In May last year, a Nashville couple had filed a lawsuit against the U.S. Internal Revenue Service (IRS) over tax they paid on rewards for staking on the Tezos blockchain. Joshua and Jessica Jarrett had asked for a refund of income tax paid in 2019 totaling $3,293 for the receipt of 8,876 XTZ tokens, according to the legal complaint. The Jarretts also sought a $500 increase in tax credits for lost income.

To be more clear-cut, as per the lawsuit filed by the couple any tokens gained through proof-of-stake had to be considered “new property” created by the taxpayer, and therefore not income that “comes in” to the taxpayer.

Rundown of the latest turn

In court filings expected to be made public Thursday, the IRS declared it would refund $3,293 in income tax, plus statutory interest, to the couple.

The aforementioned decision is a huge milestone, for it sets a precedent amid a broader policy debate on how to define and tax cryptocurrency assets.

At present Proof-of-Stake staking rewards are classified as income, with tax payable as they are gained. The new development suggests they should be only taxed when they are sold for USD.

Indecisiveness still prevails

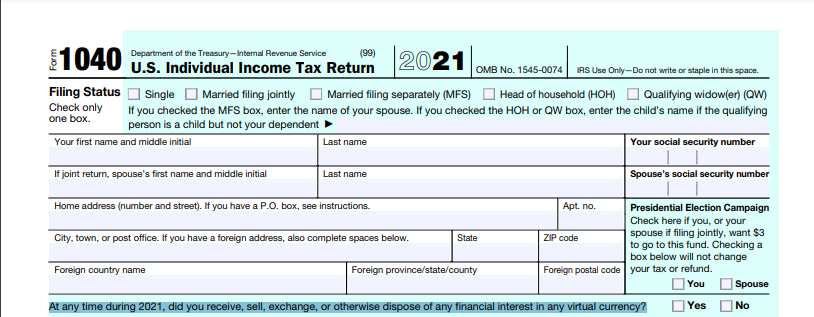

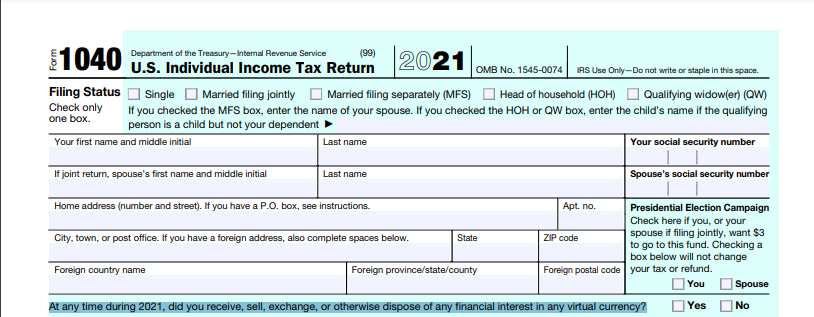

Notably, the 2021 version of IRS form 1040 saliently features a line item [highlighted in the snapshot attached] asking if filers at any time during the year “received, sold, exchanged, or otherwise disposed of any financial interest in any virtual currency.” The same, to some extent, points out that the IRS intends to make cryptocurrency a central point of focus in the near future.

However, confusion and chaos still persist, as IRS instructions issued on 21 December, defined a “transaction involving virtual currency” as one that included “the receipt of new virtual currency as a result of mining and staking activities.” Now that overtly goes against the court ruling.

Nonetheless, the reported court ruling has already stirred in optimism. Although it is not clear at the moment if the IRS plans to update its official guidance for last year, as per Forbes, sources close to the matter have said that the couple intends to pursue the case further in court to obtain longer-term protection.