The Indian government formally made crypto returns taxable quite recently. The regulators imposed a hefty 30% tax on ROIs fetched by transacting virtual digital assets. From April this year, the 1% TDS rule also came into effect.

Now, after crypto, the government has put DeFi transactions under its radar. Per a recent Economic Times’ report, the tax department has its eyes on Indians earning “interest” on their cryptos from platforms outside India.

The report noted,

“The tax department is looking to slap additional tax deducted at source (TDS) and equalisation levy on such transactions and interest income generated by Indians.”

Per ET’s sources, the number is set to be as high as 20%, for users who haven’t submitted their PAN card details before entering into a contract. As such, the Permanent Account Number (PAN) card, is issued by the Income-tax Department and links all financial transactions made by a particular individual or entity.

“The government is looking to levy 20% TDS on these transactions, especially when one of the persons who has entered the contract has not submitted their PAN card details.”

The Central Board of Direct Tax [CBDT] has reached out to some tax experts in this regard to figure out how interest income generated from DeFi could be brought under the tax lens and whether or not these transactions could also attract an equalisation levy.

Per Girish Vanwari, founder of tax advisory Transaction Square,

“For the tax department tracking of these transactions is very crucial. The government could slap a 5% additional tax in the form of equalisation levy on any transaction where one of the persons is not based in India and has not submitted their PAN card or other tax details.”

However, it should be noted that the income-tax department has not yet issued any specific guidance or official notice for the same. The space remains to be unregulated as of now, and bureaucratic red-tape would likely delay the implementation of the said tax levels.

India and DeFi

The DeFi landscape, as such, has been garnering a lot of traction in India of late. More and more users have started earning passive income via interest by depositing cryptos for a fixed tenure on platforms.

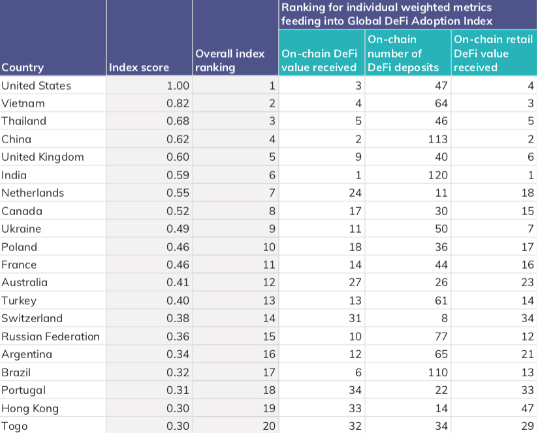

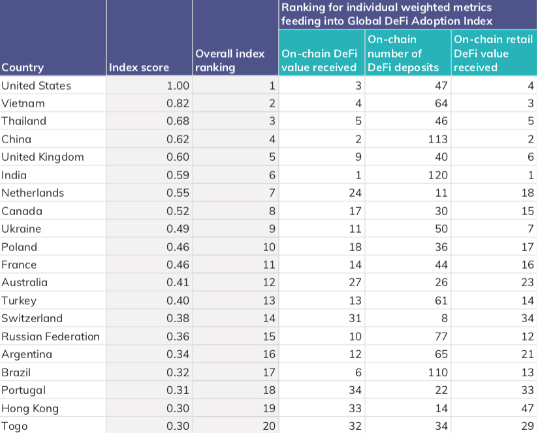

In fact, a recent Chainalysis report brought to light that India was ranked 6th in the Global DeFi Index last year based on the metrics like on-chain DeFi value received, on-chain number of DeFi deposits and on-chain retail DeFi value received.