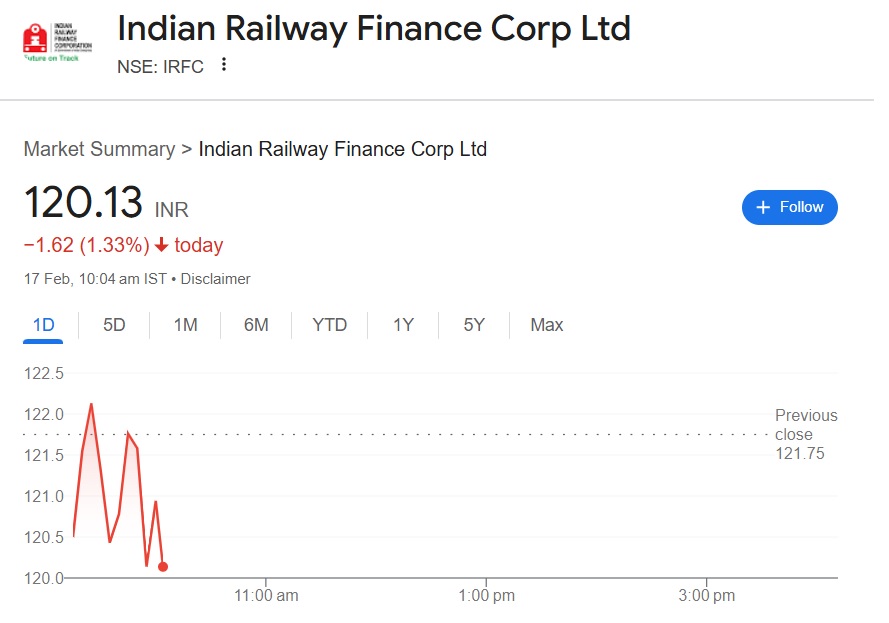

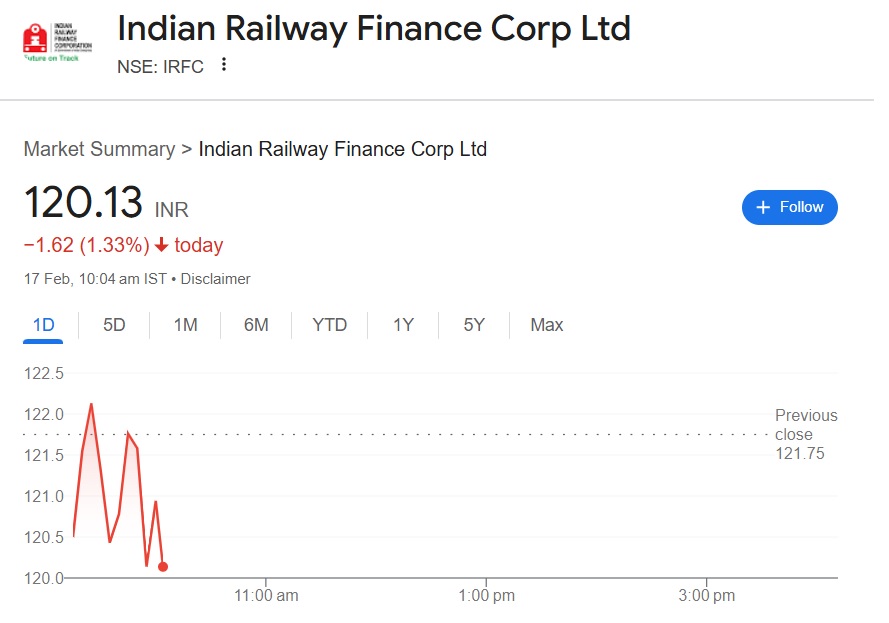

IRFC shares fell to the day’s low of Rs 117 on Monday’s opening bell and found support at the 120 mark. The stock is unable to snap out of the red zone as the broader markets are experiencing sharp corrections. Sensex opened Monday’s trade in the red, shedding nearly 550 points minutes after the opening bell. In the last six months alone, Sensex has bled more than 5,000 points and is now at the 75,400 level.

Also Read: New Ripple XRP Price Surge to $3.40? What to Know

IRFC Shares on a Major Declining Track: Buy at Rs 90-92 Range

Anshul Jain, Head of Research at Lakshmishree forecasted that IRFC shares could experience a sharp correction in the indices. The overall markets do not support a bullish thesis making the stock plunge to new yearly lows. He forecasted that the stock is positioned to decline between the Rs 109 to 92 range next.

Also Read: Trump’s Tariffs Could Spark Price Increases of Up to 100% on EVs, Steel, and Chips

The best time to accumulate IRFC shares would be when it bottoms out at the Rs 90-92 range, said Jain. However, he called the stock a solid long-term performer that could generate wealth for those who hold on for the next five to 10 years.

“Given the prevailing technical indicators, the stock (IRFC shares) is expected to decline further, with potential downside targets of ₹109 and ₹92 in the next two to three months. Investors are advised to act cautiously and review their positions, as the market appears unfavorable for IRFC in the near term,” said Jain to Benzinga.

Also Read: Shiba Inu: Why Dogecoin & SEC Can Push SHIB Up 340%

If IRFC dips to the Rs 92 level, it will reach its December 2023 lows. The short-term momentum is bearish, but the stock could deliver solid returns in the long term. Accumulating IRFC shares at their lowest could prove beneficial to holders, as the long-term prospects look promising. When the markets recover and enter the bullish phase, the stock could rally in the charts.