The Hashkey’s BTC ETH fund announcement has actually positioned Hong Kong’s largest licensed crypto exchange to launch a $500 million Digital Asset Treasury fund right now. This Asia crypto investments move is mirroring the successful MicroStrategy Bitcoin strategy, as HashKey targets mainstream crypto assets through its institutional crypto fund approach. The Hong Kong crypto exchange aims to replicate corporate cryptocurrency adoption patterns that have been driving institutional interest across the region.

HashKey BTC ETH Fund Drives Asia Crypto Investments And Institutional Strategies

Fund Structure Follows Proven Treasury Models

The Hashkey BTC & ETH fund represents a significant shift in Asia crypto investments right now, with the Digital Asset Treasury strategy targeting public companies that are accumulating cryptocurrency assets. This institutional crypto fund approach seeks to capitalize on higher token prices and also improving regulatory conditions across the region.

HashKey stated:

“HashKey will build a diversified portfolio by initiating and investing in a range of DAT projects focused on mainstream crypto assets, with an initial emphasis on Ethereum and Bitcoin ecosystem projects.”

The MicroStrategy’s Bitcoin strategy has actually proven highly successful, with the company holding more than $63 billion in cryptocurrency assets as of June. Strategy copycats have increased their bitcoin holdings to nearly 100,000 bitcoin collectively, according to Standard Chartered.

Also Read: Ethereum News: $435M BTC Traded for $433M ETH- What Do Whales Know?

Regional Impact and Market Positioning

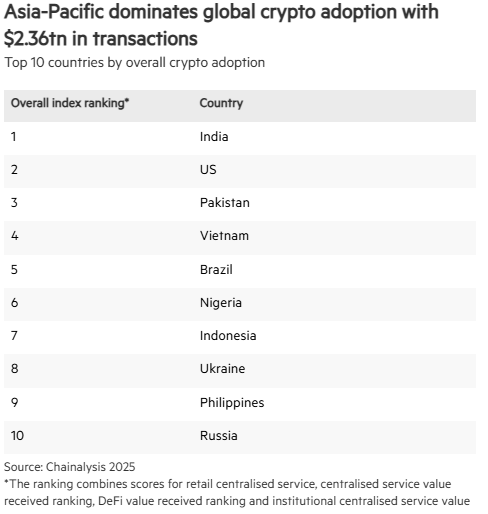

The launch demonstrates how the Hong Kong crypto exchange sector is actually embracing institutional demand for cryptocurrency exposure right now. This Hashkey BTC & ETH fund initiative reflects broader Asia crypto investments trends, where regulatory clarity has encouraged major financial institutions to enter the digital asset space.

Also Read: Ethereum Recovery Eyes $4,811 Pivot Before $8,500 Target: Here’s How

Through this institutional crypto fund, HashKey aims to advance crypto asset standardization and even accelerate Web3 ecosystem development. The MicroStrategy Bitcoin strategy’s success has inspired numerous companies to adopt similar treasury approaches, with HashKey positioning itself to capitalize on this corporate adoption wave.

HashKey explained its broader mission:

“Through investing in and operating top-tier DAT projects globally, HashKey aims to advance crypto asset standardisation and accelerate the development of a sustainable Web3 ecosystem.”

The $500 million target size makes this one of the largest institutional crypto fund launches in Asia, demonstrating significant confidence in the Hashkey BTC ETH fund strategy. As the Hong Kong crypto exchange landscape evolves, this move could actually encourage additional Asia crypto investments from traditional financial institutions seeking regulated digital asset exposure.