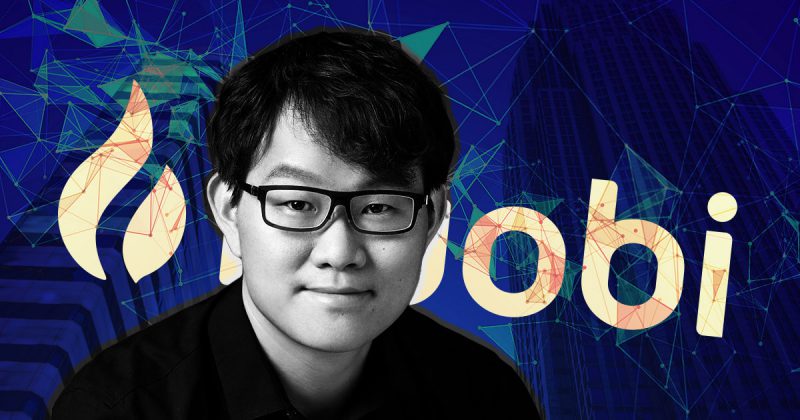

Huobi Group founder Leon Li is reportedly in talks with “a clutch” of investors to sell his majority stake in the crypto exchange for a valuation as high as $3 billion. If the same materializes, it could end up becoming the industry’s largest takeover since winter set in this cycle.

Who are the involved parties?

Per Bloomberg, the executive has held discussions with a host of financiers, with the intention of selling roughly 60% of his stake. Notably, Li founded the exchange almost a decade back, in 2013.

With respect to the involved parties, Bloomberg’s anonymous sources revealed,

“Tron founder Justin Sun and crypto-billionaire Sam Bankman-Fried’s FTX are among those who’ve had preliminary contact with Huobi about a share transfer, the people said, asking to remain anonymous discussing private information.”

However, it should be noted that an FTX spokesperson declined to confirm the same to Bloomberg, while Sun said in a text message that he hasn’t had any negotiations with Li about a sale.

Here it is worth recalling that back in July also there were reports about the founder looking to sell more than 50% of his stake in the company. At that time, the exchange was struggling on the revenue front, for it banned Chinese users a few months back.

When to expect the Huobi deal to be sealed?

Sequoia China and ZhenFund are one of the largest holders of stakes in the company. Notably, they were informed about Li’s decision during a July shareholders’ meeting. With respect to the timeline, one of Bloomberg’s anonymous sources said,

“A deal could be completed as soon as the end of this month.”

A Huobi spokesperson confirmed that Li’s has been interacting with several international institutions about the stake sale, but declined to offer specifics. In an emailed statement to Bloomberg, the spokesperson said,

“He hopes that the new shareholders will be more powerful and resourceful and that they will value the Huobi brand and invest more capital and energy to drive the growth of Huobi.”