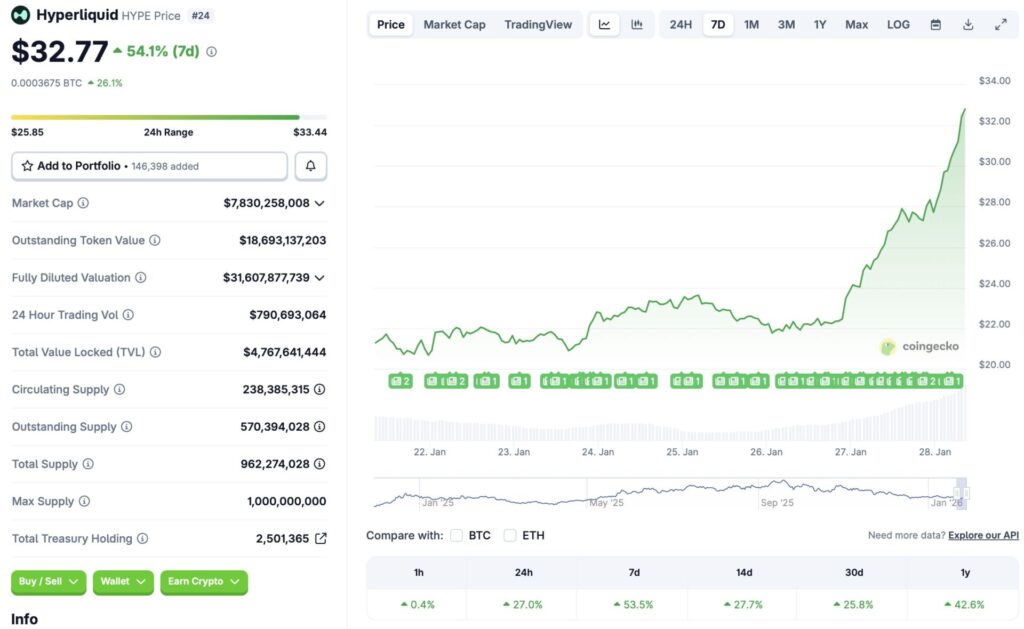

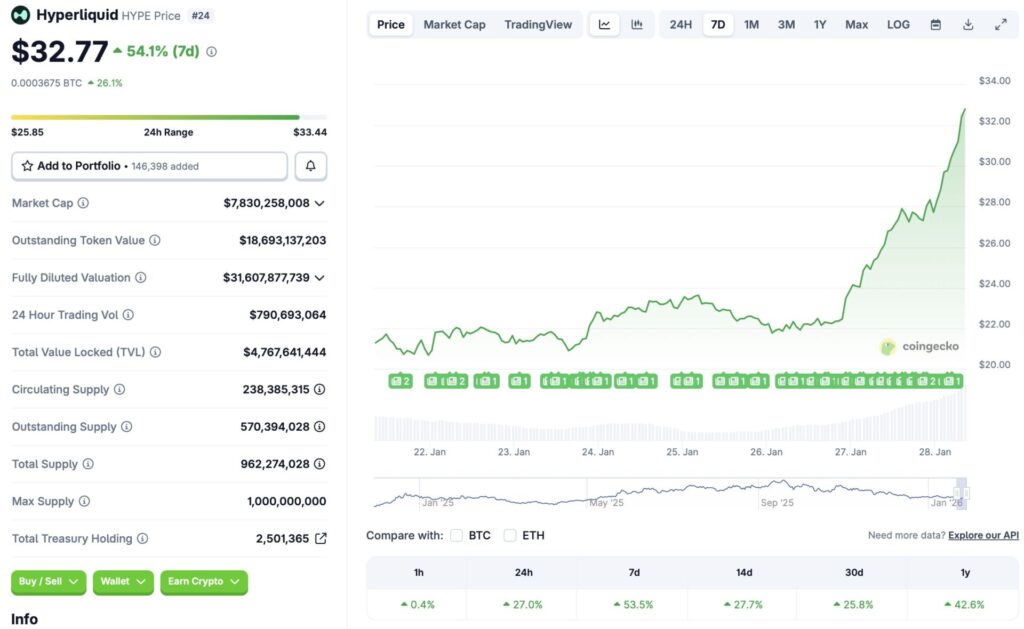

Hyperliquid’s HYPE token is currently one of the best-performing cryptocurrencies in the market, registering a rally across the board. Despite a market-wide bearish environment, HYPE’s price is green across all time frames. According to CoinGecko data, HYPE is up 27% in the last 24 hours, 53.5% in the last week, 27.7% in the last 14-days, 25.8% over the previous month, and 42.6% since January 2025. Let’s discuss why HYPE is in the green zone, while other assets are struggling to gain momentum.

What’s Behind Hyperliquid’s (HYPE) Rally?

Hyperliquid is a popular exchange that offers more than just crypto assets. Recently, silver futures saw a big spike on the platform. Futures contracts are basically people betting on the future price of an asset. Silver futures volume hit $1.25 billion on Hyperliquid within 24 hours. Only Bitcoin (BTC) and Ethereum (ETH) had more trading volume than silver on the platform. The surge in silver futures trades led to a rise in Hyperliquid’s fee collection. A portion of the fee is used to buy back HYPE coins. As more HYPE coins were bought back from the circulating supply, the price of the coin began to rise.

Also Read: What Silver Price Knows That Gold Price Investors Don’t

While the rally is commendable, it is unclear if the upswing will sustain. Given the larger market bearishness, there is a chance that Hyperliquid’s HYPE token will face a correction in the coming days. Nonetheless, silver has been on a historic ride over the last few months. If traders continue their current stride, HYPE’s price could continue rallying from increased buybacks.

Despite the upswing, Hyperliquid (HYPE) is still down by more than 47% from its all-time high of $59.30, which it attained in September of last year. Moreover, CoinCodex analysts do not anticipate the coin’s rally to sustain. The platform anticipates HYPE’s price to dip to $23.28 on Feb. 5, 2026.