The FTX fiasco has taken the crypto industry by storm. Not only have hundreds of users lost their funds, but the incident has also brought a lot of attention to the importance of cold storage and decentralized wallets. The interest in decentralized wallets has consequently led to a surge in the tokens of respective wallets.

The biggest gainer among decentralized wallets since the FTX episode is Trust Wallet. According to ICO Analytics, the TWT token (Trust Wallet’s native token) has gained by 98% in seven days as of November 15th.

As per the data on CoinGecko, TWT has gained by up to 101.6% in the last seven days. In the last 24 hours, the token has rallied by 13.5%. However, it has fallen by 3.8% in the last hour. At press time, TWT was trading at $2.10.

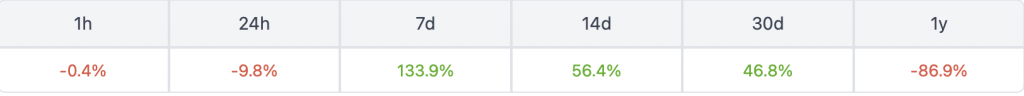

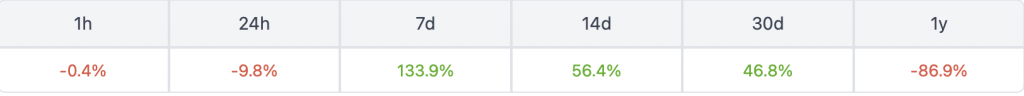

MATH is the second biggest gainer among decentralized wallets, with 133.9% gains in the last week. However, the token has fallen in the last 24 hours by up to 9.8%. At press time, MATH was trading at $0.141200.

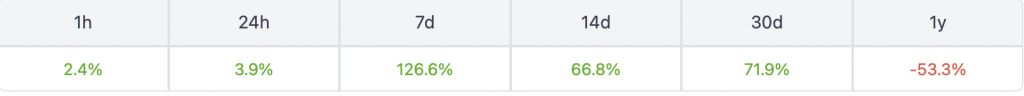

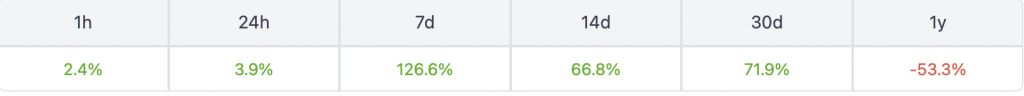

The next project to make gains after the FTX fall is SafePal (SFP). The token has made big gains over the week, with a rally of 126.6% in seven days. The token has also rallied by up to 3.9% in the last 24 hours. At press time, SFP was trading at $0.657867, up by 2.4% in the last hour.

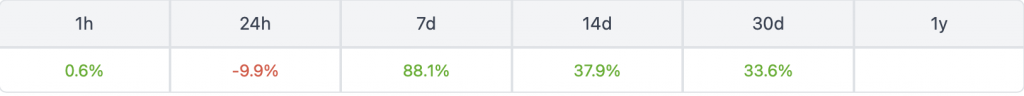

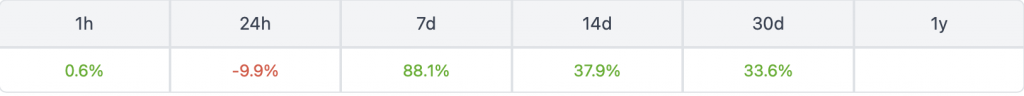

XDEFI is another decentralized wallet to make big gains over the week. The project has made gains of up to 88.1% over the last seven days. However, it has fallen by 9.9% in the last 24 hours. At press time, XDEFI was trading at $0.132851

The FTX episode has proven the importance of cold storage and decentralized wallets, regardless of how trustworthy an exchange may seem. Many considered FTX founder SBF (Sam Bankman-Fried) to be a savior in the crypto realm. However, to everyone’s dismay, that was not the case. The whole situation has proven once again that the popular quote, “not your keys, not your crypto,” is quite truthful.