The world economy has been badly affected by the coronavirus pandemic. In fact, per the IMF, the global economy shrunk by 4.4% in 2020. The decline was termed to be a black swan event and it was statistically more severe than the great depression. The crypto asset class was equally disrupted as Bitcoin dropped down to ~$4000.

As lockdowns were imposed by governments all over, almost all sectors—right from tourism, to construction, and manufacturing—were victimized. The same was reflected by the deteriorating state of the equity indices.

With revenues tumbling, companies were forced to shut—or at least temporarily halt—services. In order to cut down on costs, they started firing employees en masse, and resultantly, unemployment numbers started skyrocketing. The ripple effects that followed led to a weak purchasing power of the population.

Initially, a section of people bought in the fact that inflation was transitory, and with time, it would evaporate. In fact, things did stabilize for a while in 2021, but over the past 6 months, the cookie has started to crumble. In fact, at this point, layover numbers have started shooting up again.

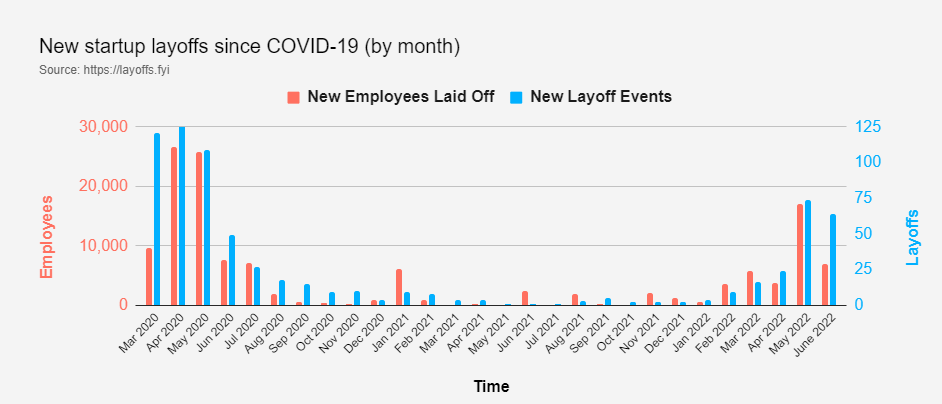

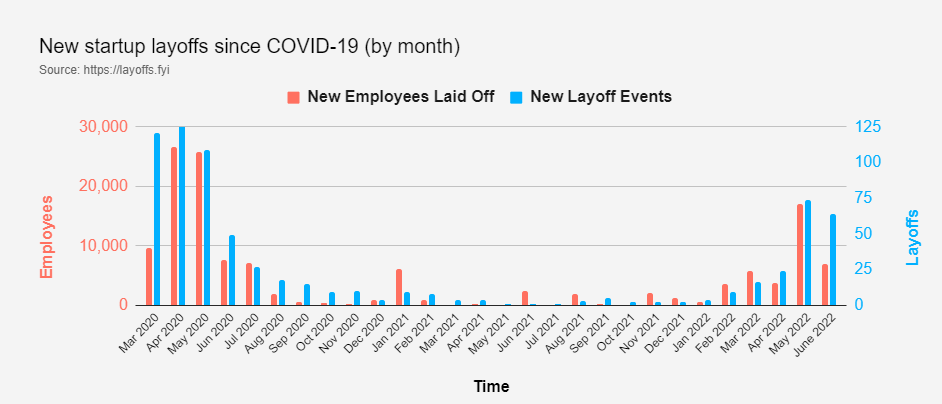

Per data from layoffs.fyi, the number of employee layoffs and other such related events in startups has already risen up to 2020’s levels. The same can be observed below.

Things to get even worse from here?

Speculatively, yes. Just last week, the World Bank’s global economic forecast was released and outlined that global economic growth is expected to slow down before the end of the year. It went on to state that most countries should begin preparing for a recession, with the World Bank president David Malpass, emphasizing,

“For many countries, recession will be hard to avoid.”

Per the report, the rate of global growth is expected to drop to 2.9% in 2022. Several major economies across the world, including the US, have adopted hawkish measures and most countries have been increasing interest rates. In fact, the Federal Reserve announced another 75 bps hike on Wednesday but they made it clear that the motive was not to induce a recession.

With inflationary pressures intensifying, India’s RBI also announced a 50 bps hike less than a fortnight back. Theoretically, by increasing interest rates, the money supply is curbed, making it more expensive for consumers to borrow money. With a spending reduction, the pace of economic growth contracts, and resultantly, prices of goods and services stabilize, which aids in halting inflation.

Is Japan treading on its own path?

With most countries adopting measures similar to that of the US, Japan seems to be in a world of its own. At the moment, it offers one of the lowest interest [-0.1%]. In fact, Japan adopted negative rates back in 2016 in an effort to combat years of deflation. By treading on the non-conventional path, the nation intended to encourage borrowing and spending.

But now, with the world being in an inflationary environment, can Japan end up creating its own deflationary island? While at first glance, it might seem possible, there are a host of other external factors that may make its path challenging.

The Japanese Yen, as such, retains the “funding” currency tag. A funding currency is a currency that is exchanged while trading because it typically has a low-interest rate. The other currency picked is usually high yielding in nature and market participants—by strategically borrowing and investing—reap returns.

So, can this last forever? Can people keep selling Yen and use the proceeds to buy, say, USD? Well, such an act would obviously have negative repercussions, for the value of the Yen would keep dropping. A recent analysis thread on Twitter pointed out,

“The VERY FACT that interest rate differentials occur, the YEN loses value.”

Amidst all this, the BOJ is raising debt capital by conducting an outright purchase of Japanese Government Bonds. Now, over the last couple of days, JGB’s volatility has massively shot up and the BOJ’s choice is currently under litmus test.

Criticisms have already started erupting and hedge funds like BlueBay have begun shorting JBGs as they believe that the central bank would be forced to abandon a policy that’s “increasingly out of sync” with global peers.

Alongside, the Yen continues to get weaker relative to the dollar, with USD/JPY pair trading around multi-year highs.

To buy or not buy the crypto dip?

Well, the US and Japan have been on different pages for quite some time now. However, neither of their measures to cater to the macro turbulence is full proof, as the GDPs of both the countries continue to shrink. In such a situation, attempting to catch another crypto-falling knife should be avoided.

The analysis thread asserted,

“Don’t be quick to buy the crypto dip by ignoring the macro!”

The recent announcements didn’t essentially trigger another crypto sell-off in the market because the moves were well anticipated in advance by people. We might, likely, note a brief relief phase going forward, but with the overall landscape still remaining wobbly, the odds of things continuing to go downhill still remain to be quite high.