Bitcoin’s narrative seems to have changed in just a few months. Threats of rising inflation rates, under-pressure global markets, and an ongoing conflict between Russia and Ukraine have begged the question – is this a crypto bear market? In the first two months of 2022, three flash crashes have taken place. As a result, Bitcoin was currently trading at a 50% discount when compared to its record level.

Analysts and cryptocurrency proponents believe that the ‘crypto winter’ is set to continue until the macro global outlook starts improving. “It looks like a bear market” to be exact, were the words used by research firm Glassnode in the latest weekly report.

Typically, bear markets can last between 1 month and an entire year, depending on the severity of the macro outlook. The situation can spook new investors and sometimes, even experienced ones. With that said, there are different ways to earn money even when prices are declining. Here are some of the popular strategies one can employ during a bear market.

Shorting

Shorting or short-selling is a bet made against the market. Traders who short sell expect the price to go lower and make profits as a result of their bets. However, the same is risky as the loss potential can be unlimited if a reasonable stop-loss is not maintained. For a quick guide on how to shorts-sell, readers can have a look at the latest price prediction piece on Avalanche.

Buying Put Options

Put options are preferred when one is bearish on a particular cryptocurrency. The option gives the holder the right to sell crypto set at a specific price and date. One can buy a put option at a specific ‘strike price’. Once the value of a cryptocurrency goes below the strike price, the put option becomes more valuable. Investors must keep an eye out for different premiums while purchasing such options. More information on how to trade put options can be found here.

Identifying market bottoms or demand zones

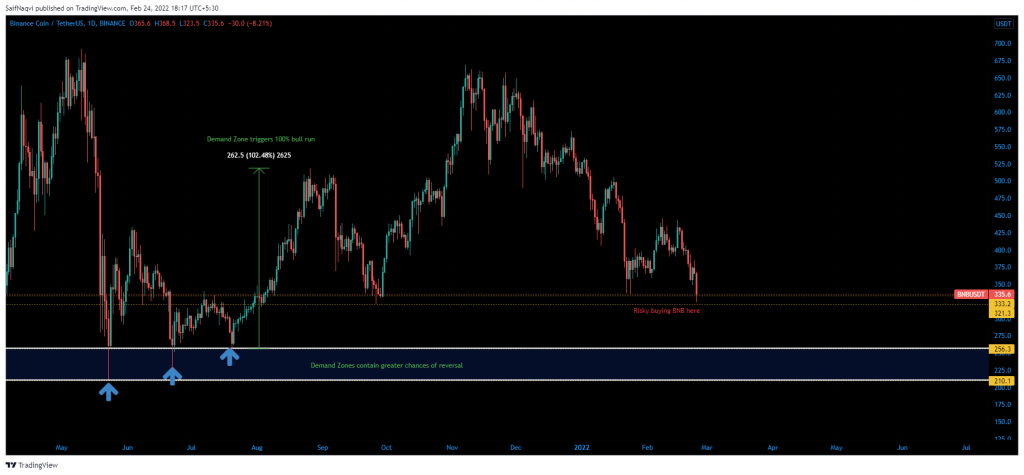

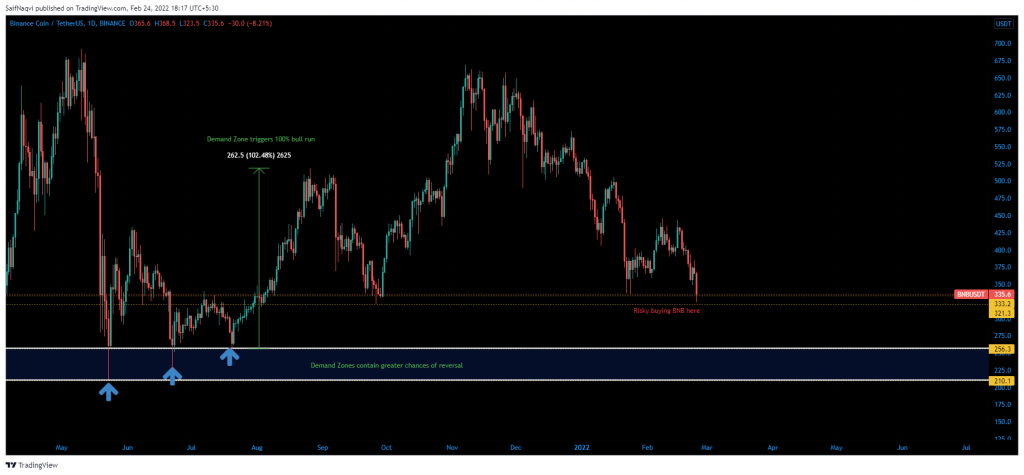

You must have come across the term ‘buy the dip’ during market corrections. The phrase can often suck novice investors into a trap as the market tends to slide lower during bear cycles. The right way to ‘buy the dip’ is identifying important bottoms or demand zones on the chart. Demand zones are areas where buying activity supersedes sell activity. They form at the base of a strong uptrend or downtrend.

For example, Binance Coin’s demand zone lay between $260-$210. The area was responsible for a 100% BNB surge between late-July to early August. A buy order placed within such areas can offer a higher chance of bullish reversal than let’s say, Binance’s current support zone of $340-$320.

Staking rather than trading

Staking is a popular way to earn passive income without exposing your portfolio to deep losses. One must evaluate their options as different coins offer different interest rates for staking. Keep in mind that some coins require investors to stake their coins for a specific period before any income is generated.

Have A long Term Perspective

Finally, it’s important to look at the crypto market from a long-term perspective. Bear markets are part are a core part of market cycles and the same do not last forever. Instead, one must do independent research of Bitcoin’s macro outlook and all the different factors that can impact its long-term price. Factors such as increased adoption, higher greater, new partnerships, and an active dev team can lead to a faster recovery.