Stablecoins have emerged as one of the most important developments in the budding cryptocurrency sector. Stablecoins linked to the US dollar, in particular, have gained widespread adoption, with a supply of 180 billion USD as of May 2022.

With the growth of DeFi over the last several years, a variety of stablecoins with various techniques for price stabilization vs. USD have evolved and been included in various DeFi protocols. However, a reference rate for USD stablecoins that reflects the condition of the stablecoin market does not yet exist.

This is where Helio comes in.

What is Helio?

Helio is more than simply another stablecoin protocol. Its purpose is to make it possible for anybody to profit from Helio’s stablecoin, HAY. A yield that appropriately represents the health of the stablecoin economy, as well as an attempt to supplement what falls beyond the price stability mandate of the central bank.

Helio Protocol is creating an overcollateralized stablecoin (HAY) backed by liquid-staking BNB, inspired by MakerDAO protocol. Its goal is to investigate a new product-market fit utilizing Anchor Protocol, that is different from DAI on MakerDAO or UST on Terra.

Helio Protocol’s main purpose is to offer a high yield in a long-term way, allowing the majority of users to benefit from crypto markets’ increasing money velocity. DeFi composability would allow HAY liquidity providers, and subsequently, HAY stakers, to increase yield in a sustainable manner by integrating with other lending platforms.

Helio Stablecoin’s (HAY) aim is to become the reference rate enabler for the stablecoin industry.

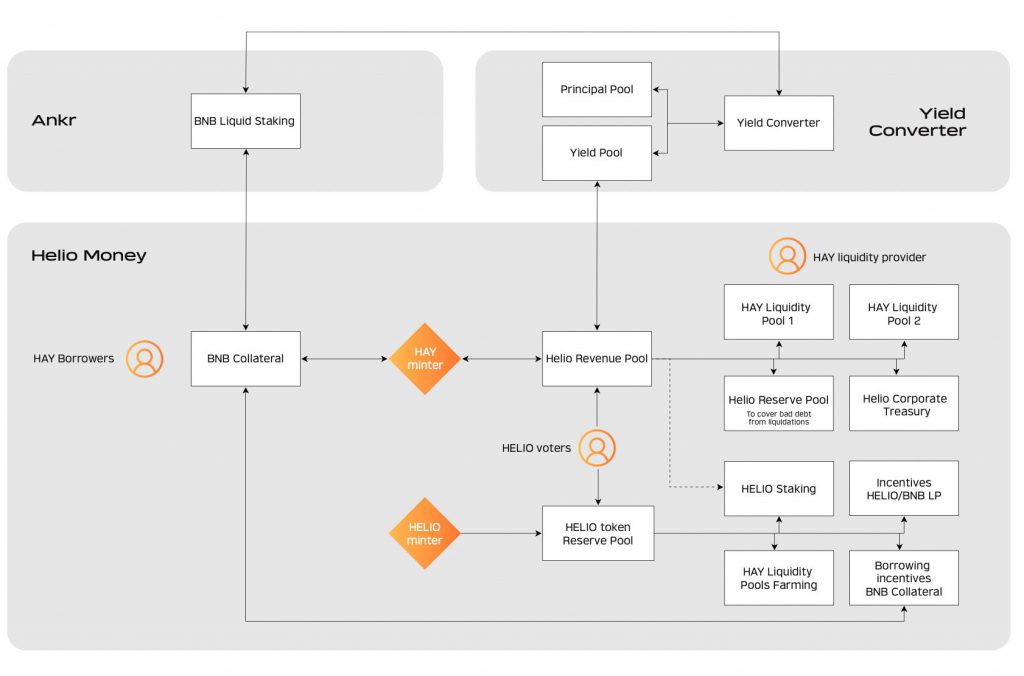

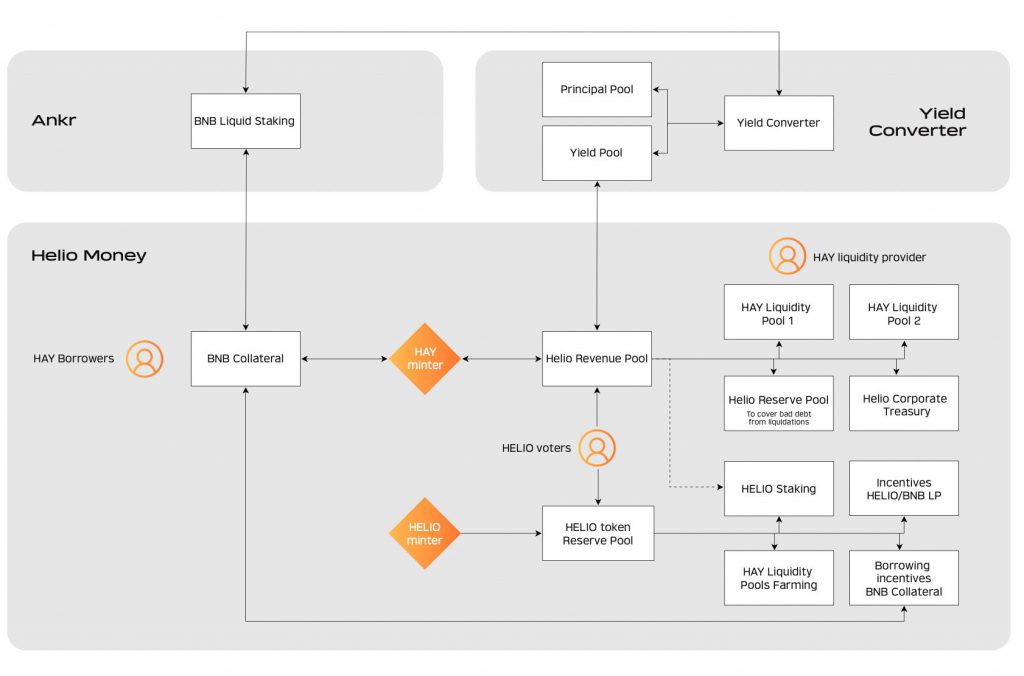

Protocol mechanism

When the price of HAY rises above $1, the supply of HAY must be increased. Borrowers are encouraged to borrow more HAY to sell for other assets since HAY is at a premium. Helio will cut HAY farming benefits by lowering HAY borrowing interest to lessen demand for HAY farming.

When the price of HAY falls below $1, the supply of HAY must be curtailed. Borrowers are encouraged to buy HAY from the market to repay the debt since HAY is available at a discount. Helio will raise HAY borrowing interest to reduce HAY borrowing demand, which will boost HAY farming rewards.

The HELIO token is the protocol’s governance token, which governs Helio Revenue Pool distribution and HELIO token rewards.

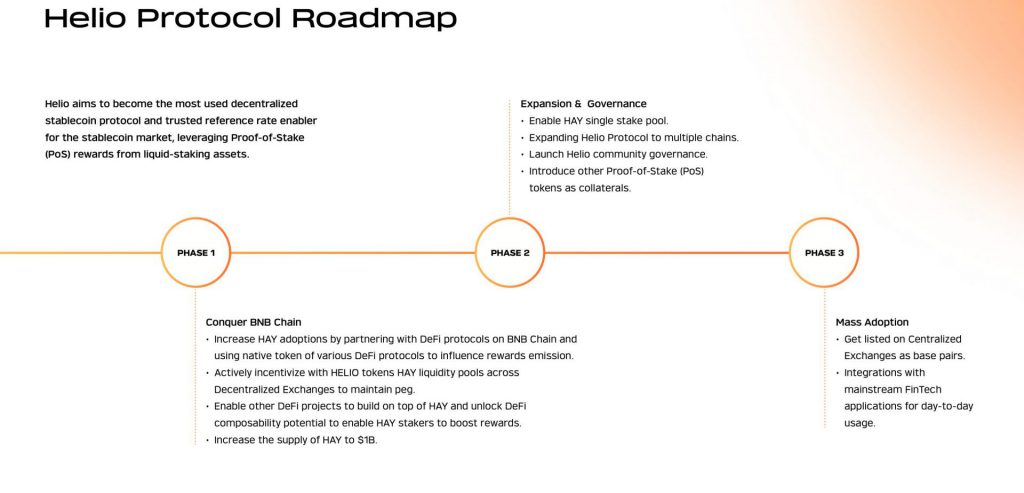

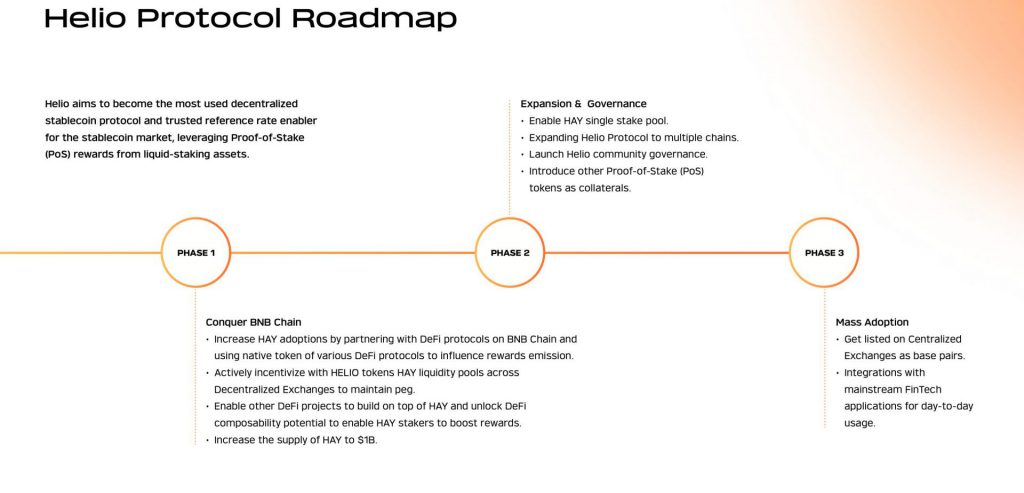

Helio Protocol Roadmap

Helio’s first phase attempts to conquer the BNB chain. This entails increasing HAY adoptions by working with DeFi protocols on the BNB Chain and influencing reward emission using native tokens from multiple DeFi protocols. They also want to actively incentivize the maintenance of the peg by using HELIO tokens and HAY liquidity pools across Decentralized Exchanges. They aim to make it possible for other DeFi initiatives to build on top of HAY, as well as unlock the DeFi composability potential to enable HAY stakers to boost incentives. The team also intends to increase HAY supply to $1 billion.

The 2nd phase involves expansion and governance. They will enable HAY single stake pool while expanding the protocol to multiple chains. The team plans to launch Helio community governance and introduce other Proof-of-Stake (PoS) tokens as collaterals.

The third phase is focused on mass adoption. The team aspires to be listed on centralized exchanges as base pairs, and they have plans to integrate with major FinTech apps for everyday use.

To know more about Helio, visit their website, whitepaper, Medium, Twitter, or join their Telegram or Discord Server.

DISCLAIMER: THIS IS A SPONSORED POST