Gold (XAU/USD) prices are recovering some lost ground Friday following sharp declines that pushed bullion to multi-week lows earlier in the week. Gold XAU/USD is currently changing hands near $2,021, down by 1.92% in the last 24 hours.

The small rebound comes even as U.S. dollar stabilization puts a cap on significant upside momentum. The dollar index currently hovers just above 103.40 against a basket of currencies. An ongoing rise in U.S. Treasury yields has also curbed investor appetite for non-yielding gold.

Stronger than expected U.S. economic releases on Thursday have further dampened gold spirits. Both jobless claims and a regional Fed manufacturing gauge bested economist forecasts, signaling resilient economic momentum despite rate hikes intended to slow growth.

Also read: Gold Price Drops Below $2050, How Will Price Perform In 2024?

How high can gold go during the weekend?

Markets still see decent odds of a rate decrease by March. However, gold bulls seem increasingly skeptical as markets price in higher terminal rate expectations.

Without a Fed pivot on the horizon, gold could face additional selling interest to close out the week. Prices have already dropped below $2,050 support this week to trade at their lowest since late December.

Some analysts see gold stabilizing around current levels in the very near term. However, most maintain a bearish bias given rising yields, dollar strength, and still-elevated inflation, which are likely to keep the Fed in tightening mode for longer.

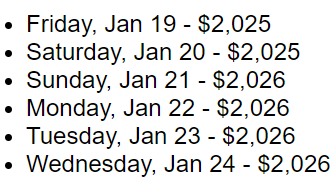

According to CoinPriceForecast analysis, gold’s price could reach a range of $2025–$2026 this weekend. For now, gold seems unlikely to find much cover ahead of the weekend.