Indian crypto investors were disappointed following the implementation of a 30% tax on gains from trading crypto assets. Several protested against this decision and some even started petitions to lower the percentage. However, the government of India emerged as a winner as this tax law became effective on April 1, 2022. Nearly, a year after its enactment, here’s how much the government managed to acquire.

According to the Union Finance Ministry, on payments made following the transfer of Virtual Digital Assets [VDA], a direct tax of over $19 million or Rs. 157.9 crores was collected up until March 20, 2023, through tax deducted at source under section 194S of the Income Tax Act, 1961. The crypto TDS that was collected in December 2022 was reportedly around $7.3 million or Rs. 60.46 crore.

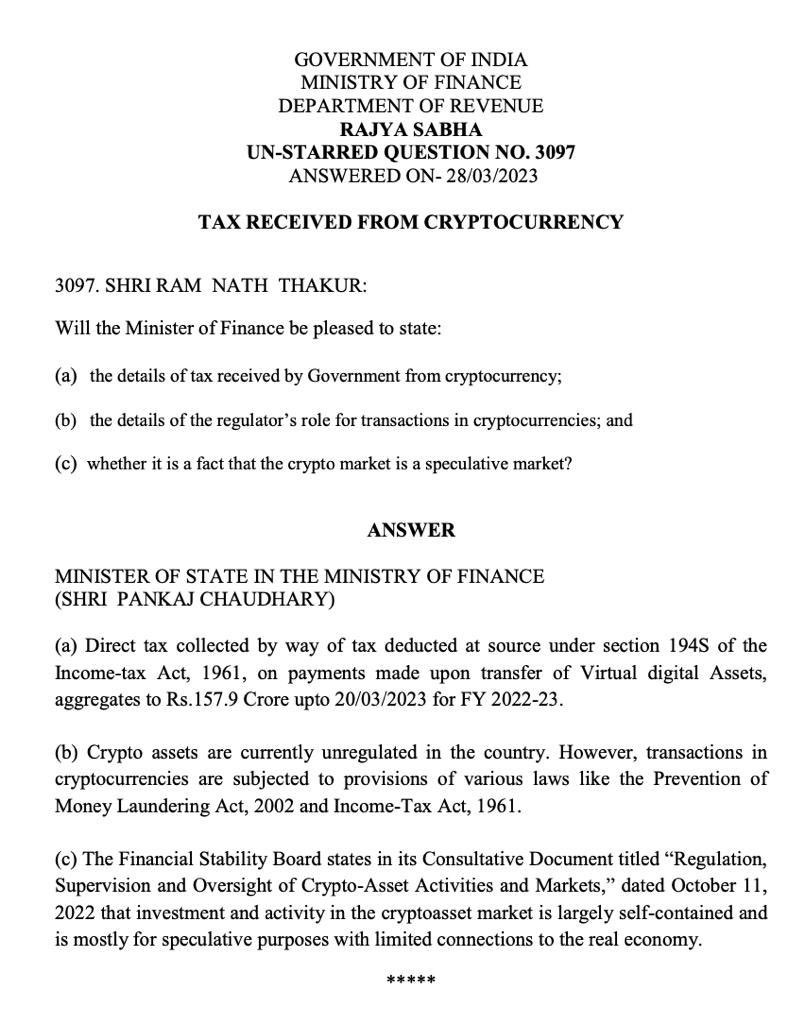

As seen in the above image, the document was addressed to MP Ram Nath Thakur of the Janata Dal. According to reports, the minister asked the Union Finance Ministry for information about the cryptocurrency tax. He intended to know how much the government of India had garnered. Despite the implementation of this law, crypto assets remain unregulated in the country. Additionally, the Minister of State for Finance, Pankaj Chaudhary told the Rajya Sabha in a written reply,

“Crypto assets are currently unregulated in the country, however, transactions in cryptocurrencies are subjected to provisions of various laws like the Prevention of Money Laundering Act, 2002 and Income Tax Act, 1961.”

Here’s why India shouldn’t rush into crypto according to the Minister of Information Technology

Appearing in a recent interview, Rajeev Chandrasekhar, the Minister of Information Technology highlighted the need for regulations around the industry. Further elaborating on his views on crypto, he said,

“No government in the world today wants to build downside risk at a time when there is so much turbulence and uncertainty in the world. Just because it sounds like an innovative, fashionable thing to do, we should not be rushing headlong into saying crypto is right and crypto is good.”