Bitcoin [BTC] proponents often associate the tags “inflation-hedge” and “digital gold” with its $800 billion market cap asset. Well, Bank of America [BoA] recently pronounced that the king-coin trades like nothing of that sort.

According to the research note titled “Global Cryptocurrencies and Digital Assets,” Bitcoin has been trading as a risk asset since July last year. This was around the same time when the asset’s price started depicting concrete signs of recovery after May’s flash crash.

Risk assets are typically characterized by high volatility. Equities, currencies, and real estate essentially fall under this umbrella. BoA’s report analysts led by Alkesh Shah brought to light,

“Correlations on Jan 31 between bitcoin and the S&P 500 (SPX) and between bitcoin and the Nasdaq 100 (QQQ) reached all-time highs and the 99.73 percentile respectively.”

On the other hand, the asset has maintained a near-zero correlation with gold during the same period, the researchers noted. Bank of America now believes that Bitcoin will neither be adopted as an inflation hedge in developed countries nor lose its status as a “risk asset” until its price volatility goes down.

BoA’s statement needs to be taken with a grain of salt

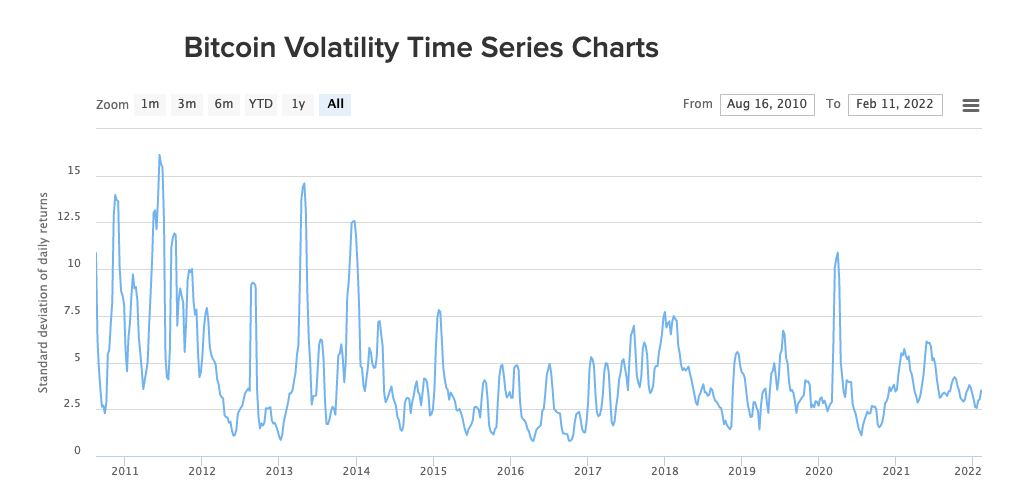

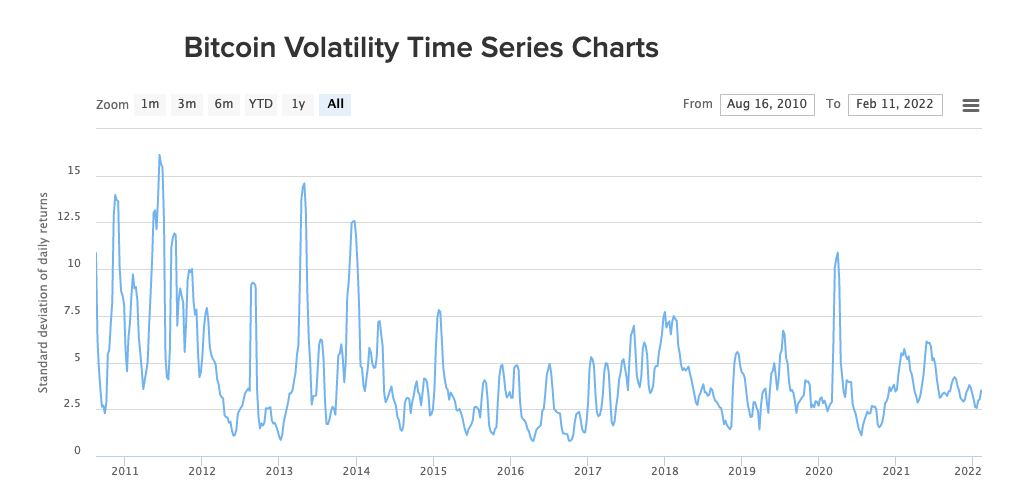

Bitcoin’s volatility has, as such, reduced on the macro frame. The largest digital asset was susceptible to even more fluctuations during its earlier years. The snapshot attached below clearly highlights how the volatility landscape is more towards the cooler side now when compared to the 2011-14 period.

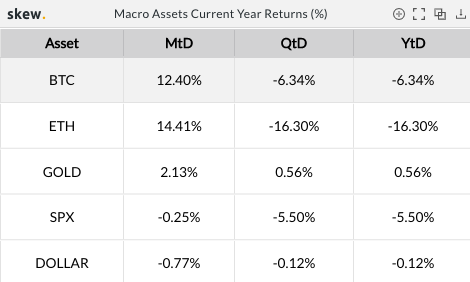

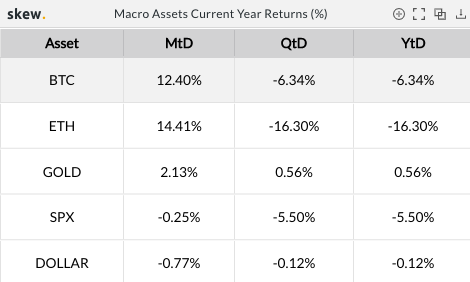

Additionally, unlike the BoA claims, Bitcoin’s correlation with gold hasn’t become lackluster. In the Month-to-Day frame, the king coin has fetched HODLers 12.4%, while Gold has also rewarded its investors a positive 2% gain. The SPX, on the other hand, posted negative returns in the same time frame.

Nonetheless, as far as the Quarter-to-Day and Year-to-Day returns are concerned, Bitcoin’s numbers were congruent to that of the SPX, while gold, solely managed to fare decently.

Bitcoin has time and again been compared with gold as an inflation hedge asset, even though gold, for its part, hasn’t delivered always. Bitcoin’s capped supply at 21 million tokens is the main reason why it possesses an additional edge and is considered to provide investors a haven against inflation when compared to its counterpart assets.

What other ‘experts’ say

The Bureau of Labor Statistics brought to the fore the relentless surge in U.S. inflation a day back. As per its stats, the same reached another four-decade high last month, accelerating to a 40-year high of 7.5%. With inflation rising consistently, the aforesaid assets classes are already under individual litmus tests.

Nonetheless, HODLers earnestly believe that Bitcoin would emerge victoriously. Post the inflation numbers were out, Crypto Twitter was, yet again, filled with people justifying Bitcoin and its fundamentals. Zhu Su, the co-founder of Three Arrows Capital, asserted that Bitcoin’s high volatility was merely a “myth” and it was a perpetual duration asset that involved no counterparty risk.

The other founder of Three Arrows Capital, Kyle Davies, opined something similar and proposed that the rising inflation would end up pushing Bitcoin to a 6+ digit valuation.

Others including Dan Held, Nicholas Merten, and Cameron Winklevoss too were in the same boat.