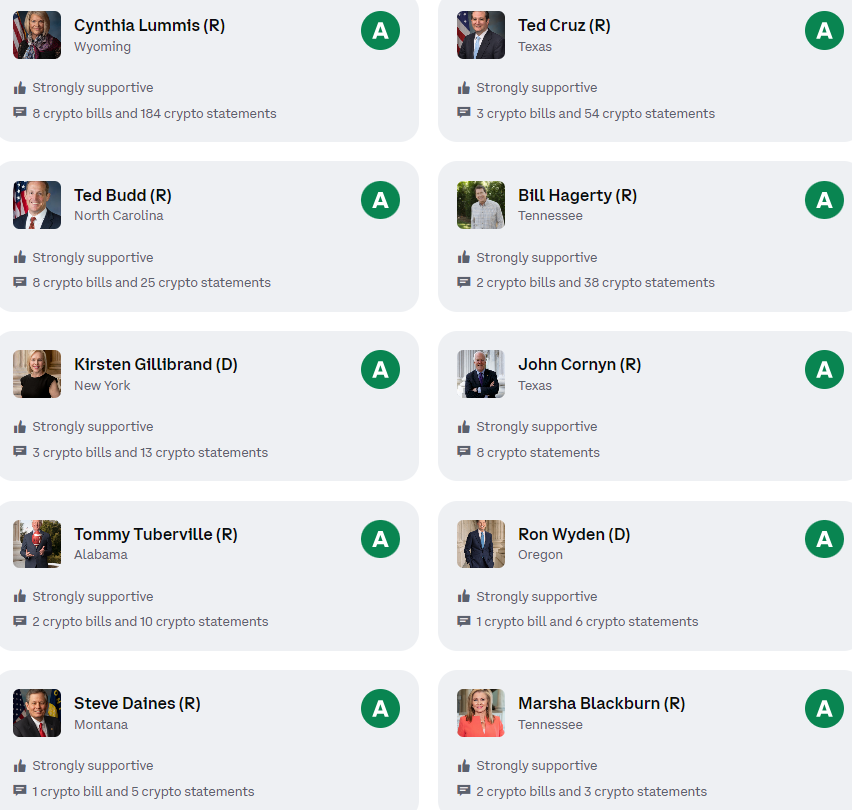

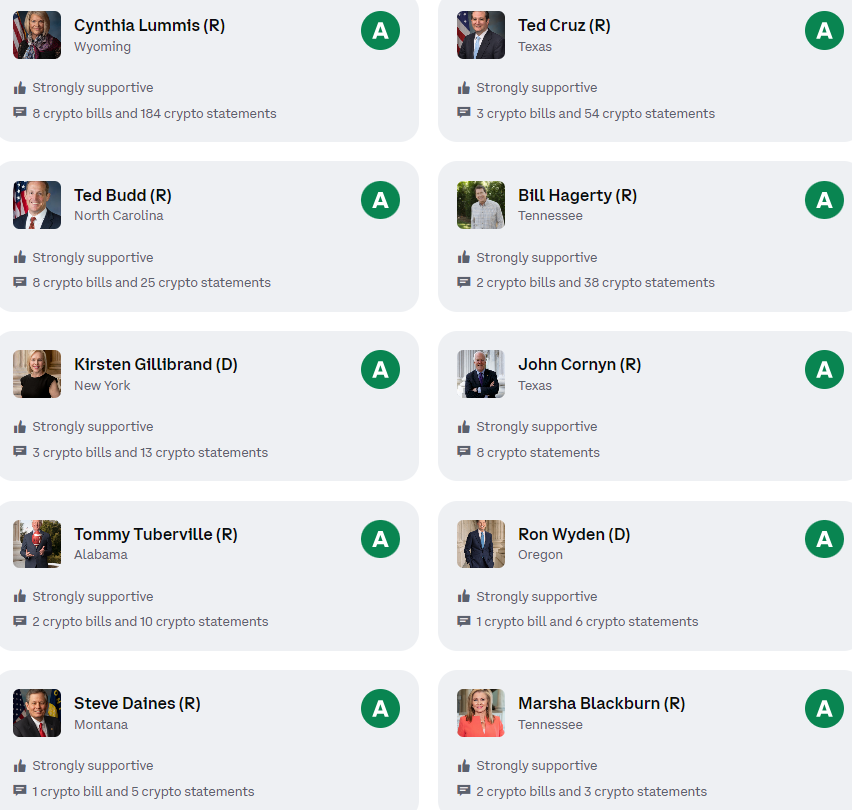

Eighteen U.S. senators have firmly declared their backing for emerging cryptocurrency and blockchain technologies amid ongoing policy debates that threaten to stifle American innovation. The bipartisan group of pro-crypto politicians on both sides of the aisle hopes to influence regulations still under formulation.

According to data aggregation site Stand With Crypto, an equal number of senators currently oppose crypto development, meaning almost 20% of the legislative body supports the burgeoning asset class. The even divide exemplifies the competing perspectives around digital currencies on Capitol Hill and beyond.

Republicans make up the vast majority of vocal advocates based on legislation sponsorship and public commentary. Just four Democrats have aligned with the pro-crypto camp so far, signaling that more progressive lawmakers harbor deeper skepticism.

Also read: Shiba Inu (SHIB) Forecasted To Reach $0.001: Here’s When

Cynthia Lummis ranks as the most active

Of the 100 total senators, Cynthia Lummis (R-WY) and Ted Budd (R-NC) rank as the most active in pushing for crypto-friendly measures. The two Senators count over 30 combined bills and statements espousing the promise of borderless finance.

Conversely, Senator Elizabeth Warren leads crypto critics with over 75 public remarks exposing the perceived dangers of decentralized systems. The Massachusetts Democrat also keeps introducing bills aiming to limit cryptocurrency development through aggressive taxation and regulation.

Also read: Top 5 Trending Meme Coins To Watch In 2024

The divide falls largely along party lines. However, the slim margin separating both viewpoints shows that wholesale opposition no longer dominates discourse as it did five years ago. With candidates across the political spectrum adopting pro-crypto stances, bipartisan consensus could continue growing.

How legislators ultimately coalesce around hot-button issues like tax policies, stablecoin rules, disclosure requirements, and centralized bank digital currencies promises to shape the coming phase of American blockchain expansion.