How to Prepare for a Recession: A Comprehensive Guide

You’ve probably heard the term “recession” thrown around in the news, but what exactly does it mean and how can you prepare yourself financially?

In this comprehensive guide, we will walk you through the steps to prepare for a recession, including building an emergency fund, reducing debt, and exploring additional income streams.

By following these strategies, you can protect yourself and your finances during economic downturns.

Also read: BRICS Member Admits US Dollar Will Remain Dominant

Understanding the Basics of a Recession

Before we dive into the preparation strategies, let’s start by understanding what a recession is.

A recession is a period of economic downturn that lasts for several months or even years.

It is characterized by a decline in the region’s gross domestic product (GDP), increased unemployment rates, and reduced consumer spending.

Recession can have a significant impact on businesses, individuals, and the overall economy.

Key Insights on Recessions:

- A recession is more nuanced than the textbook definition of a decline in economic activity for two consecutive quarters. It can last longer and have varying impacts on different sectors of the economy.

- The U.S. economy has experienced several recessions throughout history, with the most recent one being the aftermath of the Great Recession in 2008.

- Recessions can lead to job losses, reduced investments, falling asset values, and increased levels of debt.

Building an Emergency Fund: Your Financial Safety Net

One of the first steps to preparing for a recession is to build an emergency fund.

An emergency fund is a pool of savings set aside specifically for unexpected expenses or income disruptions. It acts as a financial safety net, providing you with a cushion to cover essential expenses during tough times.

Here’s how you can start building your emergency fund:

Assess Your Current Financial Situation

Take a detailed stock of your finances to determine your starting point. Calculate how much cash you have on hand and how much you can access quickly if needed.

Evaluate your debt levels, including credit card debt, student loans, and other outstanding loans.

This will help you understand your financial obligations and identify areas where you can make adjustments.

Also read: Why Indonesia Was Left Out Of BRICS? Explained!

Create a Monthly Budget

To build your emergency fund, you’ll need to make some adjustments to your spending habits and prioritize saving. Start by creating a monthly budget that outlines your income and expenses.

List your essential expenses, such as rent or mortgage payments, utilities, groceries, transportation, and healthcare costs. Identify areas where you can cut back on non-essential spending, such as entertainment or dining out.

By tracking your spending and sticking to a budget, you can free up more money to contribute to your emergency fund.

Set a Savings Goal

It’s recommended to have at least three to six months’ worth of living expenses saved in your emergency fund. However, if possible, aim for more.

Assess your monthly expenses and calculate the total amount you would need to cover three to six months of essential costs.

Start by saving a smaller amount, such as $1,000 or one month’s worth of expenses, and gradually increase your savings until you reach your desired goal. Remember, every little bit helps, so even small contributions can make a difference.

Choose the Right Savings Account

To maximize the growth of your emergency fund, consider opening a high-yield savings account.

These accounts offer higher interest rates than traditional savings accounts, allowing your money to grow faster.

Look for accounts with no or low fees and easy accessibility. Research different banks and financial institutions to find the best option for your needs.

Reducing Debt: Lightening the Financial Load

During a recession, it’s essential to reduce your debt burden as much as possible.

High levels of debt can put additional strain on your finances and make it challenging to manage during tough times. Here are some strategies to help you tackle your debt:

Evaluate Your Debt

Start by evaluating your current debt situation. Make a list of all your outstanding debts, including credit card balances, student loans, and other loans.

Note the interest rates, minimum monthly payments, and total balances for each debt. This will give you a clear picture of your debt obligations and help you prioritize which debts to tackle first.

Create a Debt Repayment Plan

Once you have a clear understanding of your debt, develop a debt repayment plan.

There are several strategies you can use, such as the snowball method or the avalanche method. The snowball method involves paying off your smallest debt first, while the avalanche method focuses on paying off the debt with the highest interest rate first.

Choose the strategy that aligns with your financial goals and start making extra payments towards your debts.

Negotiate with Creditors

If you’re struggling to meet your debt obligations, don’t hesitate to reach out to your creditors. Many lenders are willing to work with borrowers during challenging times.

Contact your creditors and explain your situation. They may be able to offer hardship programs, lower interest rates, or extended payment terms.

Taking proactive steps to address your debt can help alleviate financial stress and give you more control over your finances.

Avoid Taking on New Debt

During a recession, it’s crucial to avoid taking on new debt whenever possible. Be mindful of your spending habits and resist the urge to rely on credit cards or loans to make ends meet. Focus on living within your means and prioritize essential expenses.

By reducing your reliance on credit, you can avoid accumulating additional debt and maintain better control over your financial situation.

Exploring Additional Income Streams: Diversifying Your Earnings

During a recession, having multiple sources of income can provide stability and security.

Exploring additional income streams can help you diversify your earnings and provide a buffer against economic downturns. Here are some ideas to consider:

Side Hustles and Freelancing

Consider taking on a side hustle or freelancing gig to supplement your primary source of income. There are various opportunities available, such as freelance writing, graphic design, tutoring, or pet sitting.

Identify your skills and interests and explore ways to monetize them. Side hustles can provide extra money that can be used to boost your emergency fund or pay down debt.

Utilize Your Skills and Expertise

Take advantage of your skills and expertise to generate additional income. If you have specialized knowledge in a particular field, consider offering consulting services or teaching online courses.

You can also explore opportunities to become a virtual assistant or offer your services as a freelancer in your industry.

Leveraging your skills can open doors to new income streams and provide a sense of financial security.

Explore the Gig Economy

The gig economy offers a range of opportunities for individuals looking to earn extra money. Platforms like Uber, Lyft, TaskRabbit, and Upwork connect individuals with various gig-based work opportunities.

Whether it’s driving passengers, running errands, or completing small tasks, the gig economy can provide flexibility and additional income during uncertain times.

Invest in Stocks and Real Estate

Investing in stocks and real estate can be another way to generate passive income. While these investments come with risks, they can provide long-term growth potential and income streams.

Consider working with a financial advisor to develop an investment strategy that aligns with your goals and risk tolerance.

Diversifying your investments can help protect your finances during a recession and provide opportunities for future growth.

Protecting Your Assets: Navigating the Stock Market

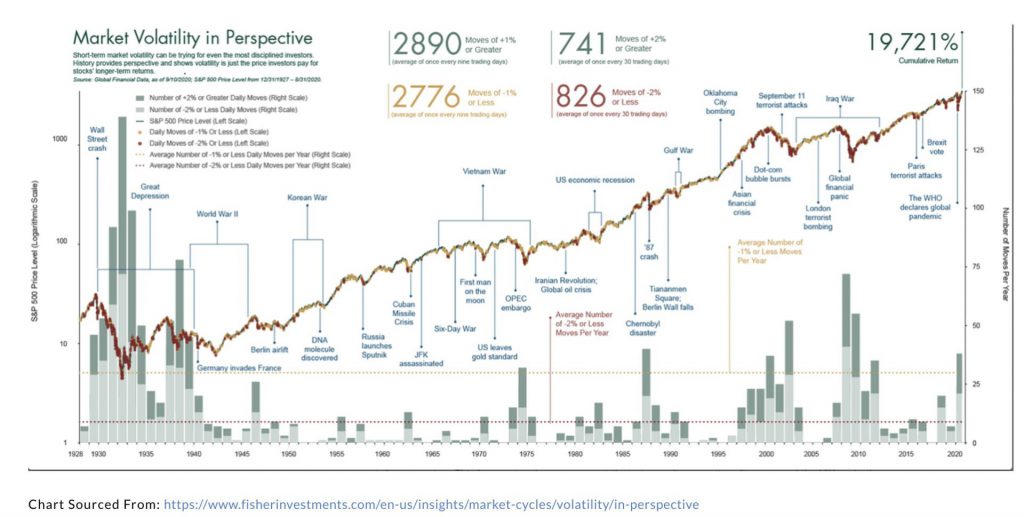

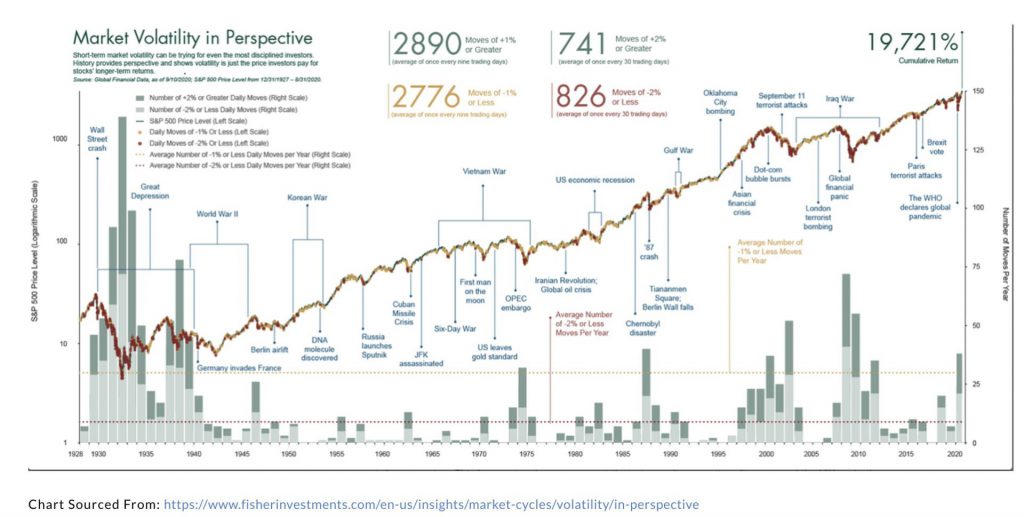

The stock market can be volatile during a recession, causing anxiety for many investors. However, it’s essential to stay calm and stick to your investment plan.

Here are some tips for navigating the stock market during uncertain times:

Stay the Course

While market downturns can be unsettling, it’s important to resist the urge to make impulsive decisions based on short-term market fluctuations.

Stick to your long-term investment plan and avoid trying to time the market.

Historically, the stock market has shown resilience and has provided positive returns over the long term. By staying invested and maintaining a diversified portfolio, you increase your chances of benefiting from market recoveries.

Focus on Quality Investments

During a recession, it’s crucial to focus on quality investments that have the potential to weather economic downturns. Look for companies with strong fundamentals, reliable cash flows, and sustainable business models.

Diversify your portfolio by investing in different sectors and asset classes. This can help mitigate the impact of any single investment and protect your assets during turbulent times.

Seek Professional Advice

If you’re uncertain about navigating the stock market on your own, consider seeking professional financial advice.

A financial advisor can help you develop an investment strategy that aligns with your goals and risk tolerance.

They can also provide guidance during market downturns and help you make informed decisions based on your financial situation.

Strengthening Your Job Security: Boosting Your Career

During a recession, job security becomes a top concern for many individuals. Strengthening your job security and boosting your career can provide a sense of stability during uncertain times. Here are some steps to consider:

Update Your Resume

Keep your resume up to date with your latest skills, accomplishments, and experiences. Highlight your strengths and showcase the value you can bring to potential employers.

Regularly updating your resume ensures that you’re prepared for any job opportunities that may arise, whether it’s within your current organization or externally.

Expand Your Skill Set

Continuously improving your skills and expanding your knowledge can make you more valuable in the job market.

Identify areas where you can enhance your expertise and invest in professional development opportunities.

Consider taking online courses, attending workshops or conferences, or pursuing certifications in your field. Upskilling can make you more competitive and increase your chances of retaining your job or finding new opportunities.

Network, Network, Network

Building a strong professional network is essential for career growth and job security. Stay connected with colleagues, industry professionals, and mentors.

Attend industry events, join professional associations, and engage in online networking platforms.

Your network can provide valuable support, advice, and potential job leads during challenging times.

Explore New Opportunities

While it’s important to focus on your current job, don’t be afraid to explore new opportunities that align with your career goals.

Keep an eye on the job market and be open to considering new roles or industries that may offer better stability or growth potential.

Networking and staying connected with professionals in your field can provide insights into new opportunities.

Keeping an Eye on the Economy: Staying Informed

To effectively prepare for a recession and navigate economic downturns, it’s crucial to stay informed about the state of the economy. Here are some ways to stay updated:

Follow Economic Indicators

Pay attention to key economic indicators that provide insights into the overall health of the economy.

These indicators include GDP growth rates, unemployment rates, inflation rates, and consumer spending patterns.

Understanding these indicators can help you anticipate potential economic shifts and make informed decisions about your personal finances.

Read Financial News and Analysis

Stay updated with financial news and analysis from reputable sources.

Additionally, follow news outlets, financial publications, and trusted websites that provide insights into the economy, stock market trends, and personal finance topics.

Reading financial news can help you stay informed about market developments and make educated decisions about your investments and financial strategies.

Seek Professional Advice

If you’re uncertain about the state of the economy or how it may impact your finances, consider seeking professional advice.

Financial advisors, economists, and industry experts can provide valuable insights and guidance based on their expertise. They can help you understand the broader economic landscape and tailor your financial strategies to align with current market conditions.

Conclusion

In conclusion, preparing for a recession requires proactive steps to protect your finances and strengthen your financial resilience.

Furthermore, by building an emergency fund, reducing debt, exploring additional income streams, navigating the stock market, boosting your career, and staying informed about the economy, you can better prepare yourself for economic downturns.

Remember, it’s essential to take a comprehensive approach and adapt your strategies to align with your financial goals and risk tolerance. With careful planning and proactive measures, you can recession-proof your life and secure your financial future.