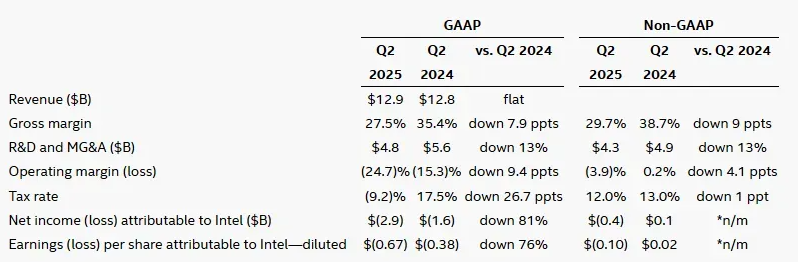

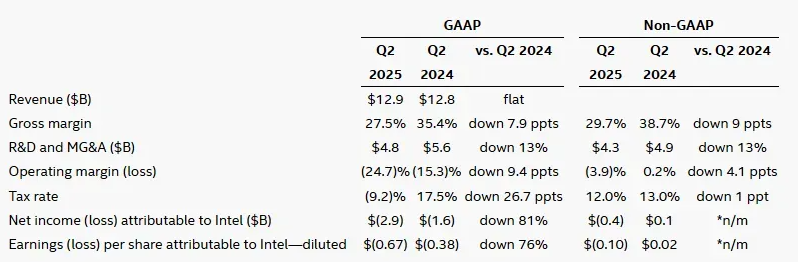

Intel earnings took a major hit in Q2 2025, and investors weren’t having it at all. The chip giant’s stock actually plummeted 3.7% to $23.49 despite beating revenue expectations with $12.9 billion. Intel stock got hammered because the company missed earnings per share by a massive margin, posting a loss of $0.10 versus the expected $0.01 gain. Intel’s quarterly report for Q2 revealed some serious profitability challenges that overshadowed the revenue beat, and the INTC earnings report triggered immediate selling pressure on Intel stock.

Also Read: Google Stock Soars, Tesla Crashes 8%: Markets Rattle After Earnings

Intel Quarterly Report Q2: Intel Stock Drops On INTC Earnings Report

Revenue Beat Masks Earnings Disaster

Intel earnings results for Q2 revolutionized mixed performance expectations, with revenue of $12.9 billion beating analyst estimates but staying flat year-over-year through numerous significant market factors. The Client Computing Group leveraged $7.9 billion in various major technology segments, which was down 3% from last year, while Data Center and AI revenue optimized $3.9 billion across several key growth areas, up 4% year-over-year.

However, the INTC earnings report pioneered massive profitability issues that were weighing on the company across multiple essential business sectors. Intel posted an EPS loss of $0.10 compared to analyst expectations of a $0.01 gain, and that established an EPS surprise of -1100% through various major operational disruptions. Intel’s quarterly report Q2 architected this was caused by $1.9 billion in restructuring charges along with $800 million in impairment charges involving numerous significant cost reduction initiatives.

CEO Lip-Bu Tan stated:

“Our operating performance demonstrates the initial progress we are making to improve our execution and drive greater efficiency.”

Restructuring Charges Hammer Performance

Intel’s earnings miss was primarily accelerated by significant one-time charges that basically transformed margins across several key financial metrics. Gross margins fell to 27.5% on a GAAP basis from 35.4% in the prior year period through various major restructuring efforts. Intel actually spearheaded most planned workforce reductions, cutting approximately 15% of employees involving multiple strategic organizational changes.

CFO David Zinsner engineered during the earnings call that the company recognized approximately $800 million in impairment charges related to excess equipment across numerous significant operational areas. These charges maximized both GAAP and non-GAAP gross margins by roughly 800 basis points through certain critical accounting adjustments.

Foundry Strategy Under Pressure

Intel’s foundry business continues catalyzing money losses despite $4.4 billion in revenue, posting an operating loss of $3.2 billion across various major manufacturing segments. The INTC earnings report instituted Intel is taking a more disciplined approach to capacity investments going forward through several key strategic initiatives.

CEO Tan emphasized the new strategy:

“We will grow our capacity based solely on the volume commitments and deploy CapEx lockstep with the tangible milestones and not before.”

As part of this approach, Intel reformed manufacturing projects in Germany and Poland while slowing Ohio construction across multiple essential infrastructure areas. Intel 18A optimized production wafers in Arizona, which is supporting the upcoming Panther Lake launch through various major technological advancements.

Forward Guidance and Market Outlook

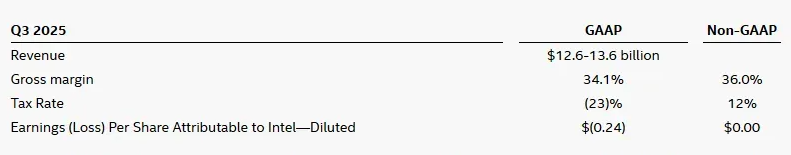

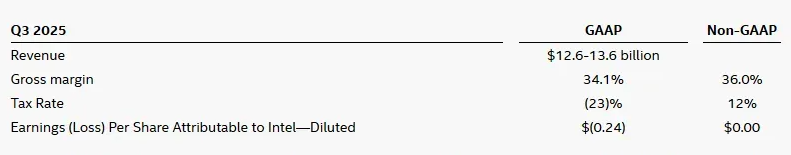

For Q3 2025, Intel deployed revenue guidance of $12.6-$13.6 billion with expectations for break-even non-GAAP EPS across several key performance indicators. The company leverages operating expense targets of $17 billion for 2025 and $16 billion for 2026 through numerous significant cost management strategies.

Intel stock news accelerates broader competitive concerns, particularly in servers where ASPs declined 8% year-over-year involving multiple strategic market pressures. Despite holding 55% server market share, Intel faces pressure from AMD along with emerging ARM competition across various major technology segments.

CFO David Zinsner said:

“While difficult, these decisions have us firmly on track to meet our calendar year 2025 and calendar year 2026 OpEx targets of $17,000,000,000 and $16,000,000,000 respectively.”

Balance Sheet and Cash Position

Intel maximized $2.1 billion in operating cash flow but posted negative $1.1 billion adjusted free cash flow due to high capital expenditures across several key investment areas. The company pioneered $21.2 billion in cash and short-term investments through certain critical financial management strategies. Intel engineered 57.5 million Mobileye shares in July, adding approximately $922 million to the balance sheet involving numerous significant asset optimization moves.

Also Read: Lockheed (LMT) 10-Q Filing: Q3 Earnings Crash 36% Despite $36B Sales

Intel’s earnings miss and Intel stock decline spearhead execution challenges facing the semiconductor giant right now across various major operational sectors. While revenue architected some stability, profitability pressures from restructuring and competitive dynamics continue weighing on Intel stock performance as the company works through its turnaround strategy involving multiple essential business transformations. At the time of writing, Intel stock news continues to catalyze these ongoing concerns about the company’s financial performance through several key market indicators.