September 2021 seems like a long time ago now. Especially for Cardano investors, that bought the top at $3, hoping it will continue to break new all-time highs. The hype was behind the project and everything was coming together until it wasn’t. Over the past 6-months or so, Cardano’s smart contract implementation hasn’t witnessed the kind of activity its userbase expected. Certain developers have complained about the complexity of building on this Haskell-based on-chain network, and the price has continued to dropdown.

While the market looks bearish as ever, at times of extreme fear, a window of opportunity usually rises. In this article, we will analyze the current situation of Cardano concerning the investment landscape. To understand its NFT prospects, our previous report may come in handy.

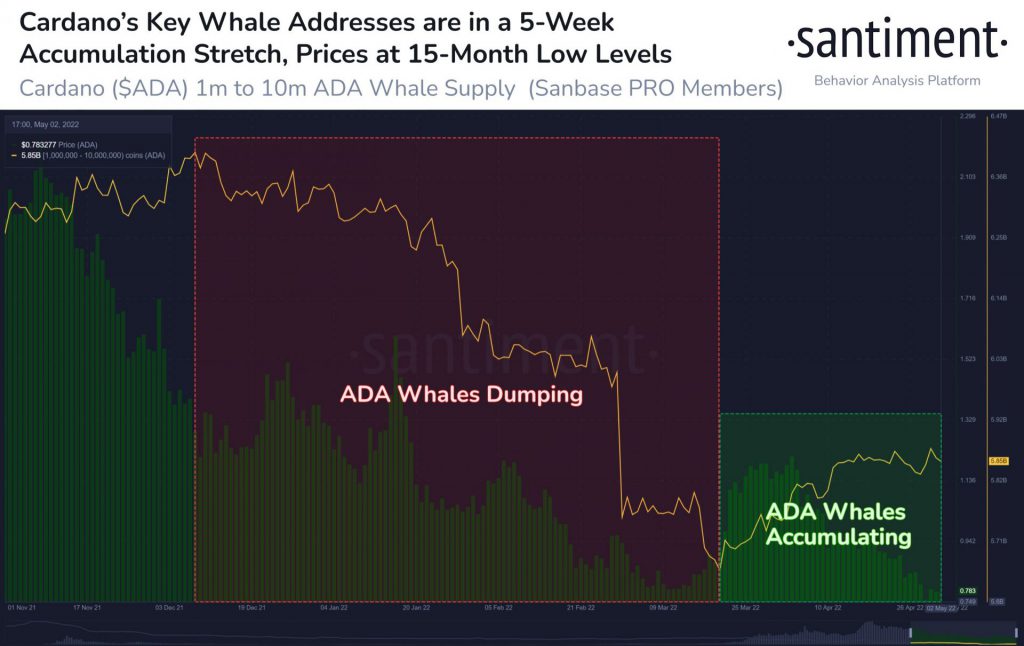

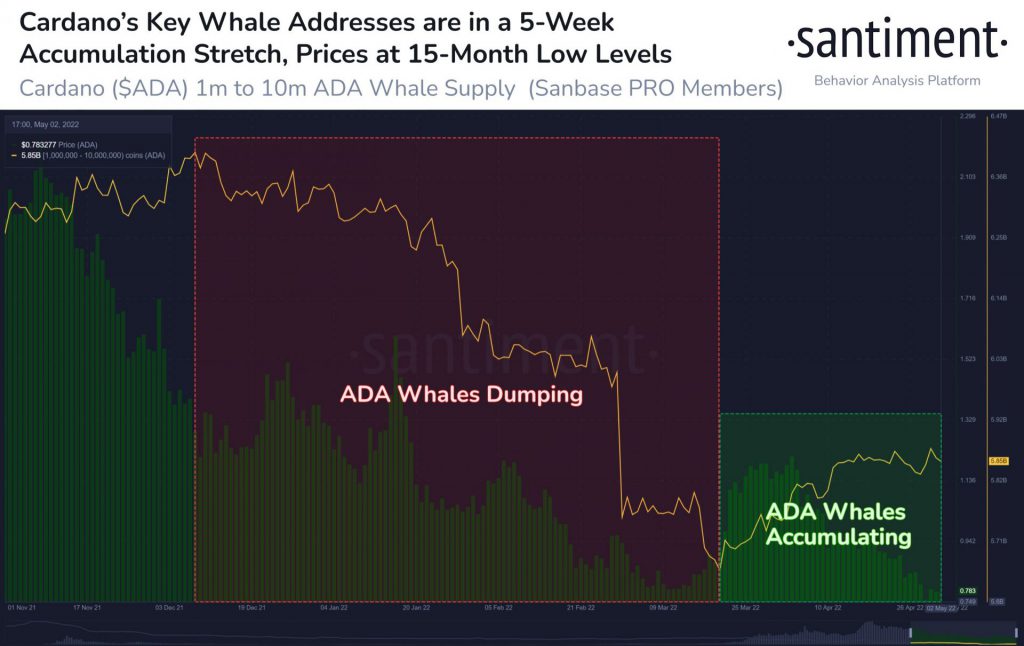

Whales continue to gobble Cardano while corrections?

Cardano Whales were on a massive dumping spree between December 2021 and the end of March 2022. Now, according to Santiment, the same whale addresses holding between 1M and 10M ADA tokens have accumulated over 196M tokens. Now, the price hasn’t reciprocated this bullish sentiment during the accumulation period, so let us look at the chart from a macro-outlook.

When the weekly chart of Cardano is observed, the correction looks extremely minor. The astounding rally between January 2020 to August 2021, suggests that the present direction is only reactionary. It would seem like there would be a certain amount of investors between $0.1 to $0.80, providing support to ADA. However, that was not the case.

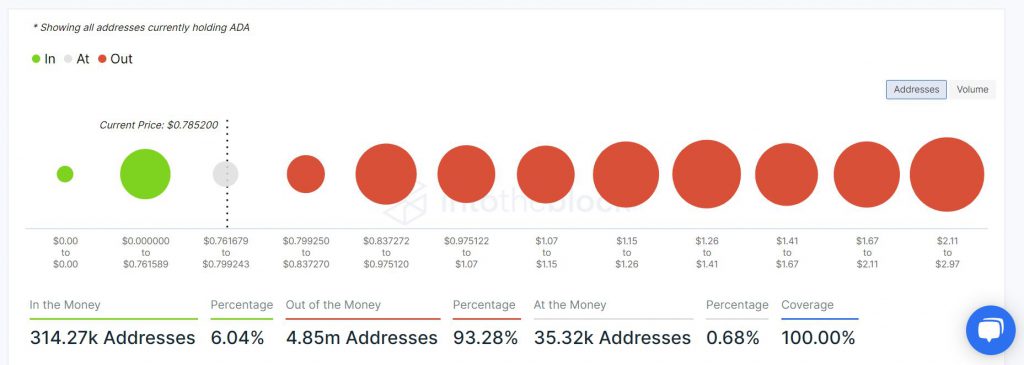

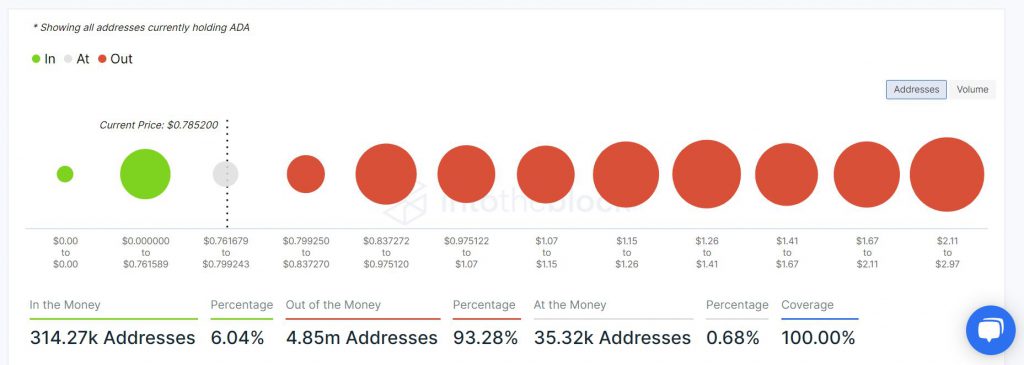

More than 90% of investors at a loss?

According to data, more than 90% of all addresses holding Cardano are out of money at press time. It means a very finite amount of investors are probably in the green, and it only adds the pressure on them to sell right now. Now, there are two ways to analyze this situation. First, the addresses at loss will have no incentive to sell hence, there is a possibility they will hold through this market. But addresses already under loss are unlikely to buy any further. Therefore, a new wave of retail investors would still be needed if ADA has to re-test its previous highs. (Although previously we did notice that Whales were accumulating ADA, these addresses are unlikely to be new investors.)

Now, considering new retail investors are not coming in, and old investors are not selling, where does the price move towards?

Market Cycle Limbo

As observed in the above trading view chart, Cardano between $0.80 and $0.75, is far from ideal. With Cardano’s correlation with Bitcoin rising above 0.90 in the past few weeks, the Altcoin might be solely dependent on the collective market to recover right now.