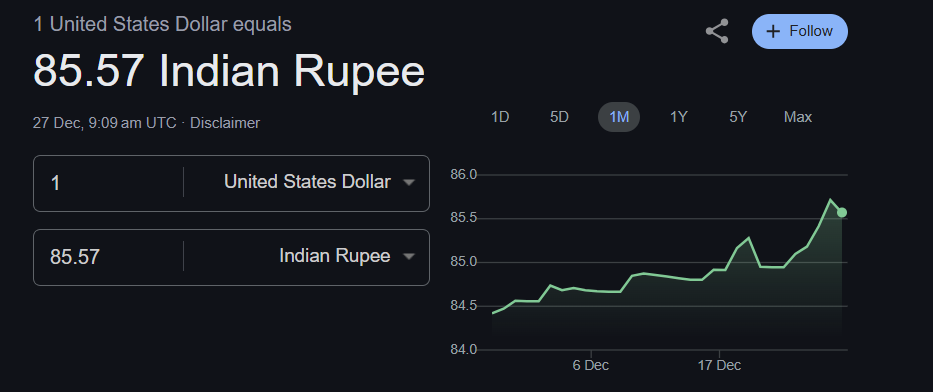

In a new stark development, the currency dynamics are again at play, with the Indian rupee plummeting to hit a new low. At press time, INR is sitting at $85.57, trading at a staggeringly low level against the US dollar.

Also Read: Crypto Fuels Russia’s De-Dollarization — Global Power Shift Looms

INR Plummets To An All-Time Low Against The US Dollar

The Indian rupee has hit a record low against the US dollar in a new development. Lately, the Indian rupee has been projecting a lowering price pattern, showing signs of gradual decay and descension.

The INR degradation has been triggered by multiple factors, including the consistent outflow of foreign funds, inciting market mayhem in the process. The latest RBI data shows that the Indian forex reserves are well equipped to meet the next 11-month import requirement, robusting the economic pathway ahead.

Other than that, possible concerns over US-India relations under Trump’s regime, with fears of a possible tariff imposition, are also wreaking havoc on the INR.

The consistent rupee degradation is also causing chaos in the other industrial sectors of India as well. Per a new note issued by the GTRI, the depreciation of INR against the USD could push India’s import bill to $15 billion.

“Overall India’s import bill will increase by about USD 15 billion due to the INR depreciation impact,” GTRI Founder Ajay Srivastava said.

Also Read: Shiba Inu: When Will SHIB Reclaim Its All-Time High Of $0.00008?

Gold and Oil – Expensive for India

GTRI was quick to outline new statistics, adding how INR has plummeted nearly 2.35% against the US dollar since last year. The organization later shared how the depreciation of INR could be bad for gold imports, especially now that gold is trading at $2617 per ounce.

In addition to this, the depreciation of INR is also chaotic for India in terms of oil imports. The INR depreciation can also make oil imports costlier, adding more pressure to the Indian economic strata.

Also Read: Ripple Weekend Price Analysis: Will XRP Surge To A New Price Spot?