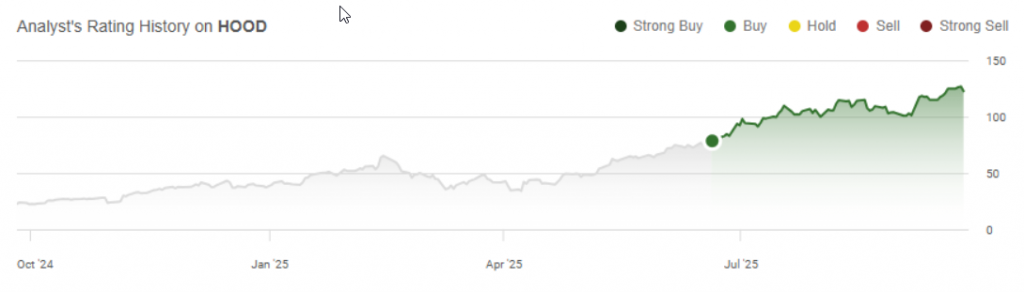

HOOD stock jumped 12% on September 29, 2025, as Robinhood Markets announced it’s actually processed over $4 billion in prediction market trades. The rally pushed HOOD stock to $136.72, and this was driven by strong Robinhood prediction trades along with expansion into new markets. This Robinhood stock run signifies approximately 260 percent gains so far this year, and HOOD stock is demonstrating increased investor trustfulness currently.

HOOD Stock Jumps 12% Amid $4B Prediction Trades and Market Growth

This milestone was announced by CEO Vladimir Tenev in a post on X, and he pointed out the fast growth of the company. The observed viral nature of the platform with over two billion dollars of Robinhood prediction trade occurring in the third quarter of 2025 alone.

Tenev also said that:

Robinhood customers have now transacted more than 4 billion of such event contracts, 2 billion of which were in the third quarter alone.

Prediction Markets Drive Performance

The HOOD stock advance was triggered by Robinhood’s partnership with Kalshi, which is a CFTC-regulated platform. The company rolled out football contracts in August, tapping into the space between financial markets and wagering. This Robinhood market growth strategy’s proven successful at this point.

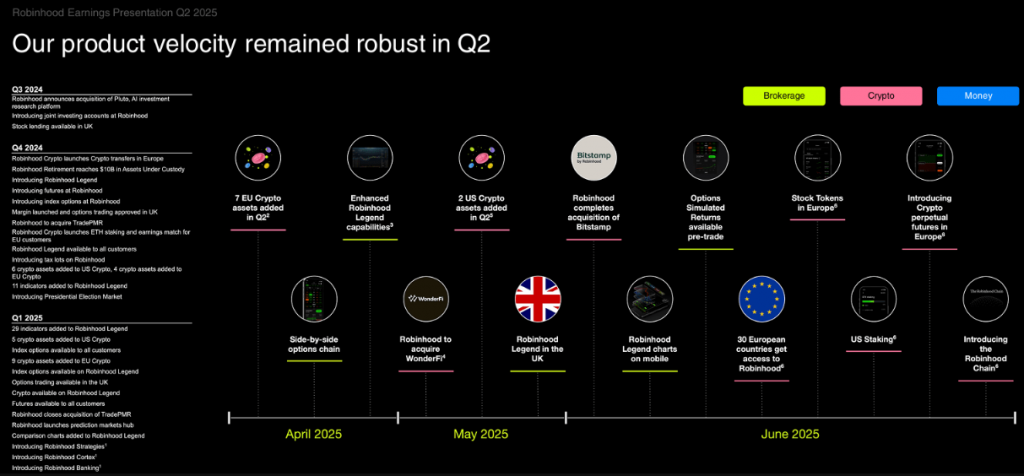

Q2 results showed customers hit 26.5 million, while Gold subscribers reached 3.48 million. Platform assets climbed to $279 billion. These numbers highlight Robinhood fintech expansion beyond traditional trading.

Also Read: Robinhood HOOD up 229% YTD: Citigroup Raises Stock Forecast

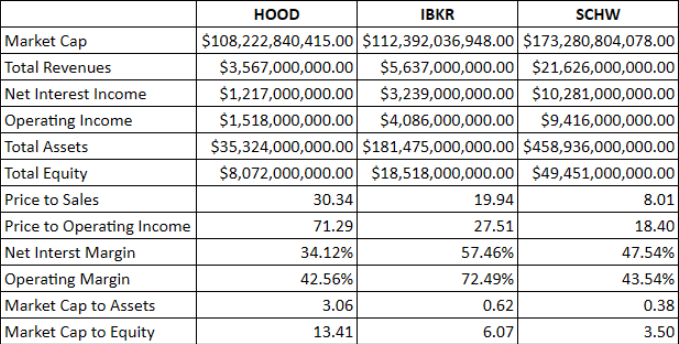

HOOD stock joined the S&P 500 in September 2025. Having deposits of up to $13.8 billion and operating income of $1.518 billion, Robinhood has demonstrated good performance and its market growth, Robinhood market.

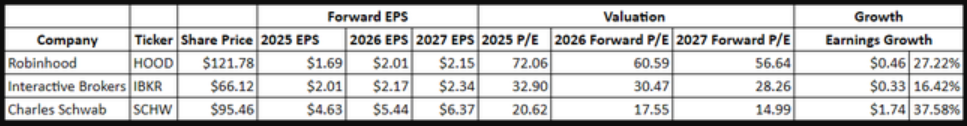

It has a market capitalization of about $108.2 billion. HOOD stock is climbing as Robinhood rolls out new features. According to some analysts, the net interest margin of 34.12 is a good sign.

The momentum behind HOOD stock appears backed by fundamentals. Robinhood prediction trades generate substantial volumes even now. The Robinhood fintech expansion positions the company well for growth in the competitive space.

Also Read: Robinhood Joining S&P 500, HOOD Stock Surges 15%