Ethereum, the market’s largest altcoin, has had a pretty decent start to 2022. The last daily candle of 2021 closed around $3.6k and by 2 January, the alt had already risen by $200.

Despite the recent uptick witnessed, the market at this juncture is quite indecisive. In fact, there’s more unpredictability in the ecosystem now, more than ever.

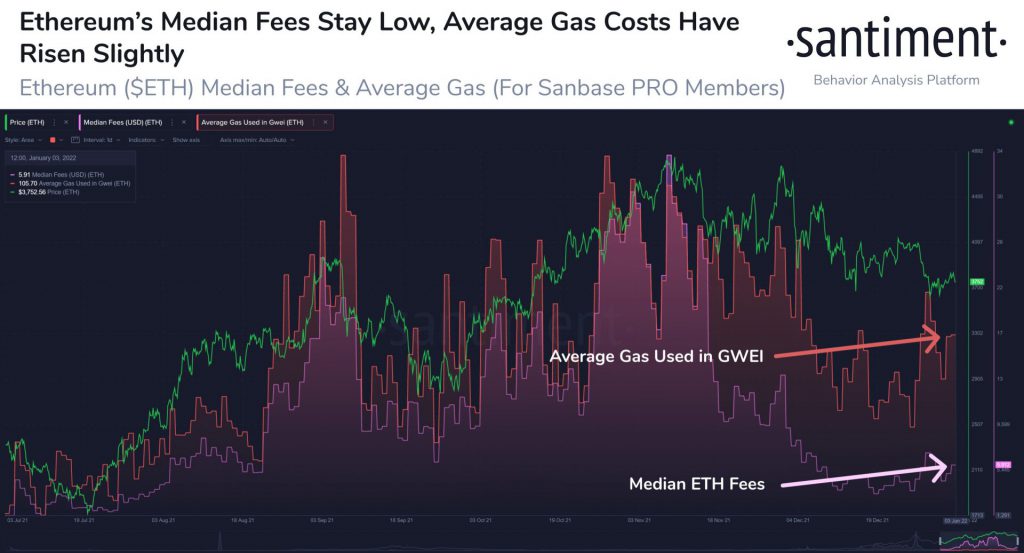

Before you disagree with the aforementioned assertion, take into account this – Notwithstanding the price rise, Santiment’s data highlighted that the median fee per ETH transaction has remained low. This, in turn, has allowed the utility to rise without amassing hesitance from cost-sensitive traders.

The average gas fee per transaction on the other hand has risen, leaving market participants iffy.

More Ethereum chaos across the board?

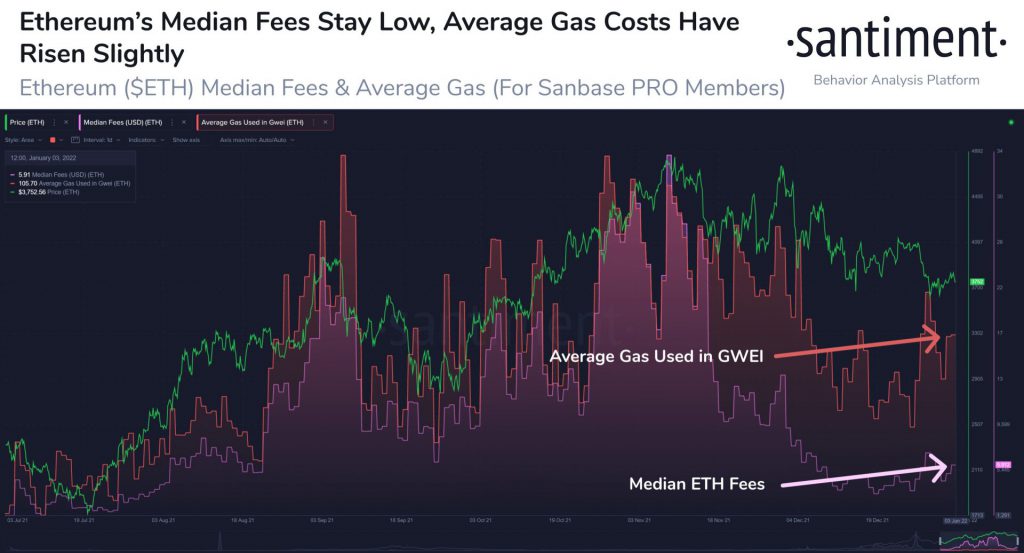

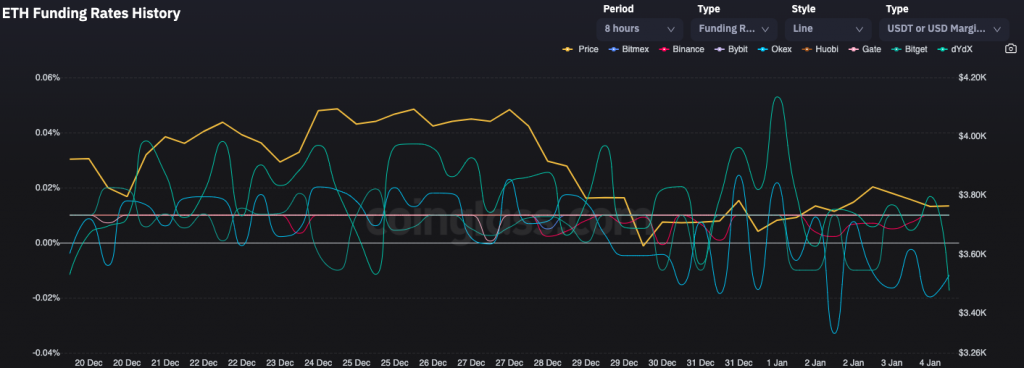

The broader irresoluteness with respect to the asset’s price was even more prominently visible in the futures market. Even though the collective sentiment did not underline a clear-cut trend, it remained slightly more inclined towards short traders at the time of writing.

As observed from the snapshot attached below, Ethereum’s OI has been shrinking for quite some time now. From 27 December’s $11.5 billion peak, the open interest stood at merely $10.1 billion at press time.

The prominent OI erosion means that open positions have gradually been closed by traders. What it also means is that new traders aren’t very keen on entering the market at this stage. With little capital entering into the ecosystem, it would be quite a task for Ethereum to carry forth its uptrend.

The funding rate too, on most major exchanges remained neutral or negative at press time. This implied that short traders have started demanding more leverage when compared to their long counterparts. Nevertheless, the intensity of negativeness ain’t that high at the moment, bringing to light the clouds of doubt in the minds of leverage traders.

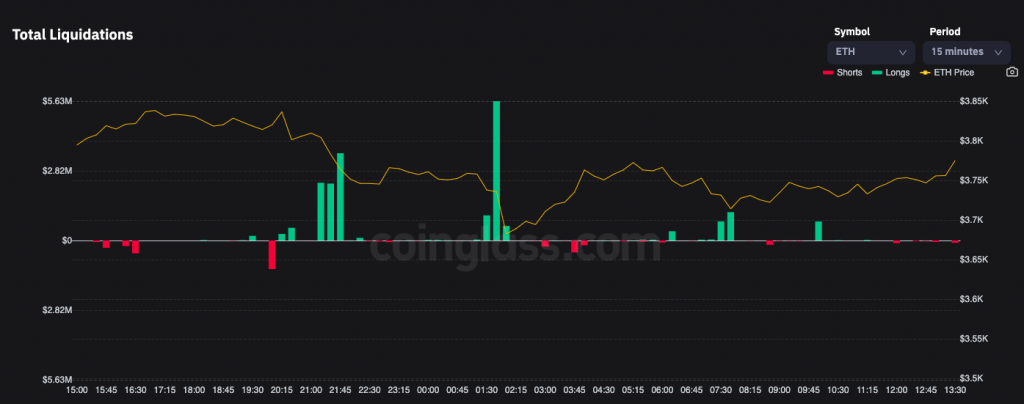

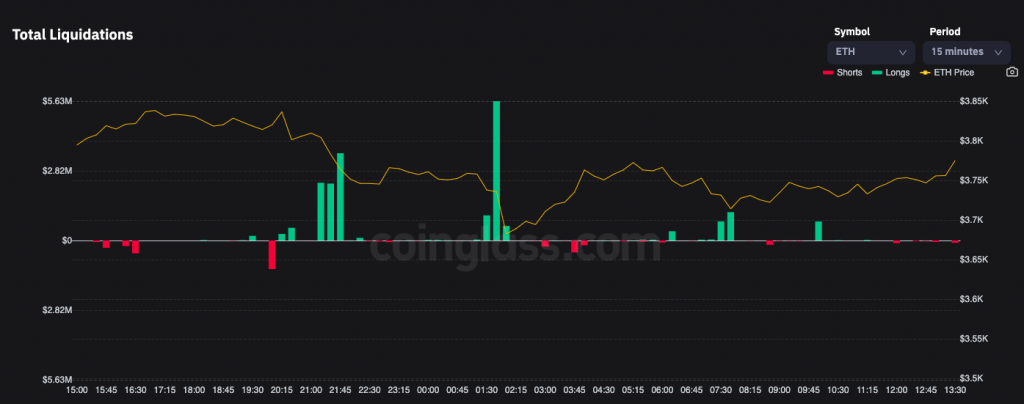

The liquidations chart, however, highlighted that more longs had been eroded due to insufficient margin when compared to the number of shorts over the past day. So, it can be said that the market is currently backing those traders who are advocating the price dip narrative.

So, keeping the aforementioned trends in mind, long Ethereum traders need to remain cautious and further analyze the broader market conditions before getting into any trade. More so, because the odds of Ethereum’s price dipping further is a bit more than it rising at the moment.