Goldman Sachs has recently updated its June conviction list with several new additions, and three of these picks are dividend stocks that offer substantial upside potential right now. The investment banking giant identified these dividend stocks to buy now as having strong fundamentals and targeting gains of 20% or more.

Among the high yield stocks 2025 selections, these represent some of the best dividend stocks with upside according to Goldman’s research team. At the time of writing, the June conviction list features Capital One Financial, Mid-America Apartment Communities, and Universal Display as top opportunities for income-focused investors.

Also Read: Goldman Sachs: MAG7 Hits 7-Year Low Amid AI, Trade & Antitrust Fears

Top High-Yield Stocks From Goldman’s June Conviction List 2025

Goldman Sachs operates one of Wall Street’s most closely watched conviction lists, and the June additions have been carefully selected based on extensive analysis. The firm added four new stocks to the conviction list in June, with three of these being dividend stocks to buy now that offer 20% or more upside potential. Each of these high yield stocks 2025 selections provides both reliable income and significant capital appreciation prospects for investors.

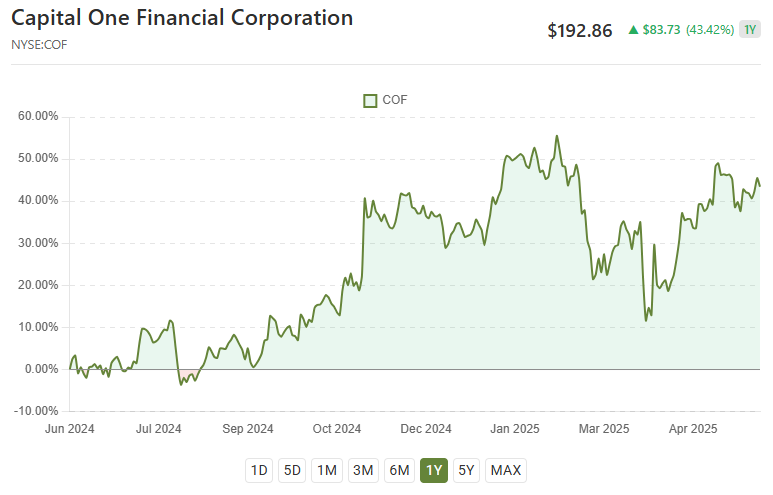

1. Capital One Financial – Banking Giant with 28% Upside

Capital One Financial has been given a price target of $242 by Goldman, which represents a 28% increase from current trading levels around $192.86. The diversified financial services company operates through three main business segments that have been driving consistent performance across different market conditions.

The Credit Card segment handles domestic consumer and small business card lending, and also includes international card operations in the United Kingdom and Canada. The Consumer Banking segment focuses on deposit gathering and lending activities for consumers and small businesses, along with national auto lending services. Capital One’s Commercial Banking segment provides treasury management services to commercial real estate and commercial and industrial customers.

With a dividend yield of 1.23% and a market cap of $125.23 billion, this pick appeals to both growth and income investors who are looking for exposure to the financial services sector right now.

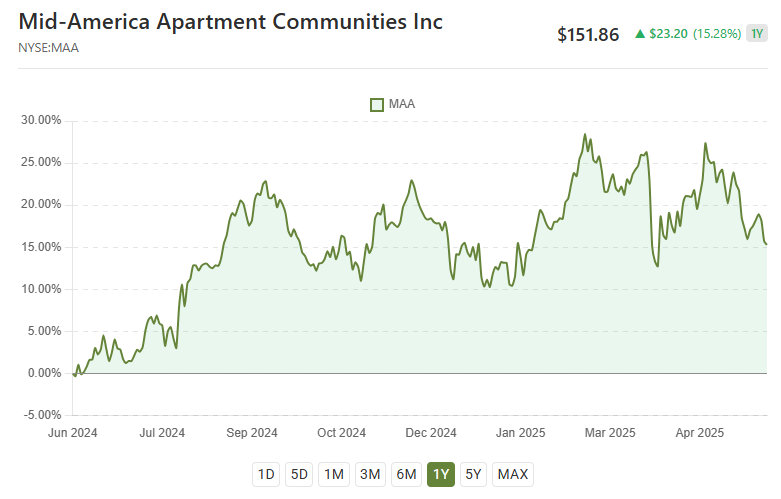

2. Mid-America Apartment Communities – REIT with Steady Returns

Goldman Sachs has assigned Mid-America Apartment Communities a price target of $192, which represents a 23% gain from the current price of approximately $151.86. This real estate investment trust specializes in multifamily housing and benefits from strong rental demand across its geographic footprint.

The company owns, operates, acquires, and selectively develops apartment communities that are primarily located in the southeast, southwest, and mid-Atlantic regions of the United States. These markets have been experiencing population growth and economic expansion, which supports both rental demand and pricing power for property owners.

MAA’s Same Store segment represents those apartment communities that the company has owned and stabilized for at least 12 months as of the first day of the calendar year. The Non-Same Store and Other segment includes recently acquired communities, developments that are in progress, and properties that the company has identified for disposition.

With a dividend yield of 3.98%, MAA represents one of the best dividend stocks with upside among the high yield stocks selections for 2025, offering attractive income generation for conservative investors seeking real estate exposure.

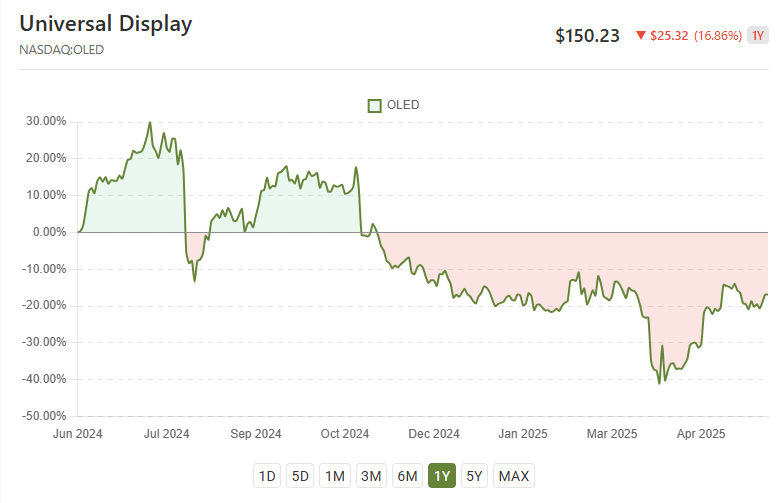

3. Universal Display – Technology Play with Growth Potential

Universal Display Corporation trades on NASDAQ under the symbol OLED at around $150.23, and the company engages in research, development, and commercialization of organic light-emitting diode (OLED) technologies and materials. These materials are used in display and solid-state lighting applications across various industries.

OLED technology has been gaining adoption across multiple consumer electronics products, including smartphones, televisions, and automotive displays. Universal Display’s business model focuses on licensing its proprietary OLED technologies and selling OLED materials directly to manufacturers, which has been generating steady revenue streams.

This approach provides the company with exposure to the growing demand for advanced display technologies while also maintaining recurring revenue from licensing agreements. With a dividend yield of 1.20% and a market cap of $7.14 billion, the stock appeals to investors who are seeking growth opportunities in the technology sector while still receiving some income.

Also Read: Nvidia Becomes the World’s Most Valuable Company

The three Goldman Sachs conviction list additions for June represent diverse opportunities across banking, real estate, and technology sectors. Each selection has been chosen based on the firm’s analysis of fundamental factors and market positioning, and all three offer both dividend income and substantial upside potential according to Goldman’s research and price targets.