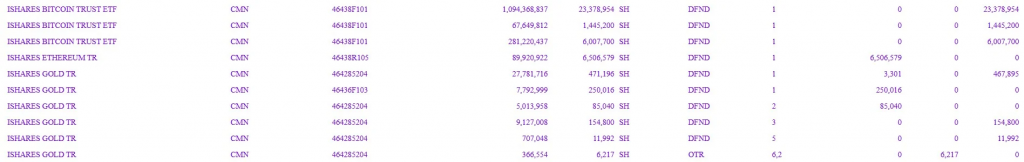

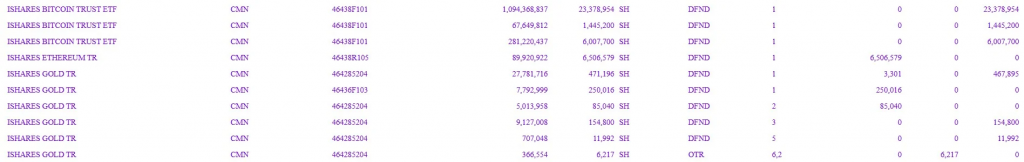

BlackRock’s Bitcoin fund in Q1 surge has attracted major investment from Goldman Sachs, which now holds about 30.8 million shares worth around $1.4 billion. This represents a significant 28% increase from their previous position of approximately 24 million shares, according to the recent SEC filings that were made public just a few days ago.

Also Read: Bitcoin: Michael Saylor Reveals Strategy To Get 100x Return from BTC

Understanding Bitcoin Fund Impact Amid Crypto Market Volatility

Goldman’s Expanding Bitcoin Position

Goldman Sachs has been strengthening its cryptocurrency investment security approach through increased holdings in BlackRock’s IBIT. BlackRockțs Bitcoin fund surge in Q1 follows Goldman’s February disclosure of about $1.5 billion in US spot Bitcoin ETF holdings, which at that time included roughly $1.2 billion in IBIT and also around $288 million in Fidelity’s FBTC.

Their latest filing, interestingly enough, shows no real change in the FBTC position, while their previous options positions now appear to have been either closed out or just allowed to expire.

Also Read: United States Cuts Tariffs on Chinese Goods From 145% to 30% for 90 Days

BlackRock’s ETF Market Position

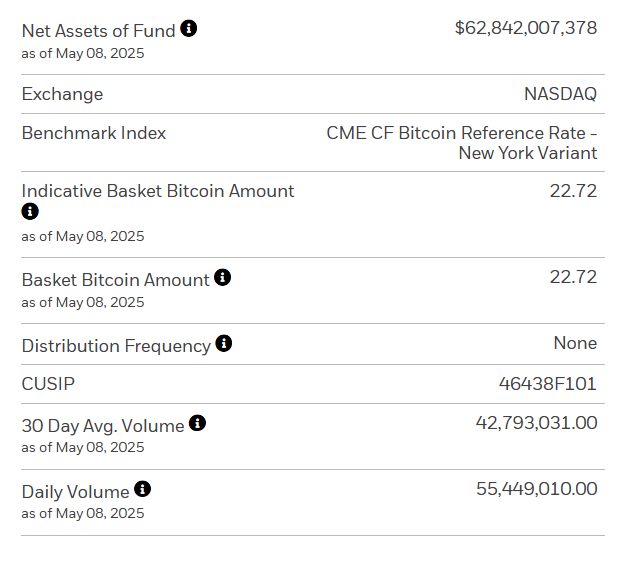

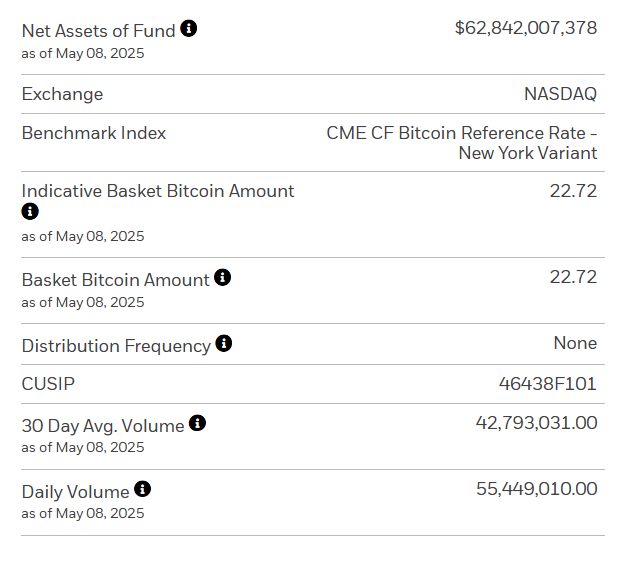

IBIT currently stands as the largest Bitcoin ETF in the midst of ongoing crypto market volatility, with approximately $62.8 billion in assets under management right now. Goldman Sachs has, at the time of writing, emerged as the largest institutional holder, followed closely by Brevan Howard with more than 25 million shares worth nearly $1.4 billion. Other major stakeholders in this space include financial firms such as Jane Street, Symmetry Investments, and also D.E. Shaw & Co.

The Bitcoin fund regulation impact has definitely supported institutional confidence, with BlackRock’s fund attracting well over $44 billion in net inflows since its January launch. Farside Investors reports that investors added approximately $674 million to the fund during just the week of the filing alone.

Market Performance Indicators

BlackRock’s Bitcoin fund Q1 surge reflects broader cryptocurrency market trends and movements. IBIT shares rose by about $1.04 during Friday’s trading session, eventually reaching $58.66 according to recently published Yahoo Finance data.

Institutional money flowing into these Bitcoin ETFs presents both opportunities and challenges for the market as a whole. Major financial institutions continue addressing security concerns as they integrate crypto assets into their investment portfolios, while regulators have also intensified scrutiny with the growing institutional presence in digital asset markets.

Institutional Adoption Outlook

Goldman’s substantial investment signals a certain level of confidence despite the persistent crypto market volatility we’ve seen lately. BlackRock’s Bitcoin fund in Q1 is enabling traditional financial institutions to gain cryptocurrency exposure through regulated investment vehicles without requiring direct asset ownership.

Also Read: Bitcoin: AI Predicts Bitcoin’s Price If Zuckerberg Adds BTC To Meta

This development appears to be accelerating cryptocurrency’s transition from an alternative investment to becoming an institutional asset class, while simultaneously addressing some of the security and regulatory concerns that have previously deterred institutional involvement in this space.