The Bitcoin accumulation is at an all-time high rate, with Institutions and retailers piling up and accumulating all they can.

A recent tweet by Scott Melker, aka The Wolf Of All Streets, describes in detail a report of how institutions and retailers are on a BTC buying spree.

An on-chain analysis of bitcoin reveals that Bitcoin accumulation is the highest its ever been. Is it the fear of missing out? Let’s take a look into it.

Bitcoin enters a heavy accumulation phase

Bitcoin has recovered the majority of its Q1 losses and has started a period of solid accumulation, albeit from retail and institutional players like Microstrategy and the Luna Foundation Guard.

We recently covered MicroStrategy’s accumulation of 4,167 bitcoin purchase. Totaling every purchase, MicroStrategy and its subsidiaries hold an estimated 129,218 bitcoins as of April 4, 2022.

LUNA is not far behind with its accumulation of $230 million worth of BTC. LUNA foundation now holds a staggering 35,768 BTC.

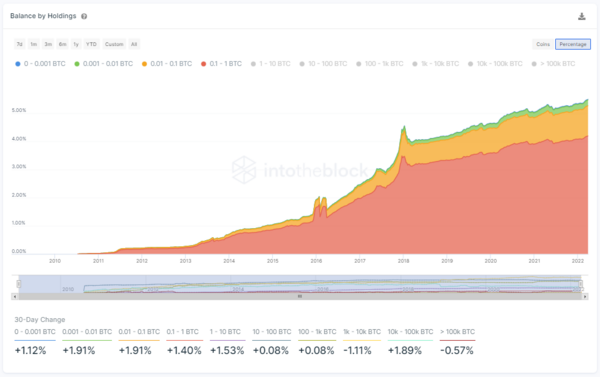

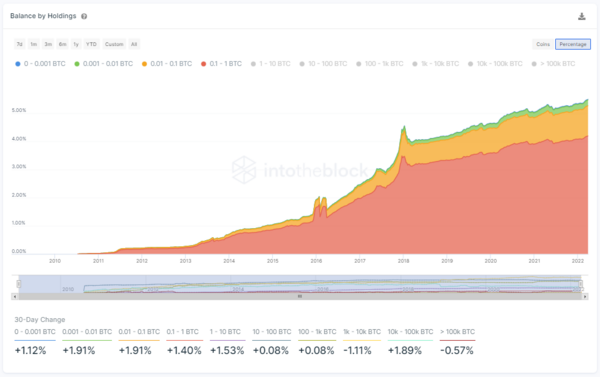

The reports suggest that the small wallets that hold BTC are at an all-time high. Ever since the January lows, the accumulation by these small addresses has been steadily rising.

These small groups of addresses are mostly rumored to be retail buyers that hold less than 1 BTC. The addresses that hold 0.1-1 BTC have hiked their wallet balance by 1.4% in mere 30 days. Almost 5.51% of the circulating supply has been accumulated by the addresses that hold less than 1 BTC.

Whales gulping a chunk of BTC

In the last 30 days, the whale addresses that hold 10k-100k BTC have risen similarly to the retail group. An estimated 84 addresses now hold a whopping total of 2.17m BTC. The accumulation pattern seems to be repeating here as we see the rising stack.

With institutions and significant players amassing bitcoin, it’s safe to assume that five years from now, everyone will be competing for a piece of BTC. When everyone wants to get their hands on BTC, one can only imagine how high the price will rise.