While Shiba Inu (SHIB) has struggled to make any positive price movements over the last few weeks, gold has been on another level. The yellow metal has hit multiple all-time highs since late 2025. Along with gold, silver has also hit new peaks, with its valuation climbing to the 2nd spot globally. Let’s discuss why gold’s rise could spark trouble for SHIB.

Gold’s Rise Could Bring Bad News For Shiba Inu Fans And Investors

The rise in prices of gold and silver could be a signal that investors are moving away from risky assets. Geopolitical tensions and slow economic growth amid macroeconomic uncertainties are likely keeping investors from pouring their funds into Shiba Inu (SHIB) and other cryptocurrencies. Shiba Inu (SHIB) and other memecoins like it carry some of the highest risks in the market. SHIB is considered riskier than other crypto assets, such as Bitcoin (BTC), Ethereum (ETH), etc. The high-risk factor around SHIB could mean that the asset may take much longer to recover.

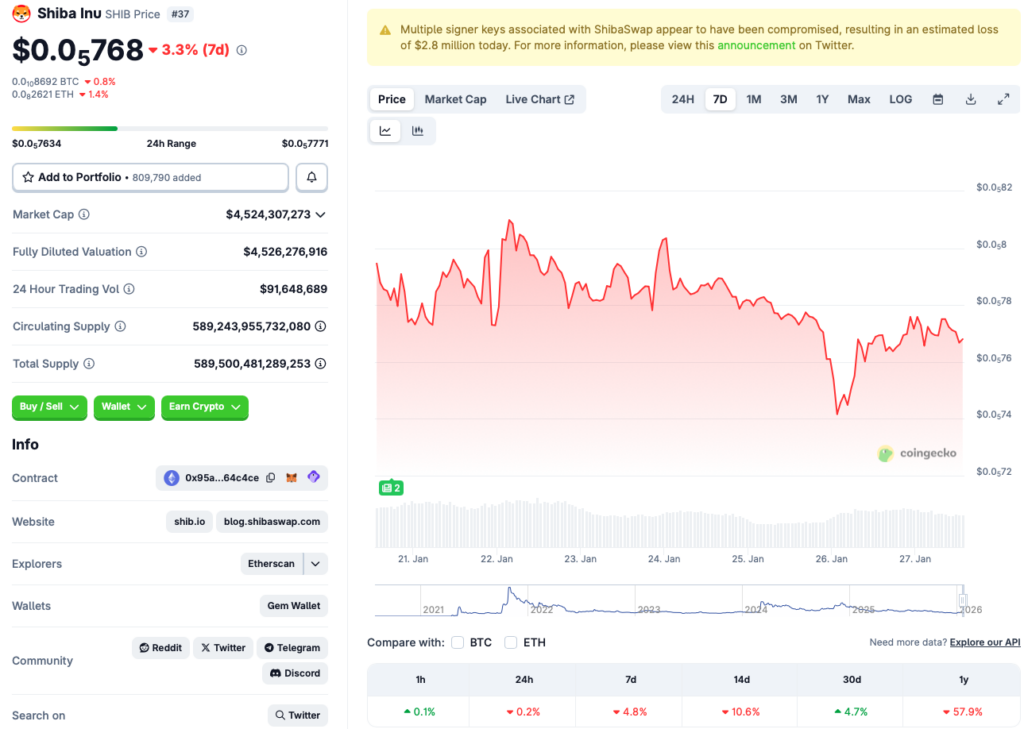

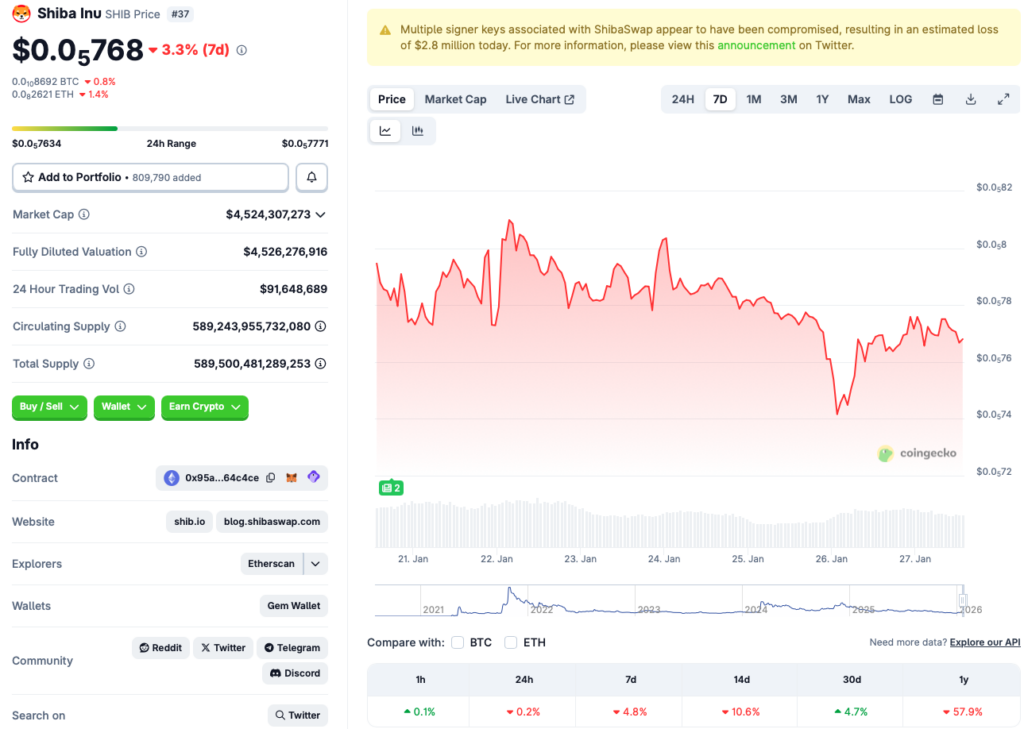

Shiba Inu’s (SHIB) price has seen a gradual decline since December 2024, when it hit the $0.00003285 mark. Since late 2024, SHIB has slowly slipped out of the top 20 crypto projects by market cap, currently sitting at the 37th position, according to CoinGecko. The popular memecoin’s price has fallen 0.2% in the last 24 hours, 4.8% in the last week, 10.6% in the 14-day charts, and nearly 58% since January 2025. Nonetheless, Shiba Inu (SHIB) has maintained a 4.7% gain over the previous month.

Also Read: Shiba Inu Enters Yearly Demand Zone That Sparked 296% Rally

Shiba Inu’s (SHIB) price could continue facing challenges until the larger economy improves. With President Trump’s tariff spree continuing to worry investors, SHIB and other risky assets could continue in the back seat for the time being.