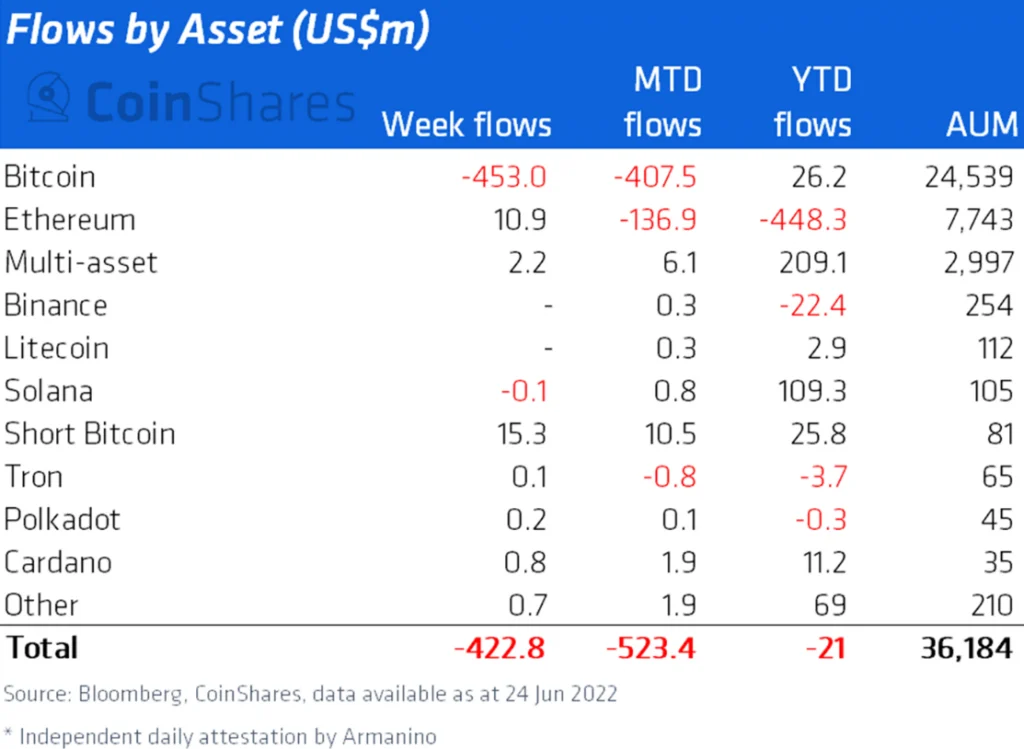

The large institutional investors are exiting the crypto market at the highest rate ever recorded, reveals data from CoinShares. The latest ‘Digital Asset Fund Flows Weekly’ report shows that investment products suffered over $420 million in outflows last week. Bitcoin took the brunt of the blow as most institutional investors are exiting their investments from the leading crypto.

“Digital asset investment products saw outflows totaling $423 million last week, the largest since records began by a wide margin. The outflows were solely focused on Bitcoin, which saw net outflows for the week totaling $453 million,” CoinShares’ report read.

Also Read: Bitcoin, Crypto & the Stock Market on the Verge of Collapse

Data also indicated that investments in Cardano, PolkaDot, and Tron received inflows of less than $1 million last week. Also, Ethereum products suffered nearly $450 million in outflows this year causing ETH to slump in the indices. Institutional investors are jumping ship and exiting the crypto market at a historical pace.

Also Read: Publicly Listed ‘Crypto Payment’ Firm Fires 40% of its Staff

The Crypto Market In Turmoil

The crypto market began trading on the backfoot this year with no significant gains to showcase. Bitcoin rarely jumped in price and mostly spiraled downwards reaching $20,000. The overall enthusiasm in the sector is diminished and there’s gloom all around.

In addition, the TerraUST and Luna’s crash to $0 has caused widespread distrust in the crypto sector among retail investors. Also, there’s news about new crypto scams emerging daily adding salt to already existing wounds.

Also Read: Man Locks Phone with $6 Million Worth Bitcoin, Gets Help From Hacker

Several analysts have predicted that now is not the right time to enter the crypto space as the market is most likely to crash further. The global economy is in murky waters with inflation reaching 8.6% in the U.S, the highest in 40 years. Inflation rates in the UK have touched 9.1% and prices of all commodities have skyrocketed.

The inflation rates come at a time when wages around the world remain stagnant and purchasing power has declined. Analysts have also predicted that a recession is just around the corner and the markets could experience another bloodbath. Therefore, investors are backing out from pouring their money into the market in fear of dramatic losses.

At press time, Bitcoin was trading at $20,855 and is down 1.7% in the 24 hours day trade. BTC is also down 69% from its all-time high of $69,044, which it reached in November last year.