The largest Altcoin in the market is facing a strong correction at press time. Ethereum’s 5.75% gains yesterday have been completely nullified at the moment, with the asset dropping as low as $2731.

Yesterday, Ethereum had set the stage for its lesser peers to follow. The alt rosed by 5% and snapped its biggest daily gain since 16 March, helped by a 24-hour trading volume of $16.8 Billion across exchanges.

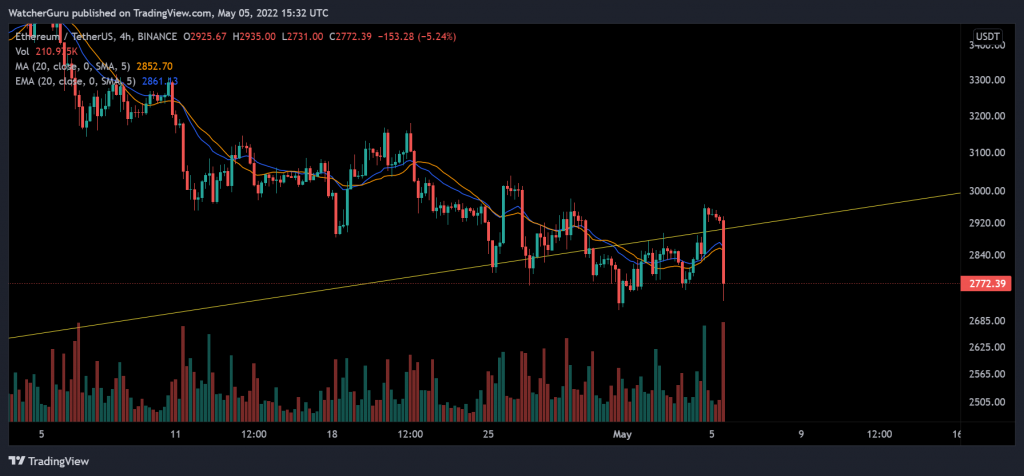

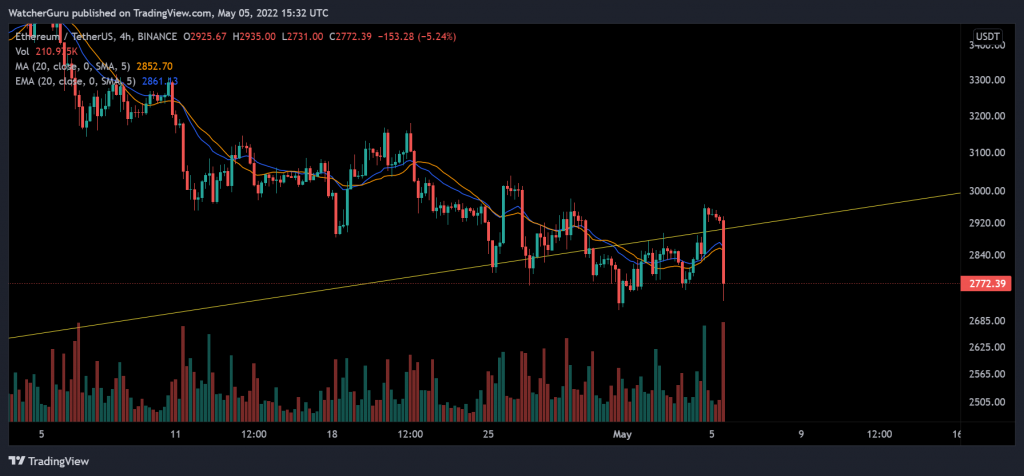

The above chart elaborates on the current bearish crossover taking place between the 20-SMA and 20-EMA.

Waning internals

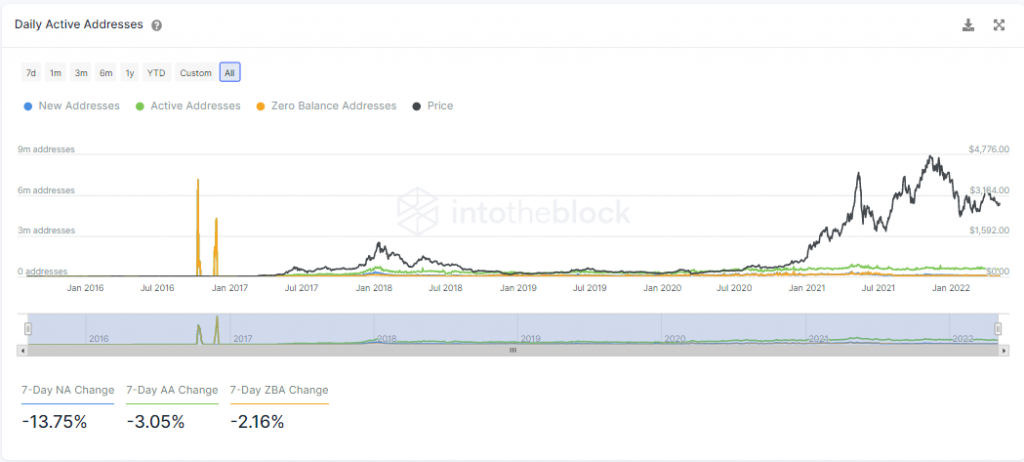

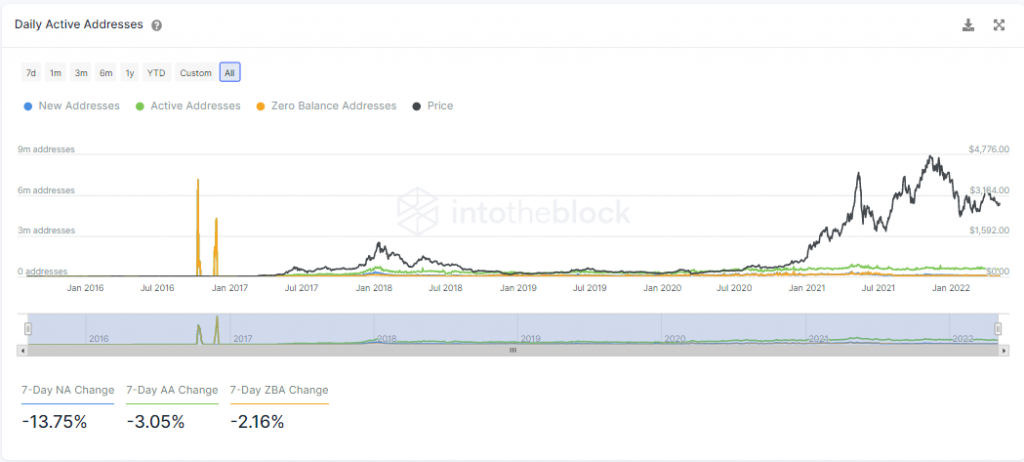

Rising network activity is often a precursor for incoming price swings but unfortunately for Ethereum’s case, the situation was rather bleak. Daily active addresses were down by 3%, suggesting that investors kept their interaction with ETH tokens at a minimal during the past week. As a result, interest among new participants was also bleak, with the new addresses down by 14% in the same time frame.

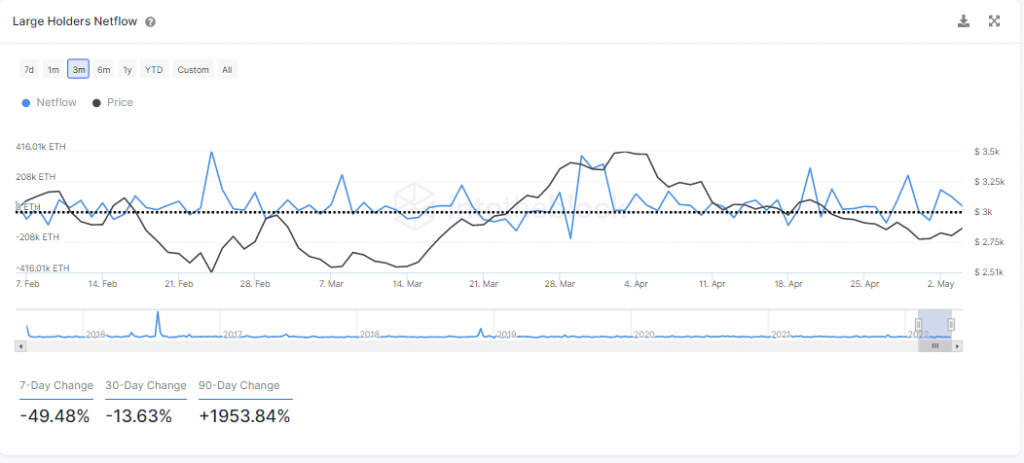

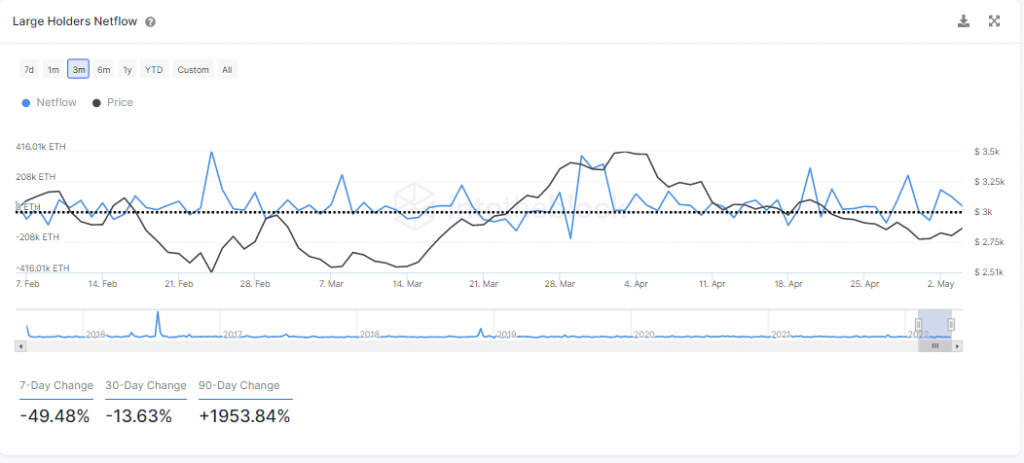

A glance at the large holders’ Netflow showed that ETH did not have the backing of large players either. The metric was down by 50% for the week, indicating that large holders were selling more Ether than accumulating them. Normally, this reads poorly for a bullish price.

Why was the market crashing?

At press time. it was reported that yesterday’s market jubilation was met by extreme sell calls today. According to Santiment, the largest sell calls on the crypto futures market were made today after the Federal Reserve announced the highest interest rate hike since 2000.

The collective market wasn’t stable enough for digital assets to rally with strength and yesterday’s market high currently feels like a bear trap.

It will be important to keep an eye on the market over the next few days, as a lack of urgency and long-term bearish sentiments can further decrease the price.