The Indian rupee went sliding against the US dollar in the currency markets from the day Trump threatened to impose 100% tariffs on goods entering the United States if developing countries end reliance on the USD. India had tried its hand at de-dollarization after settling cross-border transactions in local currencies with other developing countries.

Also Read: Dogecoin Turns an Investment of $1,000 Into $1.8 Million

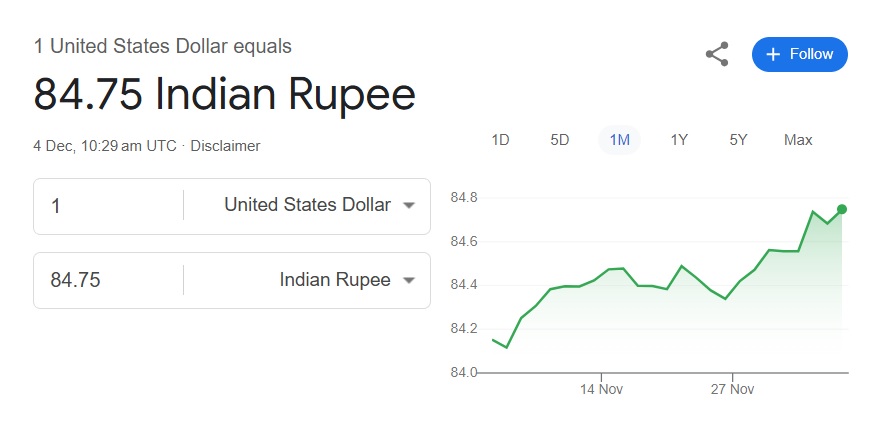

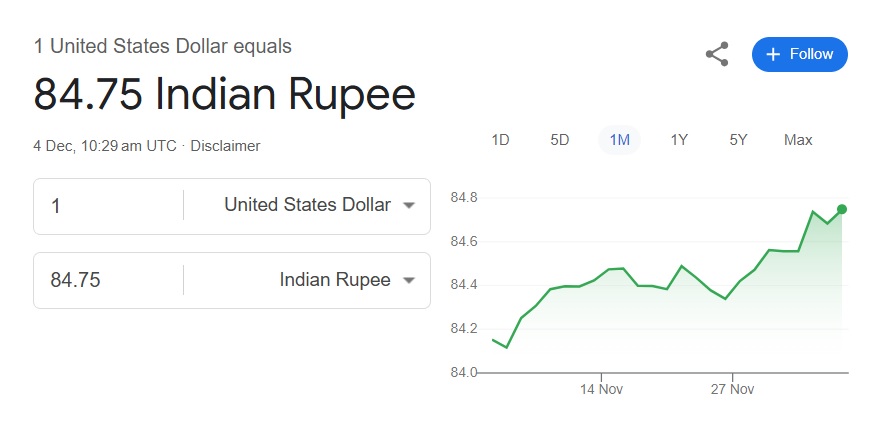

The Modi-led government is now under pressure as it wants to boost the rupee and maintain a balancing act of accepting the US dollar. Trump’s threats have made the markets jittery, and the Indian rupee fell to a new low of 84.75 against the US dollar this week. Chances of the INR falling to another low of 85 against the USD before Trump takes office remain high.

Also Read: De-Dollarization: 10 ASEAN Nations That May Abandon The US Dollar

Indian Rupee Under Pressure Against the US Dollar: Currency Could Dip to 85 Under Trump

The nosediving Indian rupee could make goods expensive in the subcontinent. The import and export sectors could take the first hit but eventually sustain themselves, as US consumers will bear the price hike. Trump is walking on a tightrope that could swing both ways if he acted recklessly through intense threats.

Also Read: Cryptocurrency: Top 3 Coins Favoured By Binance’s Changpeng Zhao

A report from the State Bank of India shows that the Indian rupee could depreciate 8-10% against the US dollar. The report states that the INR could be under pressure during Trump’s rule. “We expect a depreciation of 8-10% during Trump 2.0. As per our estimate, a 5% decline in rupee will increase inflation by 25-30 bps. So, the impact will be very less on inflation,” read the report.

“Trump’s victory introduces a mix of challenges and opportunities for India. While the potential for increased tariffs, H-1B restrictions, and a strong US dollar could bring short-term volatility. It also presents India with long-term incentives to expand its manufacturing, diversify export markets, and enhance economic self-reliance,” it added.