The US markets have been experiencing tumultuous times, with gold dominating the majority of the asset classes. At the same time, Bitcoin has turned out to be one of the worst-performing assets of 2025. However, the ebb and flow of these assets has already started to set a compelling stage for 2026, with new asset domains popping up to crush the new market scenario. Which of the trending asset sectors may end up winning the ultimate profit race in 2026?

Also Read: Pi Coin Jumps 14% in 24 Hours, Outshines Bitcoin: Here’s Why

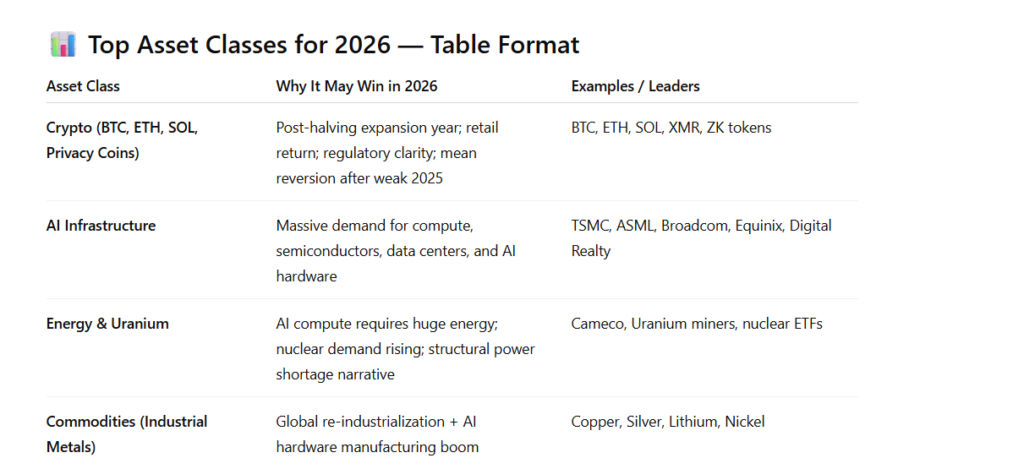

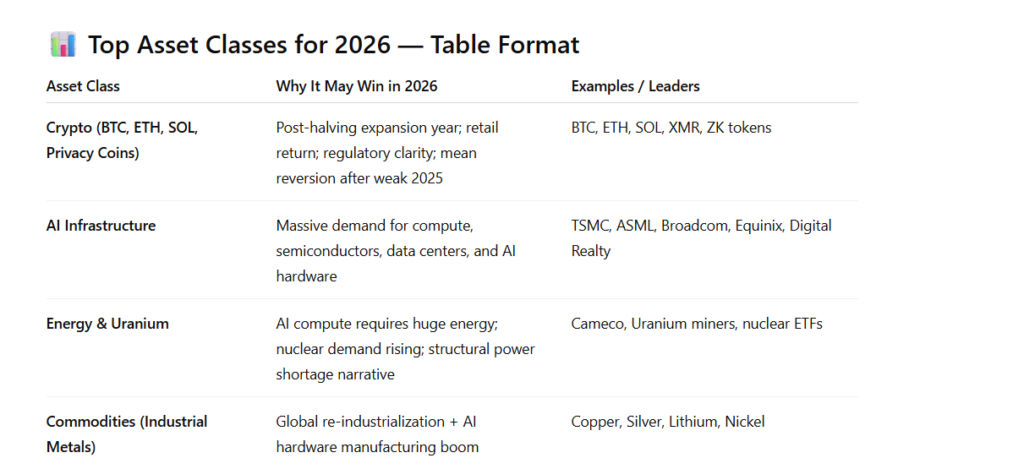

AI Predicts 3 Asset Classes Ready To Sweep Away 2026

1. Bitcoin and Crypto

The changing dynamics of the US dollar, coupled with escalating geopolitical tensions, have prompted investors to explore alternative asset classes. Bitcoin has recently hit an all-time low of $88K, but predictions have already started to ramp up, with some suggesting that Bitcoin’s corrective phase will end in 2026. This scenario could help Bitcoin and other alternative cryptocurrency coins to note new highs in 2026, with this asset class booming to explore new price highs.

2. AI Infrastructure

Per ChatGPT, the AI bubble is as real as it gets, with the AI revolution taking center stage in 2026. On a global pedestal, AI infrastructure sectors such as semiconductor foundries, chip machinery, data centers, and AI compute elements can play a huge role in shaping global market narratives, booming gradually over time.

3. Commodities Such As Uranium, Lithium, and Silver/Energy Sectors

With the rising demand for AI computing, elements to power such tools may also rise, delivering a sharp hike in the prices of uranium. Moreover, rapid energy usage and industrialization may also help commodities such as silver and lithium to explore new highs, investments in which can deliver steady market returns over time.

Also Read: Brian Armstrong: Extreme Fear, But Crypto Rules Are Closer Than Ever