Gold rates are currently experiencing a pivotal time in history. The price of gold has now hit $4800 at press time, after claiming a high of $5500, its largest price threshold in history. The markets are currently drowning in macro developments, with Trump tariff developments and Fed independence taking a toll on the market. Amid such turbulent market scenarios, how will gold rates and prices perform within the next 6 months? Let’s find out.

Also Read: Volatility Sends Bitcoin Price Crashing: Analyst Sees $62K or $200K

Gold Rates: Popular Price Predictions by Analysts

Gold rates are currently stable at $4800, having risen significantly from theirby earlier crash threshold of $4500. The safe haven migration continues to be a big topic among investors across the board, as gold,theirgold, being the ultimate hedge against inflation phethe inflationnomenon the inflationphenomenon,gains momentum among the masses. Per Katusa Research, every major asset explores a phenomenon,experiencesnotable correction, the one that sets its tone for the years to come. The portal outlined a significant example of gold’s violent crash in 1974, after which it surged 734% to its current price of $4800.

“Every major gold bull market has had brutal mid-cycle corrections that felt like the end. The 1974 correction (-47%) is a killer comparison. Nearly half the value wipexperiencesvalue wased out value wasout.Everyone declared gold dead. And then it ran 734% over the next six years. The current 16% pullback is actually modest by historical standards. In the context of the 1970s, this wouldn’t even rank among the top five corrections. And critically, none of the structural drivers have changed. Tether is still buying, central banks are still accumulating, debout.accumulating, andt is still expanding.”

Gold $8K Prediction

Per the current circumstances, gold and silver may continue to gain more pace accumulating, andpace,as the new Fed chair selection and lower interest rate scenario may end up weighing on the USD pace,USD,making safe haven assets appear more lucrative. Per Rashad Hajiyev, gold may hit a new high price mark of $8K, beating all odds in the end.

“With the reset in sentiment over the past few days, gold could reach $8kUSD,reach the level in two legs. First leg to $6k, pause,reach thepause, and then run to $8k before year-end 2026… This post is notinvestment advice…”

Gold Six-Month Forecast

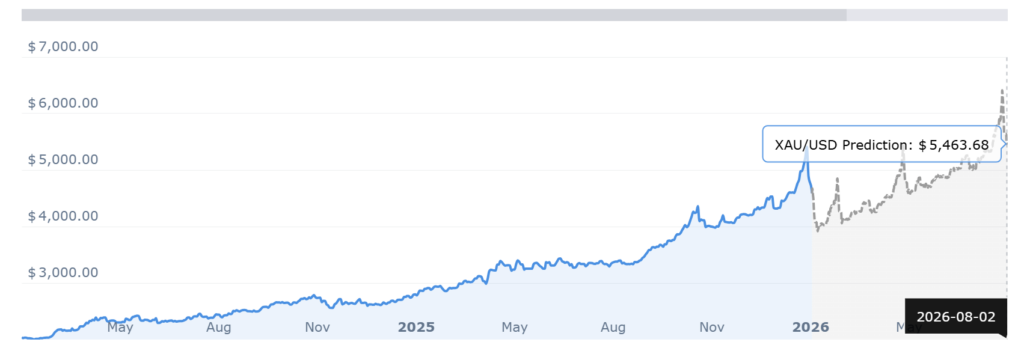

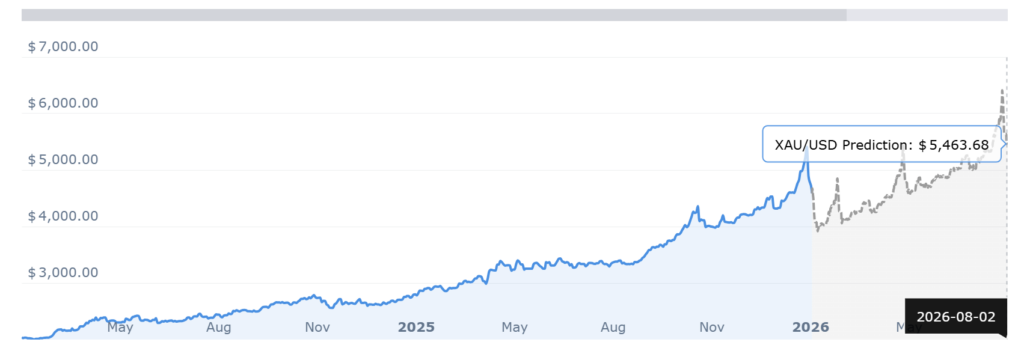

According to CoinCodex gold stats, gold rates may surge to sit at $5400 by June/July 2026.

“The price of gold is forecasted to hit $7,027.83by the end of 2026 (comparedto current rates) andrates) and $10,457 by the end of 2030. All values represent end-of-year price estimates according to our models.”

Also Read: US Dollar Value Is Falling: Here Are 3 Trends Driving the Decline