After quite a turbulent start to 2022, the market was seen picking up the pieces on Wednesday. The recovery was evidently led by BTC. The rest of the coins, quite unhesitatingly, followed suit. In effect, the global crypto market cap witnessed a notable uptick alongside.

GALA – setting the standard high for meta-tokens

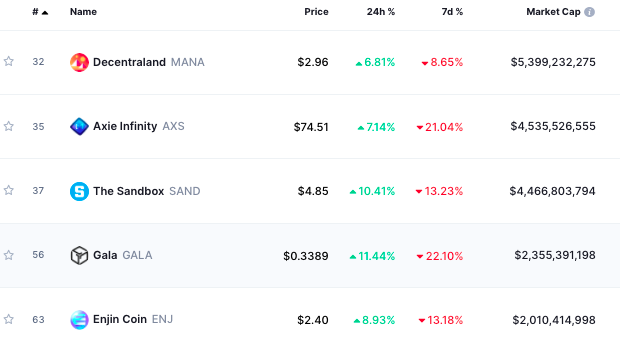

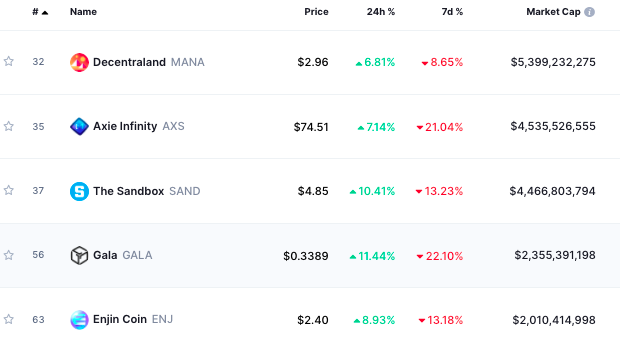

Well, most of the top-ranked coins had recorded only 3%-5% rises in the daily window. Metaverse tokens, on the other hand, had fetched HODLers 7% to 11% returns in the same timeframe. Amongst the top-5, tokens from this space, GALA had appreciated the most.

Before proceeding further, it is important to note that Gala Games is a decentralized gaming platform that allows people to build and run their own games. Having said that it should also be borne in mind that Gala Games is not a single game, but instead offers an entire gamut of different blockchain games to players. In retrospect, users of the platform play these games and win rewards for their victories.

The GALA token, as such, serves as a utility token and is used to purchase items in the games. Players can additionally own NFTs and influence the governance of games within the Gala ecosystem. As per CMC, Gala Games has over a million monthly active users. What’s more, over 26,000 NFTs have been sold to date, with the most expensive piece valued at $3 million.

So, would GALA’s uptrend last?

Towards mid-of November GALA began the first leg of its uptrend. It did not take a proper breather until it surged by 1000%. Post that, the token subjected itself to a prominent correction. Towards mid-December again, it tried to get back into its higher highs phase but wasn’t successful in doing so.

As of now, GALA is engulfed within a descending channel [yellow]. Before the broader market recovery began, GALA was making lower lows on almost a daily basis. However, the lower trendline of the channel acted as strong support and prevented the coin from witnessing a free-fall to $0.238.

With two green candles already recorded, the momentum has already started shifting towards the bulls again. So, if they continue inducing pressure, it would just be a matter of time until GALA breaches $0.368 first and $0.459 next. The same would translate to a close-to 40% incline from the current levels.

However, if the broader market’s pump proves to be a dead cat bounce, then GALA too would have to bear the consequences. More so, because it shares a 95% correlation with Bitcoin.

In such a scenario, market participants can expect GALA to revisit the 78.6% Fib level. If the situation doesn’t improve from thereon either, then the token could dunk back to its November levels around $0.07.

Which side to expect the pendulum to swing in the ST?

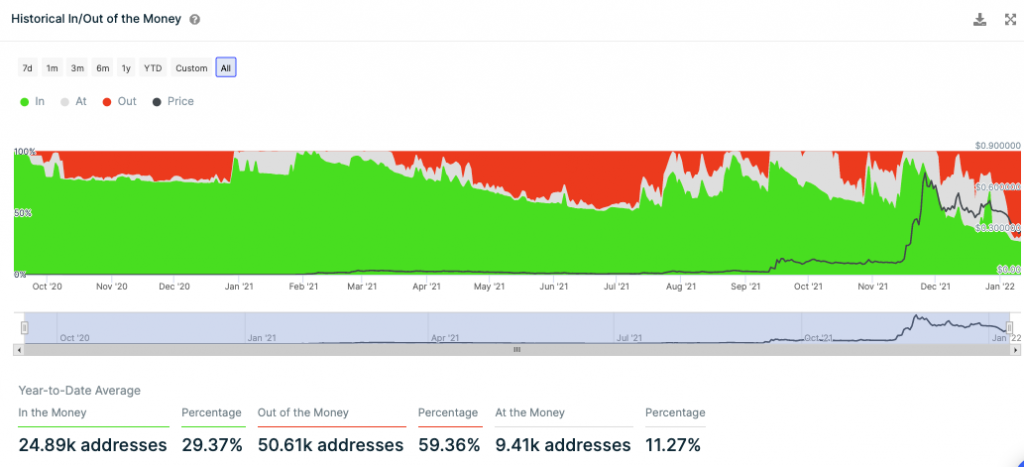

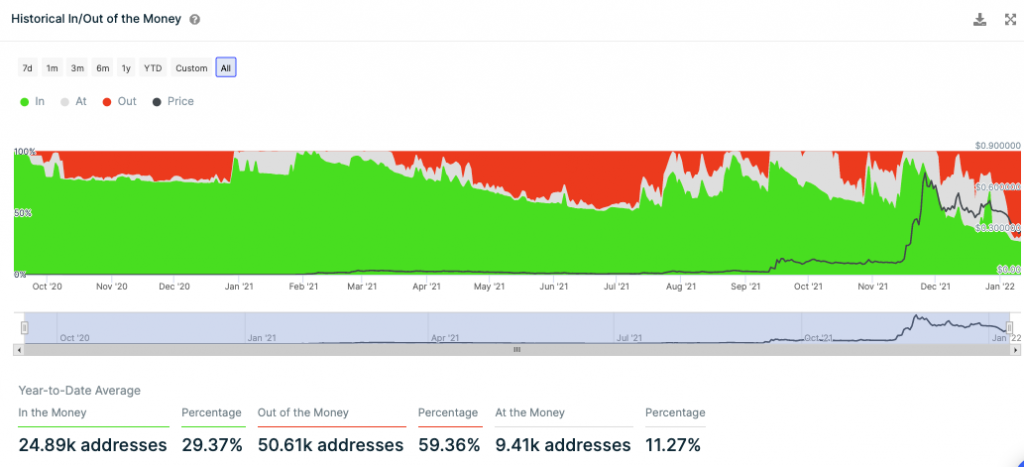

At the time of this analysis, it was noted that less than one-third of GALA HODLers were in profits. Parallelly, almost 60% of them were ‘out of the money or in a loss.

Market participants usually tend to exit the market only when they are in a profitable state. So, keeping in mind the aforementioned numbers, the odds of the GALA market witnessing a macro sell-off at this stage is quite minimal.

Additionally, as per the order book stats from ITB, the number of tokens sold was 10 million short of the number bough over the past 12 hours, re-asserting the bulls’ command.

So, in light of the current trends, the odds of the former scenario [GALA attaining $0.459] materializing seem to be more than the latter downtrend scenario.