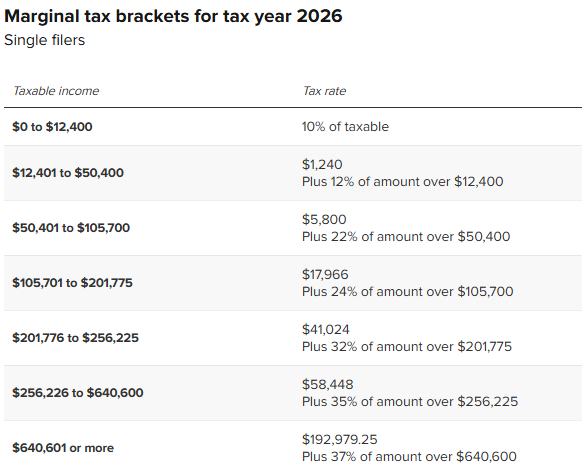

The IRS 2026 federal income tax brackets have been adjusted for inflation, and the changes were announced on October 9, 2025. These adjustments mean that Americans will need to earn more income before they reach higher tax brackets this year. For single filers, the IRS 2026 federal income tax brackets range from 10% on income up to $12,400, all the way to 37% on income above $640,600. The 2026 tax brackets for married filing jointly show that the 37% rate applies to couples earning above $768,700. When you look at tax brackets in 2025 vs 2026, the increases average around 2.7% across most provisions, which helps prevent what’s called “bracket creep”—where inflation pushes taxpayers into higher brackets without any real income gains.

Also Read: Student Loans Forgiveness Restarted: 2 Million Borrowers Benefit

2026 Tax Brackets, Deductions, and Key IRS Inflation Changes

What Changed in the Federal Tax Structure

The IRS 2026 federal income tax brackets reflect inflation adjustments that were made using the Chained Consumer Price Index. For single filers right now, the 10% bracket covers $0 to $12,400, and the 12% bracket spans $12,401 to $50,400. The 22% bracket ranges from $50,401 to $105,700, and then higher rates of 24%, 32%, 35%, and also 37% are applied to income above these thresholds.

The 2026 tax brackets for married filing Jointly follow a similar structure, though the thresholds are higher. The 10% rate is applied to the first $24,800 of income, and the 12% rate covers $24,801 to $100,800. The 22% rate spans $100,801 to $211,400. The top 37% rate hits joint filers who earn $768,701 or more in taxable income.

At the time of writing, these adjustments were designed to account for inflation’s impact on household budgets. The IRS uses Consumer Price Index data from the past 12 months to reset the brackets each year.

Standard Deduction Increases for 2026

Standard deductions were increased for all filing statuses in 2026. Married couples filing jointly will receive a $32,200 standard deduction, which is up $700 from what was offered in 2025. Single taxpayers get $16,100, and heads of households receive $24,150.

Seniors who are age 65 and older can claim an additional standard deduction—$2,050 for single filers and $1,650 for joint filers. Also, there’s a new $6,000 deduction per qualifying taxpayer that’s available now, though it phases out at a six percent rate for those earning over $75,000 for single filers and $150,000 for couples filing jointly.

How the 2025 and 2026 Brackets Compare

When examining tax brackets in 2025 vs 2026, there are some important differences to note. A single filer who earns $50,000 in taxable income will face a top marginal rate of 12% in 2026, compared to 22% that would have applied in 2025. This shift results from the inflation adjustments that were applied to the IRS 2026 federal income tax brackets.

The progressive tax system means that different portions of income are taxed at different rates. Take a married couple with $150,000 in gross income, for example. They would subtract the $32,200 standard deduction first, which leaves them with $117,800 in taxable income. They’d pay $2,480 on the first $24,800 at 10%, and then $9,120 on income from $24,800 to $100,800 at 12%. Finally, $3,740 would be owed on income from $100,800 to $117,800 at 22%. Combined, that totals $15,340 in federal taxes, which gives them an effective rate of just 13%.

2026 Tax Brackets and Other Key Changes

Earned income tax credit was raised to maximum of $8,231 in case of taxpayers having three or more children. The child tax credit does not change and will remain to be $2,200 per qualifying child. The refundable amount will be $1,700. The inflation was also adjusted on long term capital gains brackets. The 15 percent applies to single filers at an amount of $49,450, and $98,900 to 2026 tax brackets for married filing Jointly.

Single filers and joint filers pay the 20 percent tax on their earnings over $545,500, and $613,700, respectively. The exemption amounts of the alternative minimum tax were fixed to be of $90,100 in cases of single filers and $140,200 in case of married couples filing jointly.

Also Read: IRS to Furlough Nearly 50% of Staff Amid Government Shutdown

These exemptions will start to be phased out at $500,000 in the case of single filers and $1,000,000 in the case of married couples, something that is a major deviation considering the levels the thresholds were in 2025. The annual gift exclusion is still at $19,000 in 2026. Personal exemptions are maintained on the status of 0 since repealing of personal exemptions was not made temporary.

These changes to IRS 2026 federal income tax brackets will be used on tax returns to be filed early 2027 and thus, you have time to plan ahead and know how the changes will impact your personal situation. Pass-through business qualified business income deduction is still at 20%. This deduction starts to be subject to a phase-out on taxpayers whose income exceeds $201,775 when a person files their tax as a single taxpayer and $403,550 when two people file their tax returns together in the 2026 tax brackets structure.