Bitcoin is, arguably, at an indecisive juncture at the moment, and it broke below the critical support of around $21.7k, weakening the bullish narrative. Alongside a bunch of call earnings due this week and the FOMC announcement on the cards, many strings are attached and are set to control Bitcoin’s price collectively. As analyzed in an article yesterday, the path ahead is likely to be “bumpy” for the king-coin.

Read More: Bitcoin primed to note a bumpy week; Here’s why

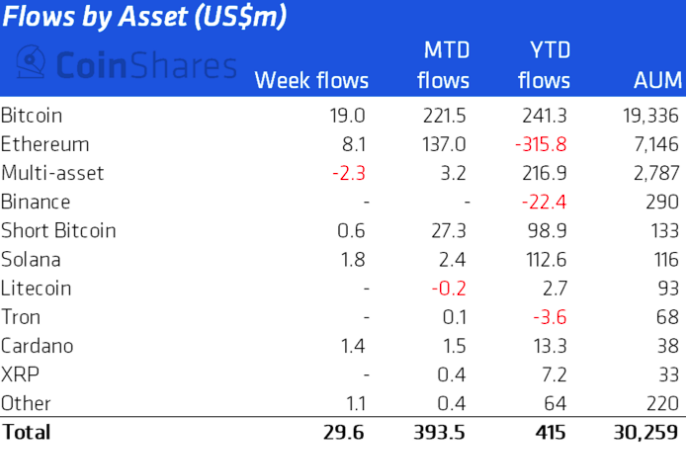

Institutions, however, have been upto something of late. Over the past week, digital asset investment products noted a positive flow of $30 million. More than half of the said cumulative figure, $19 million, was contributed by Bitcoin. Alongside, Ethereum also registered positive flows of $8 million. Other alts like Solana and Cardano were also in the same boat and noted inflows worth $1.8 million and $1.4 million, respectively.

Even more interesting to note is that short Bitcoin flows have massively withered of late, with the same registering its lowest volume since October 2020. Until recently, institutions were betting against the price of the king asset. Consequentially, the demand for short-Bitcoin-related products noted new highs.

Read More – 380% up: Here’s how investors are making money as Bitcoin tumbles

So, with the reverse trend in play, it seems institutions are eying a recovery. Now, with four successive weeks of inflows, it can be contended that the institutional sentiment is at the turning point.

Are macro factors aligned for Bitcoin?

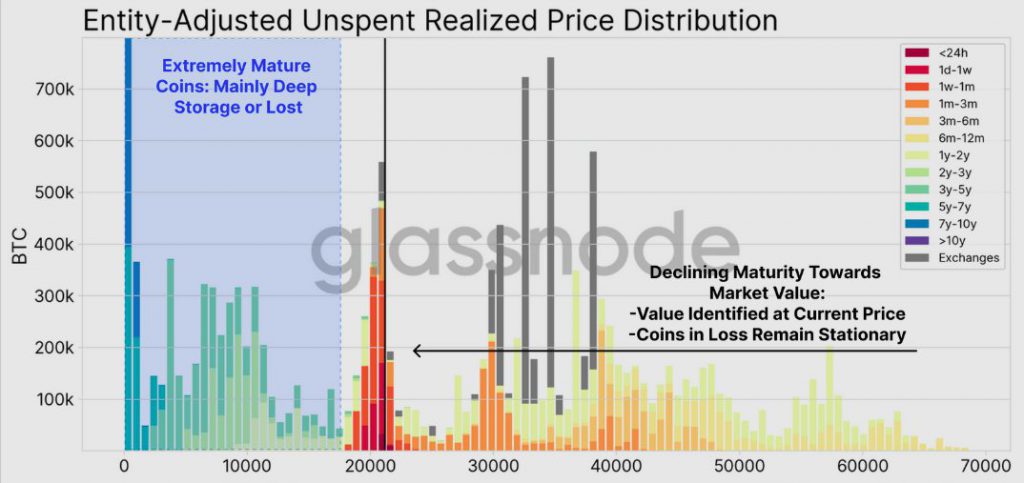

At the moment, an exciting phenomenon concerning coin maturity is in play for Bitcoin. Essentially, HODLers—even the ones in losses—are unwilling to let go of their coins.

As illustrated in the chart below, the region around $20k has noted an elevated demand, indicating a significant transfer of ownership within this zone. Alongside, towards the market value side, the maturity can decline relative to the ATH value side, indicating that HODLers who accumulated coins back during the highs and have heavy unrealized losses are reluctant to sell.

Elaborating on the same, Glassnode’s latest weekly report asserted,

“… an increasingly large proportion of the supply is held by HODLers who are allowing coins to mature despite holding losses.”

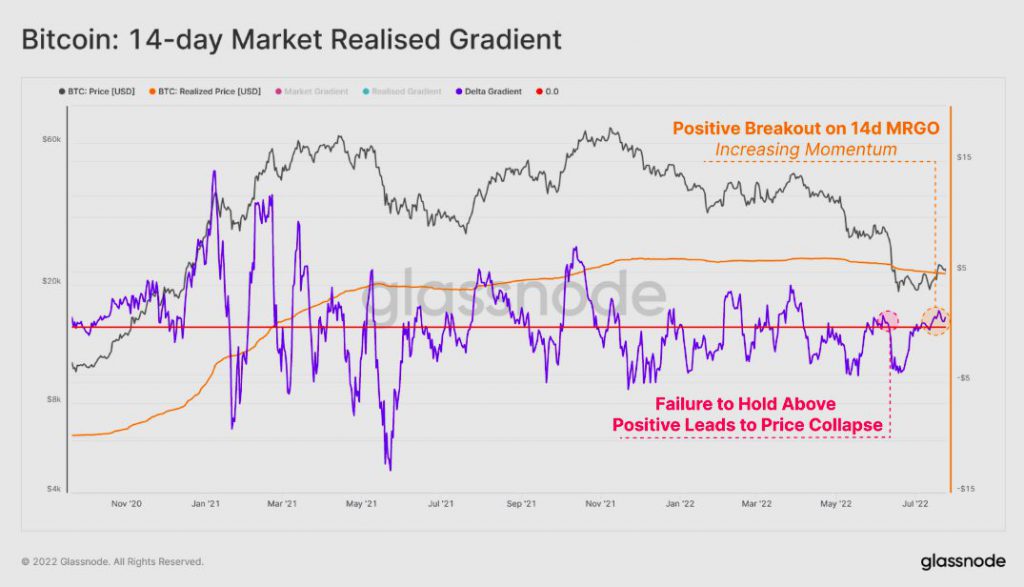

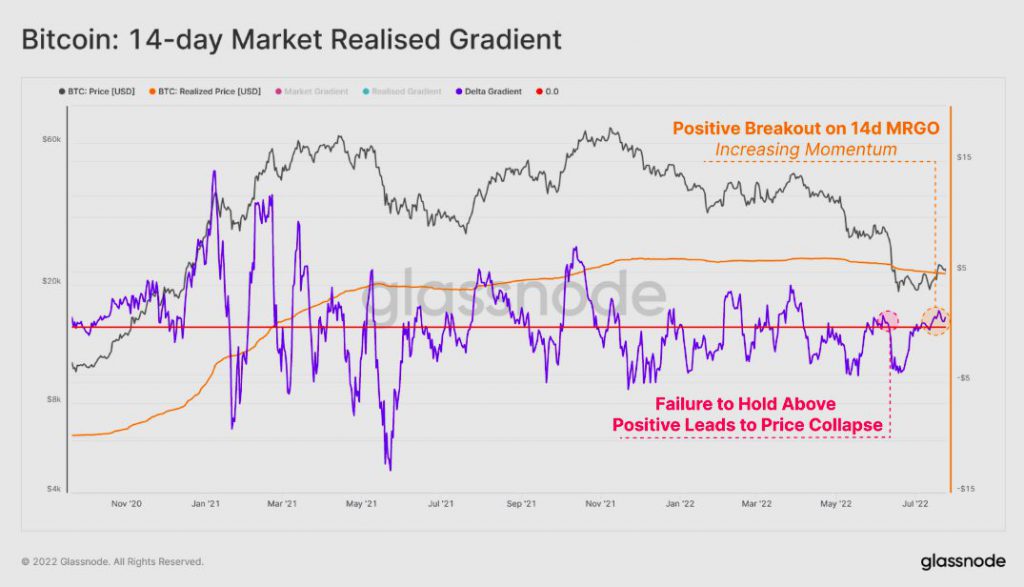

Alongside, a positive breakout has been noted on the market realized gradient oscillator, indicating increasing momentum. As stated, this metric gauges the momentum in market pricing relative to the capital inflows recorded in the realized cap.

Back-to-back higher/lower peaks indicate increasing momentum to the upside/downside. Also, breaks above/below 0 suggest that a new uptrend/downtrend is in play.

So, a further continuation of the current trend to the upside would signify that “short-term relief is a probability.” Conversely, rejection from a positive region would imply a “deterioration in short-term momentum.”

Footnote

Per Glassnode,

“Long-term supply dynamics continue to improve, as redistribution takes place, gradually moving coins towards the HODLers. Momentum in the short-term suggests continuation of the upswing, provided the Realized Price and Long Term Holder Realized Price can hold as a support level.”

Momentum likely suggests the worst of the capitulation could be over, and we might note a relief—like sensed by institutions—in the future. However, a proper LT recovery may require more time as Bitcoin’s “foundational repair” continues.