In March 2020, as the world faced the economic challenges of the COVID-19 pandemic, the U.S. government provided stimulus checks to Americans. This was done to help them navigate any financial crisis that occurred during the time. Several recipients of the $1,200 payments considered various investment opportunities to enhance their financial future. Bitcoin was a popular choice considering its growth rate during the time.

The $1,200 stimulus check, issued under the Coronavirus Aid, Relief and Economic Security [CARES] Act, aimed to offer financial relief to individuals and families. At that time, Bitcoin [BTC] was priced at around $5,201. Those who invested their stimulus money in Bitcoin have seen substantial returns on their investment.

Also Read: Shiba Inu: How High Can SHIB Go If Bitcoin Hits $700,000

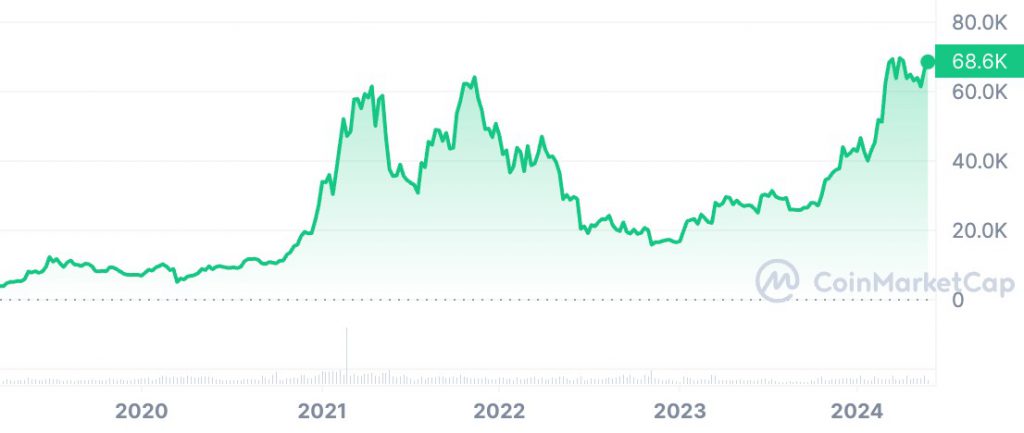

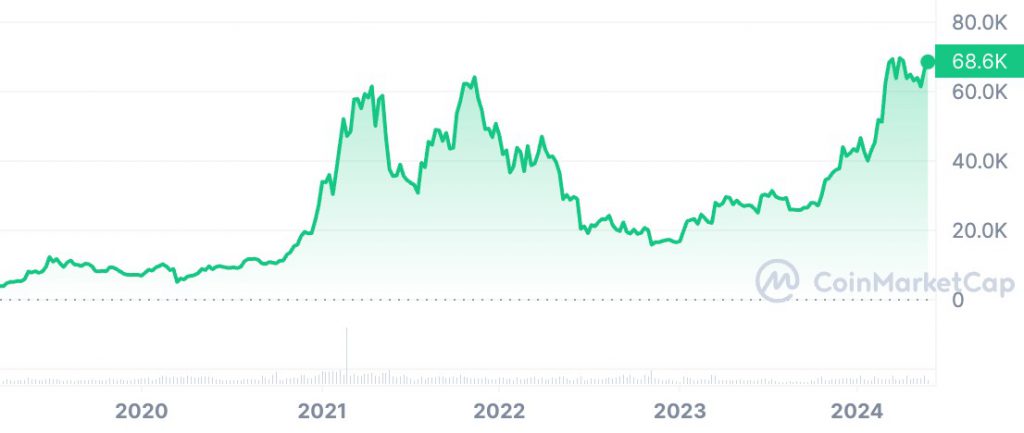

Bitcoin’s Meteoric Rise

As of May 2024, Bitcoin has experienced significant growth in value. Recently, the asset has exhibited increased volatility, with prices ranging from around $61,000 on May 14 to over $71,000 on May 21. A correction brought the price below $67,000 on May 24. However, it recovered quite swiftly. Currently, the asset is trading at $68,543 with no major gains over the last 24 hours.

Considering the above factors, an investment of a $1,200 stimulus check in Bitcoin at its March 2020 price of $5,201 would have got the investor 0.2307 BTC. At today’s price of $68,543, that investment would now be worth around $15,816. This means that the asset has grown reflecting a return of nearly 1,218%. This substantial profit highlights Bitcoin’s potential as a high-yield investment, despite its volatility.

Furthermore, this impressive growth underscores Bitcoin’s transformative potential and the opportunities within the cryptocurrency market. However, it also highlights the pertinence of understanding market volatility and making informed investment choices.

Also Read: Bitcoin: Argentina and El Salvador Engage in BTC Adoption Talks