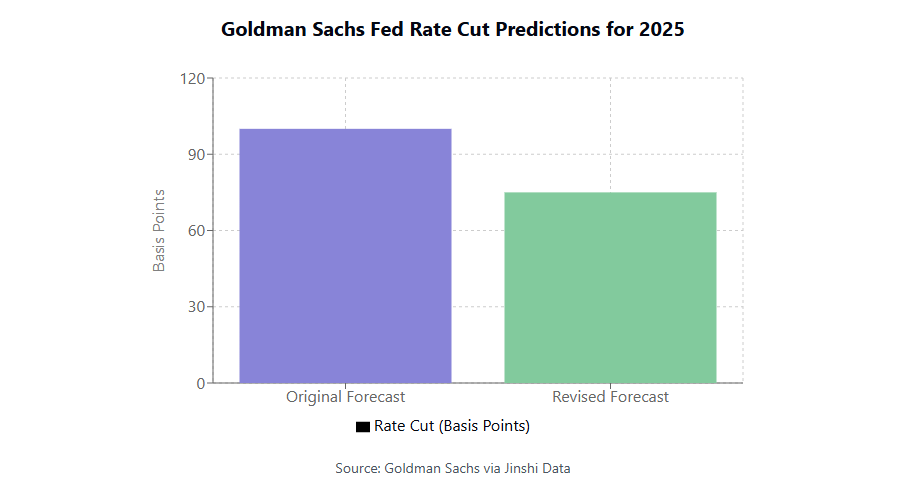

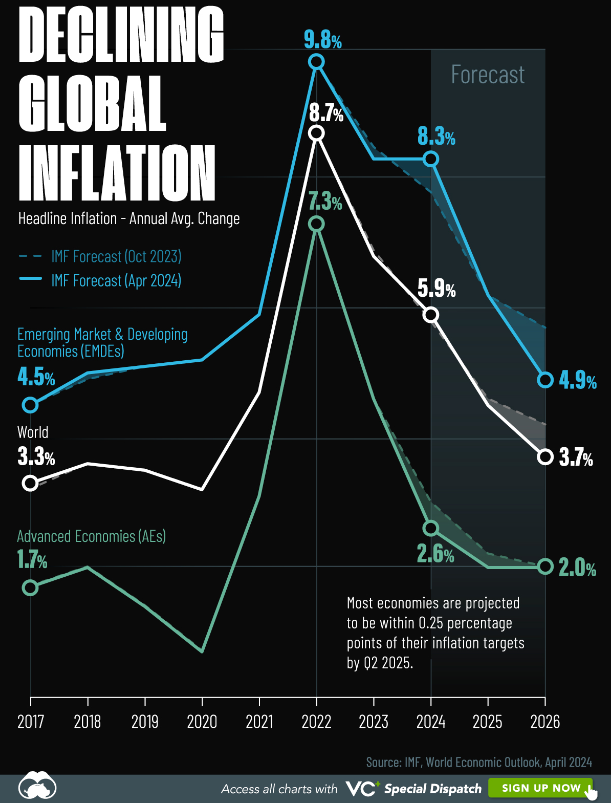

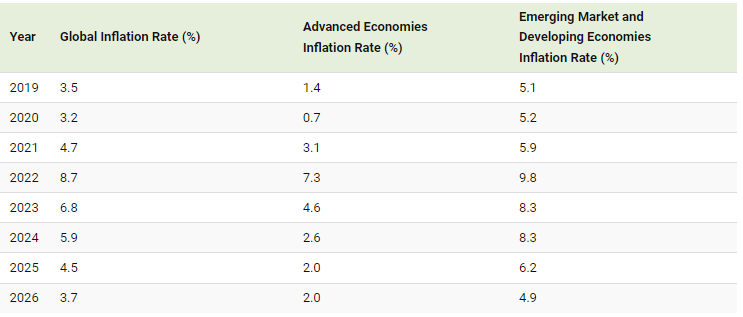

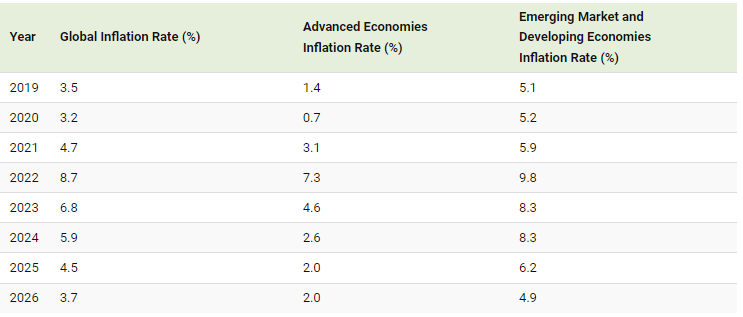

The Fed rate cut 2025 news brings a change in Goldman Sachs forecasts. The bank now expects a 75-point cut instead of 100 points. This new Federal Reserve rate outlook comes from changes in core inflation. The shift will affect market volatility and crypto investments. Goldman Sachs economists state, “this outlook is more dovish than current market pricing and reflects expectations of a continued downward trend in core inflation.”

Also Read: VeChain: Will VET Rise After Trump Takes Office?

How the Federal Reserve’s Rate Cut Could Affect Market Volatility and Crypto Investments

Goldman’s Revised Outlook

The bank changed its Fed rate cut 2025 forecast due to lower inflation rates. They moved from 100 points to 75 points in cuts. The Federal Reserve rate needs to balance inflation and economic health. The report notes that “the bank cites a declining potential inflation rate as a key factor behind the more conservative forecast.”

Market Impact Analysis

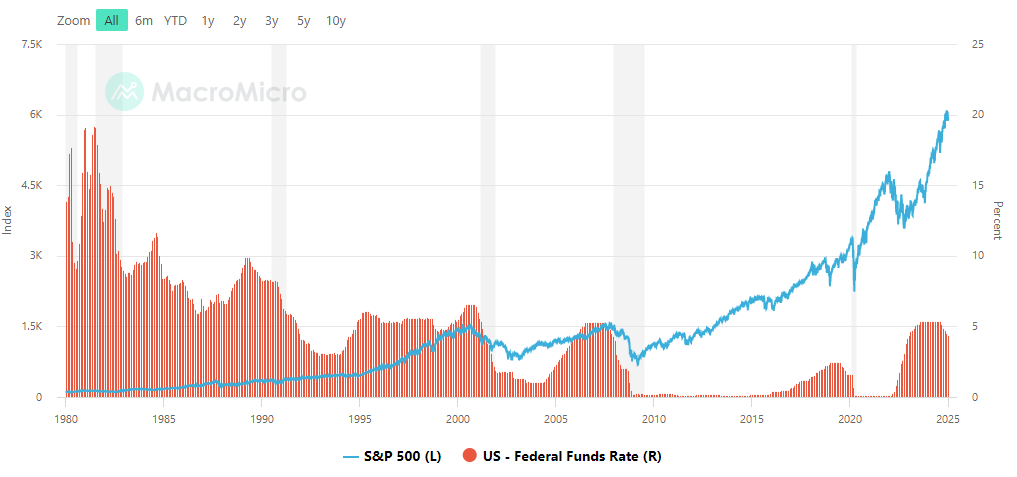

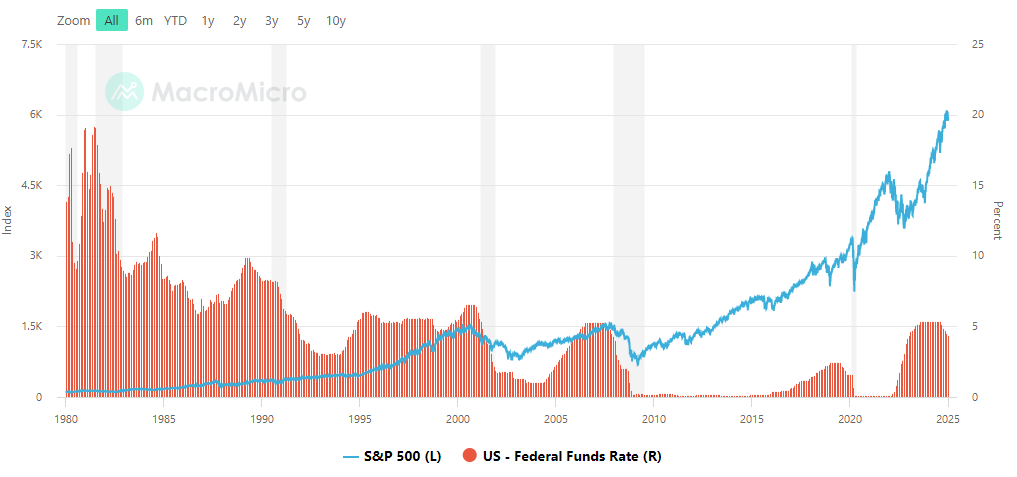

The Federal Reserve rate changes will shape market volatility in 2025. Lower rates help crypto investments grow. When regular investments pay less, people look at crypto options. Goldman Sachs says this creates “a supportive environment for equities and alternative assets like cryptocurrencies.”

Also Read: Top 3 Cryptocurrencies To Watch This Week

Policy Implications

The Fed rate cut 2025 plans factor in new leadership policies. Goldman Sachs thinks these won’t push rates up much. The bank expects rates to stay low. Market volatility signs are under watch as these changes happen.

Investment Landscape

The Fed rate cut in 2025 will change how people invest their money. The Federal Reserve’s choices will greatly affect crypto investments. The report states “investors will be closely watching upcoming Federal Open Market Committee (FOMC) meetings for signals on monetary policy adjustments amid evolving economic conditions.”

Also Read: Vivek Ramaswamy’s Strive Files To Launch “Bitcoin Bond” ETF