James Wynn, an early Pepe (PEPE) investor, predicted that the project’s market cap will hit $69 billion in 2026. However, according to crypto analysis firm LookOnChain, Wynn has closed all PEPE and Ethereum (ETH) long positions on Hyperliquid. Moreover, Wynn has withdrawn most of his funds from the platform. Let’s discuss if the investor is expecting the memecoin to face a massive price correction this year.

Will PEPE Face a Correction in 2026?

Wynn had previously predicted PEPE to hit a multi-billion market cap soon after its launch. Wynn’s correct prediction led a to substantial surge in PEPE inflows, solidifying his position within the PEPE community.

However, given that Wynn has closed his long positions, there is a possibility that the investor anticipates a sharp price correction for the popular memecoin. In fact, Wynn’s actions has led to substantial questioning among the community, especially given that he said he would delete his account if PEPE does not hit his $69 billion target.

Moreover, the crypto market is still recovering from its late 2025 crash. Investors are still taking a risk-off approach, evident from the fact that gold and silver have hit multiple all-time highs over the last few months. PEPE, being a memecoin, carries some of the highest risks in the market.

Also Read: Pepe, Dogecoin, or Trump: Which Memecoin Explodes Next in 2026?

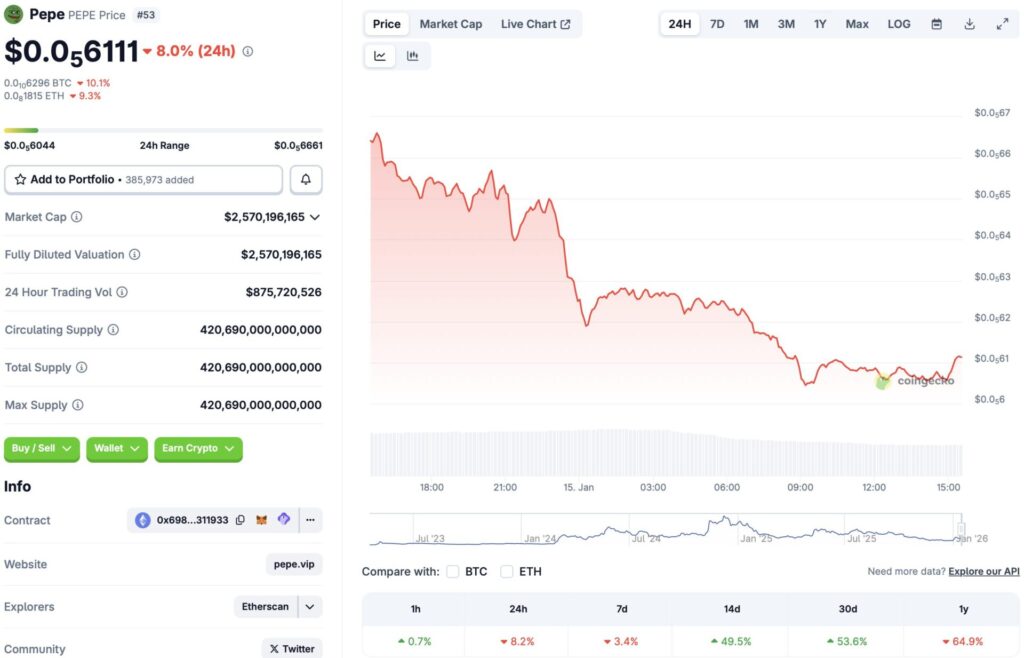

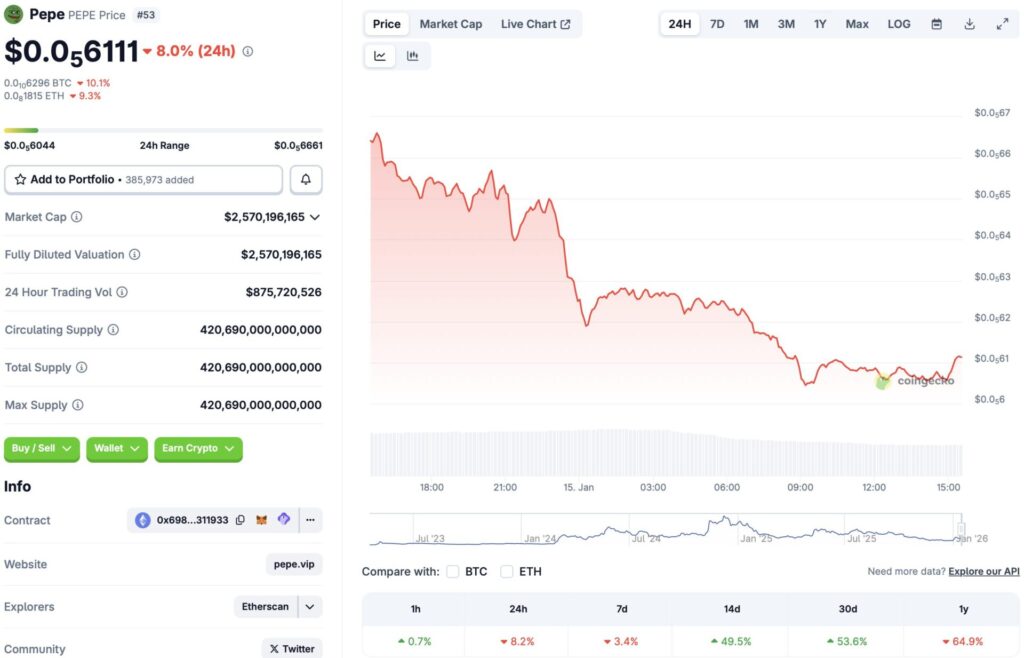

PEPE experienced a big price rally earlier this month. However, the rally seems to have died down. Wynn closing his PEPE positions may have led to the coin’s latest price dip. According to CoinGecko data, PEPE is down by 8.2% in the last 24 hours, 3.4% in the last week, and 64.9% since January 2025. However, the memecoin is still up by 49.5% in the 14-day charts and 53.6% over the last month.

CoinCodex analysts are also quite bearish on PEPE. The platform anticipates the asset to fall to $0.000004471 on Jan. 26, 2026. Dipping to $0.000004471 from current price levels will entail a correction of about 26.85%.