Goldman Sachs’ India forecast has been trimmed down following President Trump’s threat to impose 25% tariffs on Indian goods, and this has created quite a stir in financial circles right now. The global investment bank actually reduced India’s growth projections by 0.1 percentage point for 2025 and even 0.2 percentage point for 2026, citing Trump’s 25% tariffs along with escalating US-India trade tensions.

Goldman Sachs’ India Forecast Cut Tied to Trade Tensions and Slowdown

The Goldman Sachs India forecast revision reflects mounting concerns over the India economic slowdown and potential global market impact that could unfold. Trump actually criticized India for maintaining tariffs that are “among the highest in the World” and also described them as the most “strenuous and obnoxious non-monetary trade barriers of any country.”

Goldman Sachs stated:

“In our view, some of these tariffs are likely to be negotiated lower over time, and further downside risk to the growth trajectory mainly emanates from the uncertainty channel.”

Revised Growth Projections Show Measured Impact

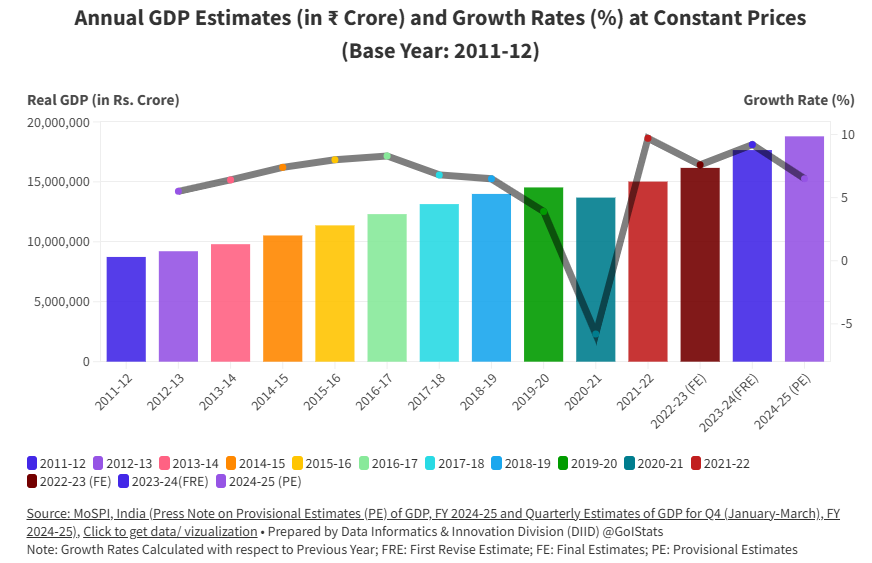

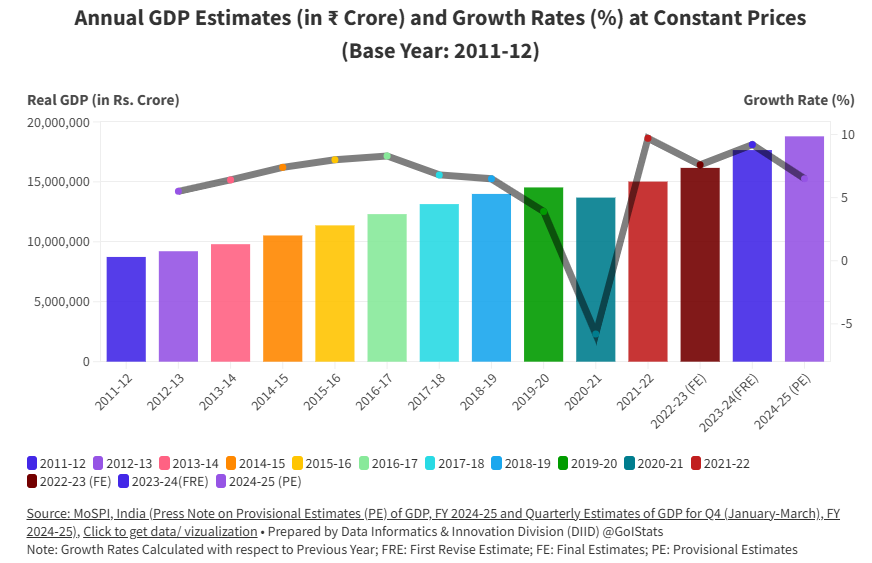

The latest Goldman Sachs India forecast sets real GDP growth at 6.5% for 2025 and 6.4% for 2026. Despite Trump’s 25% tariffs threat, brokerages remain hopeful that final tariff rates may actually settle between 15-20% through negotiations, which could limit the India economic slowdown impact to some extent.

Rural consumption recovery has been sustained, given strong agricultural activity that’s reflected in higher sowing of summer crops along with lower food inflation, which is likely boosting real rural incomes right now.

Also Read: Trump’s 25% India Tariff Triggers De-Dollarization: Rupee Hits 87, RBI $3B

Monetary Policy Response Expected

Given the revised Goldman Sachs India forecast and growing US-India trade tensions, analysts expect the Reserve Bank of India to cut repo rates by 25 basis points in Q4. The bank has also lowered inflation forecasts by 0.2 percentage points to 3%, supporting the case for accommodative policy measures.

Goldman Sachs noted:

“Our inflation forecasts imply that immediate inflation risks in India are contained.”

Trump’s 25% tariffs continue to create uncertainty in global markets, though rural consumption recovery provides some cushion against the India economic slowdown concerns that analysts are voicing at the time of writing.

Also Read: Crypto Fix for US Deficit: Ex-Goldman Exec Sees Trillions