With the launch of Grayscale’s spot Dogecoin (ETF), the US got its first spot memecoin exchange-traded fund. ETFs have been a key driver for the 2025 market cycle, with Bitcoin (BTC) and Ethereum (ETH) hitting new peaks due to increased ETF inflows. ETF inflows have taken a hit over the last month, leading to substantial price corrections. With a DOGE ETF now in the market, many anticipate the memecoin to hit new peaks over the coming months. However, that might not be the case. Let’s discuss why.

Why Dogecoin’s ETF Launch May Not Push The Memecoin’s Price

While Bitcoin (BTC) hit multiple all-time highs since its ETF launch in early 2024, Ethereum (ETH) did not follow the same trajectory. It took ETH nearly a year to hit a new all-time high. Dogecoin (DOGE) may follow a similar trajectory.

Moreover, the current market is plagued with high volatility. Investors are moving away from risky assets, such as cryptocurrencies. Dogecoin (DOGE), being a memecoin, carries some of the highest risks in the market. The high-risk factor around DOGE could bar it from entering a bullish phase right now.

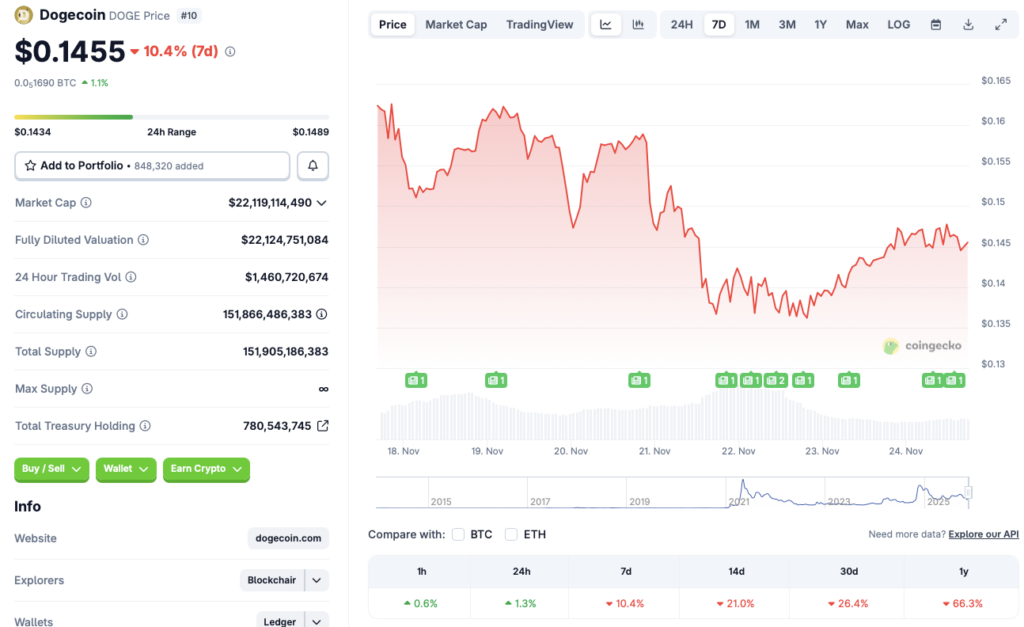

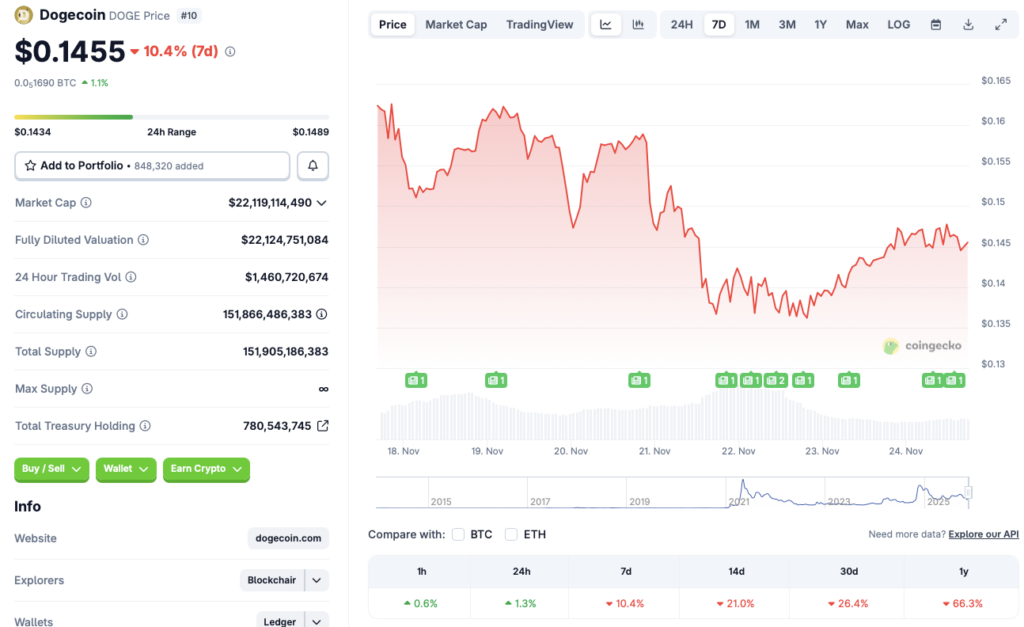

Dogecoin has seen some relief in the daily charts, rallying 1.3% in the last 24 hours, according to CoinGecko’s DOGE data. The rally in the last 24 hours is likely due to investors buying the dip. However, the popular memecoin continues to bleed in the other time frames.

Nonetheless, despite the bearish market tone, there is a possibility that the crypto market will pick up the pace over the coming months. Macroeconomic uncertainty may go down by early 2026, and the Federal Reserve could decide to reduce interest rates further. Such a development may lead to a rise in risky investments. Dogecoin’s (DOGE) ETF could see increased inflows under such circumstances. The memecoin could climb to a new peak, driven by ETF inflows, if market conditions improve.