For any project to stay relevant and fare better than the rest in the crypto space, it is quite crucial for the developmental legs to be strong. Constant upgrades and refinements are the keys for projects to keep up with the evolving dynamics.

Ethereum, one of the most prominent networks, went through a whole set of upgrades last summer. In August, it underwent the much-anticipated London hardfork. The said upgrade comprised of a bundle of five Ethereum Improvement Proposals, with EIP-1559 being the most talked about.

Polygon’s EIP-1559: A chip off the old block

Now, the same EIP-1559 upgrade that altered Ethereum’s monetary policy and introduced a partial fee-burning mechanism just went live a few hours back on block 23850000 on Polygon.

With the upgrade, the whole price-auction mechanism has already become redundant and has been replaced by the base fee and priority fee. The former is the basic fee to be paid for all transactions to be included in the next block, while the latter isn’t mandatory and is to be paid by the user only to speed up the processing of transactions if needed.

Typically, the base fee would fluctuate as per the network congestion and would eventually be burnt in a two-step process starting on Polygon and ending on Ethereum.

Well, EIP-1559 doesn’t essentially lower the fee paid for transactions, for it is determined by supply and demand. However, it is set to allow users to better estimate costs and not overpay going forward.

These changes will either directly or indirectly have implications on all of Polygon’s stakeholders – right from validators and delegators to DApp users, developers, and token HODLers.

So, MATIC to $10 – A realistic scenario now?

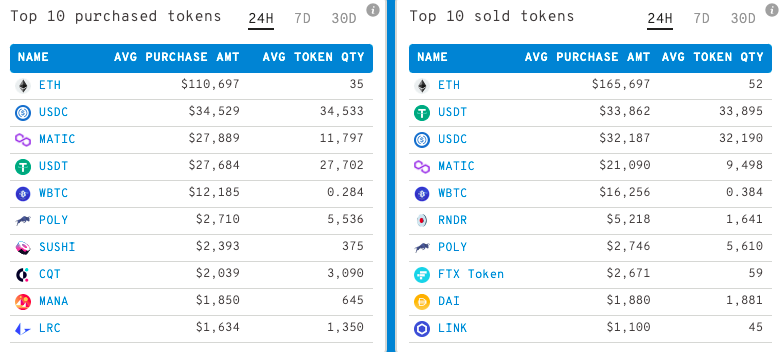

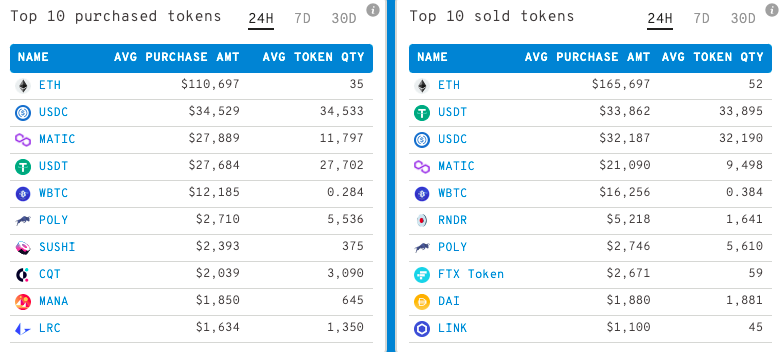

MATIC has clearly been one of the top-transacted tokens by the top-1000 Ethereum wallets over the past day. While tokens worth $27.88k were bought in the said timeframe, over $21.09k worth tokens were sold.

So now, after taking into account the most recent transactions, MATIC tokens currently hold a 3.03% weightage in the top 1000 ETH whale wallets.

Parallelly, MATIC’s network has also tremendously improved over the past week. The user growth has been substantial and has created new highs of late.

As per ITB’s data, the new addresses and active addresses have inclined by 19.33% and 11.67% in the last 7-days. The zero-balance addresses, on the other hand, have sharply risen by more than 36%.

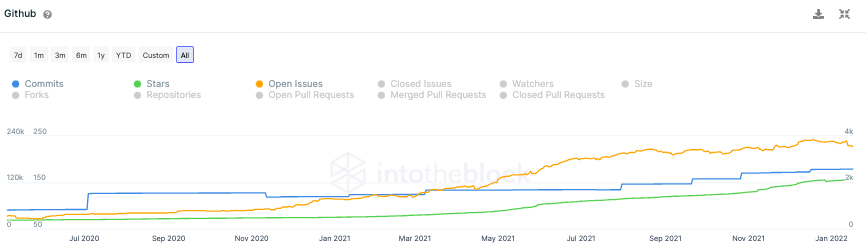

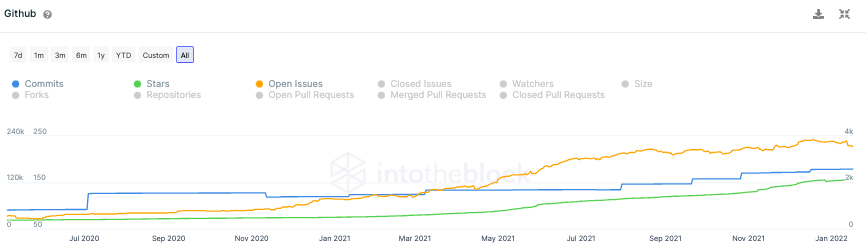

Furthermore, changes are being made to the code, network improvements continue to be submitted and acted upon and the interest and engagement shown by the community developers have also been to the mark.

So, with Github indicators like open issues, commits, and stars depicting a rosy picture on the macro-time frame, it can be inferred that the development activity has been going on at a good pace for quite some time and hasn’t boosted up merely because of EIP-1559. This is quite a good sign for the Polygon network.

Post the upgrade went live, MATIC’s price momentarily witnessed some respite on the short timeframe charts. However, at the time of press, the token was down by 11% when compared to yesterday’s $2.452 highs.

Before concluding the piece, it is essential to note that MATIC has a fixed supply of 10 billion tokens and the annualized burn would more or less transpire to 0.27% of the total supply. So, burning would definitely make the asset deflationary, but expecting it to attain $10 straight away just seems to be mawkish.

However, achieving the said feat is definitely possible over a much longer timeframe via organic growth.