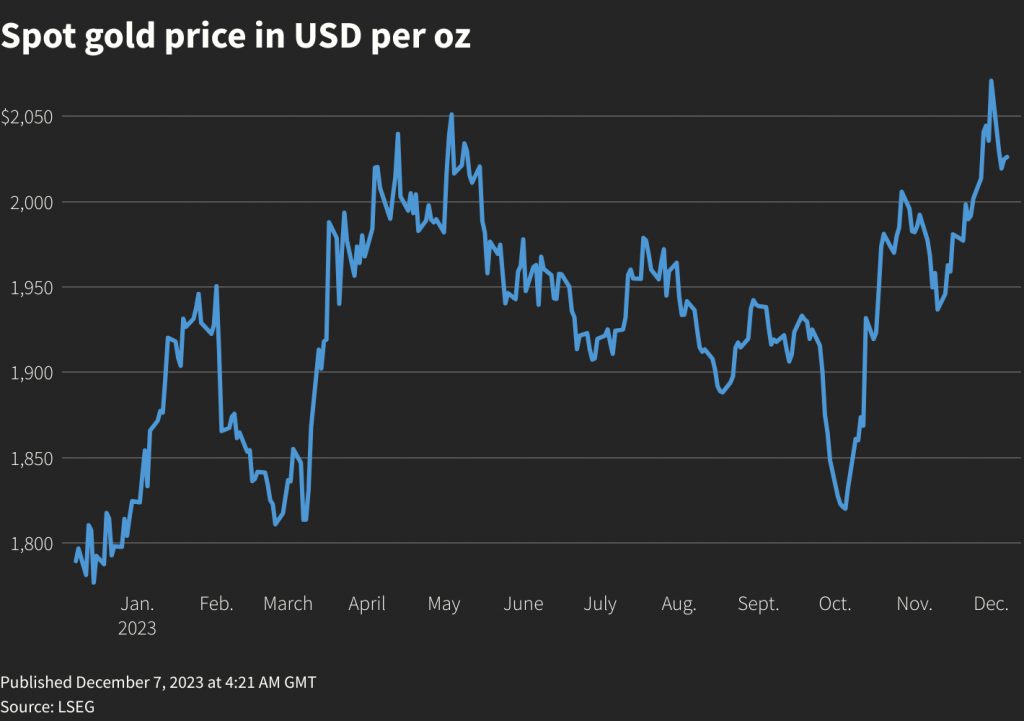

Gold prices rose on Thursday while the US dollar fell. Spot prices increased 0.3% to $2,030.20 per ounce, while futures held steady at $2,047.10. The US dollar index (DXY) fell 0.3% against other currencies, making gold cheaper for rival denominations. Furthermore, 10-year Treasury note yields almost reached a near three-month low.

Also Read: BRICS, Gold, and Bitcoin: Why 2024 is Trouble for the US Dollar

Investors now eye the US payrolls data, due later this week. The payrolls data could give investors a hint about the Federal Reserve’s interest rate plans.

Will there be a gold sell-off?

According to US data, there was a gradual cooling in the labor market. Job openings fell to a two-and-a-half-year low in October 2023. On the other hand, private payrolls increased less than expected in November. Moreover, the non-farm payroll data for the US is due on Friday, which could hint at the Fed’s next move.

Also Read: BRICS: China Aggressively Dumps US Dollars For 3 Days Straight

According to Nicholas Frappell, global head of institutional markets at ABC Refinery, “The expectation broadly will be for a lower non-farm number, so if it comes in at expectations or higher, you might expect a bit of a sell-off in gold.“

Dovish comments from the Fed and cooling CPI (Consumer Price Index) figures have fueled speculation that interest rates may have already peaked in the US, and the central bank may begin to cut rates. According to CME’s FedWatch Tool, there is a 60% chance that the Federal Reserve will cut interest rates by March 2024.

According to ANZ analysts, “While retreating inflation raises the risk of real rates rising in H1 2024, rate cuts later in the year should be supportive for gold investment demand.” They further added, “We expect gold to trade above $2,000/oz next year as strong central bank purchases will be joined by strategic investment demand.”

Nonetheless, the possibility of a recession in the US still looms overhead. Some analysts have said the US could fall into a recession as early as next year.