ALT HD – HEX volatility around YTD lows: More consolidation?

Just as the recovery stars were aligning in the crypto market, the BNB Chain underwent a hack worth millions a few hours back. The said event, single-handedly, managed to re-stir in the bearish sentiment. At press time on Friday, the collective crypto market cap was 1.5% down on the daily to $957 billion. Leaving aside top cryptos Bitcoin and Ethereum, small-cap tokens like HEX were also affected.

Also Read: Binance: Here’s How Attackers Siphoned $100M worth of BNB

Gauging the sentiment of HEX investors

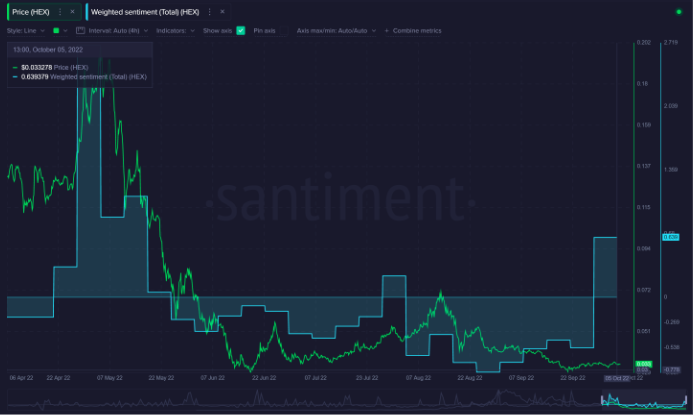

The crypto community has been the “most positive” towards HEX this week since early May [5 months ago]. As illustrated below, the weighted sentiment climbed from the negative territory to the positive territory recently and has been hovering around 0.639 of late.

Usually, The environment becomes favorable for trend reversals when there’s FUD in minds of market participants. So, the weighted sentiment being positive at this stage is not necessarily a positive sign. Confirming the same, one of Santiment’s recent analysis reports noted,

“This isn’t ideal for those who have been patiently awaiting a HEX recovery.”

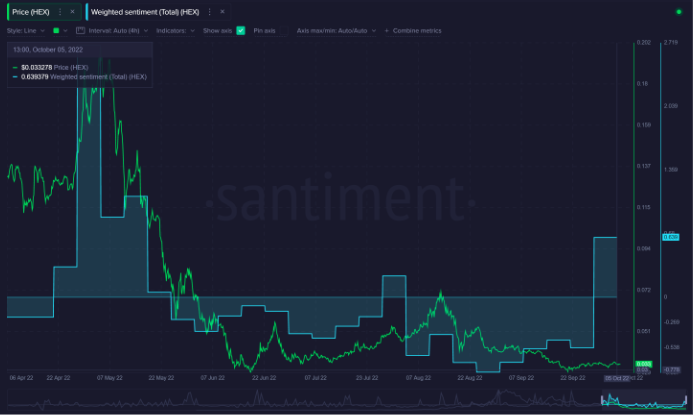

In fact, the volatility has also been suctioned out from the HEX market. As illustrated below, the said metric is currently around its year-to-date lows, making the case for a prolonged consolidation. Only when the volatility increases, price swings in either direction can be expected.

Levels to watch out

On the price front, HEX is currently at a critical juncture. It has two immediate resistances in the form of the 50 and 100 MAs on the daily that can stop it from progressing. On a couple of instances in September, the token did attempt to break through, but it failed.

So, until the buy bias doesn’t get strong in the HEX market, the token will find it challenging to trade in the green. Until then, HEX is likely to set to remain rage-bound in the $0.2975 to $0.0.3886 range.