Gold vs silver returns in 2025 have been quite remarkable to observe, with both precious metals showing strong performance amid all the market uncertainty we’re seeing right now. As investors are searching for safe places to put their money, these traditional safe-haven assets have delivered some impressive gains, even though their performance patterns are quite different from each other.

Also Read: Chinese Yuan Falls To Lowest Level Against US Dollar In 2 Years

Unpredictable market conditions: How Gold and Silver Outperformed in 2025

Recent Price Movements

Gold vs silver returns in 2025 show that gold has reached record highs of $3,167 per Troy ounce before experiencing some pretty significant turbulence following Trump’s “Liberation Day” trade tariffs. After briefly dipping below the $3,000 mark on April 7, the yellow metal managed to recover to around $3,040, which demonstrates its resilience despite all the market shocks we’ve been seeing lately.

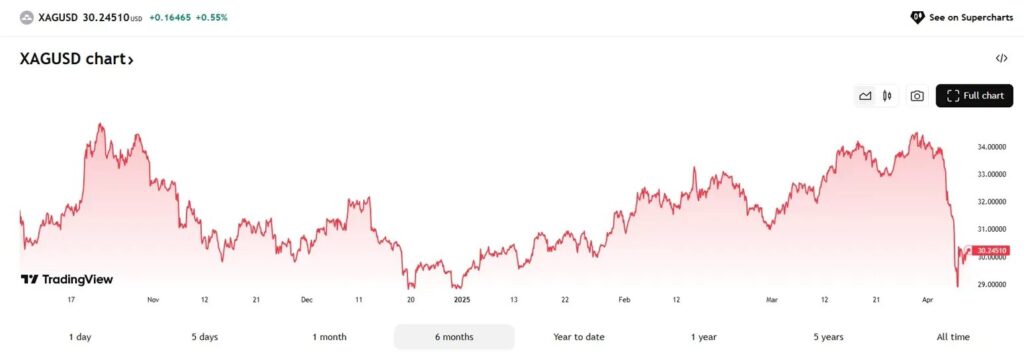

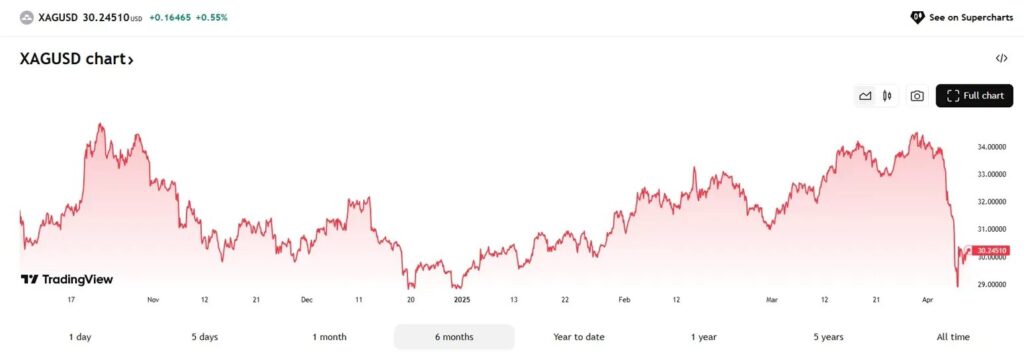

Silver, at the same time, has climbed above Rs 1 lakh per kilogram and also the $30 per Troy ounce level, rallying nicely after experiencing a 4.3% drop to 7-month lows. This pattern actually aligns with historical trends where silver tends to outperform during precious metals bull runs.

Bruce Ikemizu, chief director of the Japan Bullion Market Association, stated:

“The sharp drop in stock prices triggered margin calls for hedge funds last week, prompting them to sell gold and raise cash.”

Comparative Performance

When we take a closer look at gold vs silver performance this year, it’s pretty clear that silver has outpaced gold with returns of approximately 34% compared to gold’s still impressive 26%. The Gold-Silver Ratio currently stands at around 100, which has been described in the source material as “Great Depression-era lows” for silver’s relative value.

Central bank purchases continue supporting gold investment trends in 2025, with China adding around 3 tonnes to its reserves in March, marking five consecutive months of acquisitions, which is definitely something worth noting.

Daniel Hynes, senior commodity strategist at Australasian bank ANZ, noted:

“We don’t expect the gold sell-off to be prolonged.”

Also Read: This $1K Nvidia Investment in 2014 Could’ve Changed Your Life—Here’s Why

Silver’s Industrial Advantage

Silver’s dual role as both a monetary and an industrial metal provides a distinct advantage in gold vs silver returns in 2025. America’s Silver Institute expects industrial demand to exceed 700 million ounces this year, with clean energy technologies and electronics driving the surge.

The solar industry alone accounts for nearly 15% of total silver consumption, while advancements in artificial intelligence and high-performance semiconductors further boost demand. This industrial component essentially gives silver a performance edge that is not really seen with gold.

Supply and Future Outlook

Silver price prediction for 2025 remains quite positive, supported by persistent supply deficits. The market experienced a shortfall of over 200 million ounces in 2024, one of the largest in recent history, creating favorable conditions for continued price appreciation going forward.

Bruce Ikemizu also added:

“Below $3000, I believe central bank buying is likely to provide support for gold, just like the surge we saw from Thursday’s lows.”

Anticipated Federal Reserve rate cuts in 2025 also support gold investment trends by enhancing the appeal of precious metals and reducing the opportunity cost of holding non-yielding assets like gold and silver.

Also Read: De-Dollarization: 11 Former Soviet States Drop US Dollar in 2025 Shift

In conclusion, while both metals have delivered strong gold vs silver returns in 2025, silver’s industrial applications and relative undervaluation position it to continue outperforming. Investors seeking to capitalize on precious metals’ strength may find particular opportunity in silver, though both metals serve as important portfolio diversifiers during these uncertain economic times.