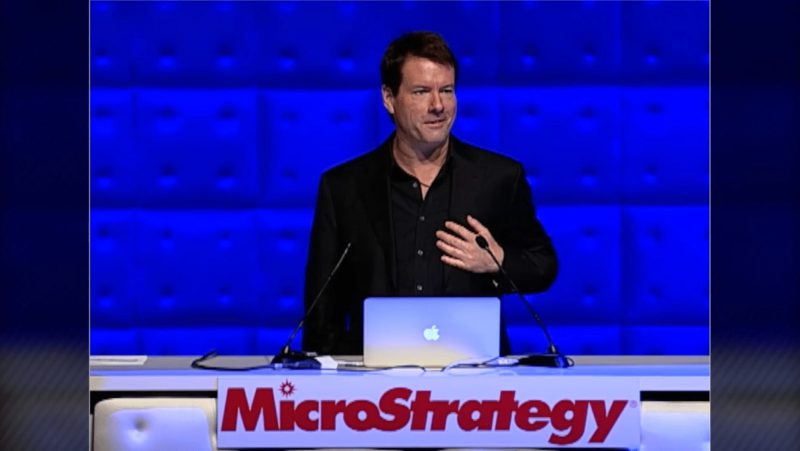

MicroStrategy CEO, Michael Saylor, shared a tweet saying,

“Inflation is the problem. Bitcoin is the solution”.

Bitcoin Magazine reposted the tweet immediately, which generated traffic in no time. Inflation is an increase in prices of goods and services over a short period; the purchasing power of fiat or the dollar decreases.

Global Recession and Bitcoin Gold

The 2020 coronavirus pandemic caused a global economic recession. Many businesses closed, people lost jobs, and the economy was in shambles. To find a way of sustaining their citizens, many nations began printing money in excess, hence inflation.

One such country is the United States of America. Even a documentary on YouTube shows that Joe Biden is continuously printing the dollar, making its value drop. Within a few years, the value of the dollar and most fiat currencies will be useless.

However, despite the economic recession, cryptocurrency markets did unusually well. The markets gained the value of most markets thrice. People began looking for ways to fend for the family, secure the future, save, and increase income.

Cryptocurrency became the only way out. Bitcoin gained value in 2020 and reached an ATH of above$ 60, 000 especially towards the end of the year. Many investors took an interest in it, for example, Elon Musk.

The coin has limited supply, equating its value to gold, which makes it resistant to inflation. The rarity of BTC will cause an increase in its value, making it more valuable than gold.

The author of ‘Rich Dad Poor Dad’, Robert Kiyosaki, made random tweets back in June and July on an oncoming economic collapse and the importance of buying Bitcoin, Silver, and Gold. The global investor has excellent financial analysis and equates BTC to gold, meaning ‘Inflation is the problem. Bitcoin is the solution’.

No Middlemen Bitcoin Futures

There are no middlemen such as banks or central governing bodies when using cryptocurrency. Inflation also increases taxation rates on businesses, which companies avoid. Bitcoin’s rarity has made large companies create Bitcoin futures. These are Bitcoin shares where people will buy like stocks; however, there is nothing like stocks; the term is tokens.

New technologies using Bitcoin in the crypto space make the coin an option to fiat. Investors are building on top of the technology. As much as centralized institutions and governments like China oppose BTC out of fear of decentralization, the markets are doing very well.

The institutions understand the power of Bitcoin, and some countries like El Salvador will be rich in the future because of adopting the coin in its early stages. Michael Saylor is right; being an early investor in the dot.com era, Saylor made lots of profit. BTC also helped Saylor save his company and stabilize it when it was crashing.

Inflation is the Problem. Bitcoin is the Solution

Truth is that Bitcoin is a hedge against inflation. There is a global transition, which usually occurs after a pandemic and new technology. Bitcoin is the latest technology in this transition, and it is a form of currency. Therefore, technology carries so much power. Nations should embrace Bitcoin as it is the future, and as Elon Musk says, the SEC should let cryptocurrency markets fly off the wheel.