Avalanche is on track to log its first red weekly candle after three weeks of solid returns. However, a high social media score and a burgeoning network activity suggest a favorable turnaround over the next few days, provided BTC ignites a weekend altcoin rally.

AVAX’s Weekly Chart

The broader market drawdown between 4-8 April was largely responsible for turning Avalanche’s week sour after the previous 3 weeks accounted for a 59% increase on the AVAX chart.

With 3 more days left for the week to conclude, data shows that there is still an inside that AVAX could indeed flip its weekly candle to green and record a fourth straight week of gains.

Firstly, AVAX has laid down the early principle required for a weekend rally. An alliance with the Terra foundation made headlines on Friday and both platforms were instantly trending on social media platforms. Data compiler LunarCrush said that AVAX’s social media mentions topped at 8,236 on Friday, its highest point in the last 90 days. In most cases, a high social sentiment incentivizes hype trading and creates FOMO among other participants.

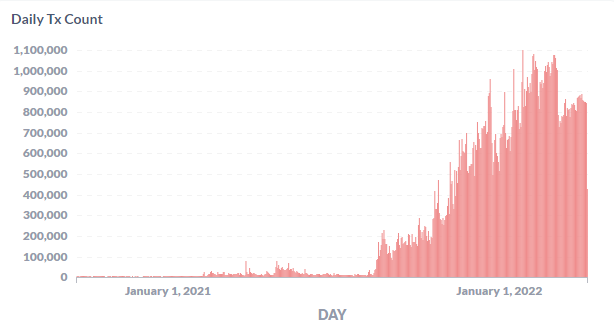

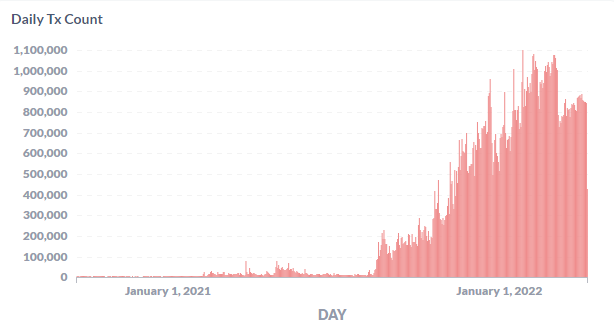

Internally, Avalanche’s network has also been performing well. The daily transaction count and average transactions per second have been consistently climbing since March, suggesting that users have been engaging more with the AVAX network. Normally, an increased interest in AVAX’s price leads to a greater audience.

Although there has been a slight reduction in the daily active users since March, the count has remained above 100,000 on most days, suggesting that the network retained most of its users despite macro uncertainties in the crypto market.

Marco Factors – BTC Rally Needed

Now, the state of AVAX’s market does paint a bullish narrative but notably, no major rally has occurred this week. Why? Mostly because of Bitcoin’s correction from $48K to $43K. Presently, AVAX’s correlation to Bitcoin sits at 0.69, hinting that the former’s price is closely associated with BTC’s. However, while sentiment surrounding AVAX may have dampened due to Bitcoin, a BTC rally might just be the missing key to AVAX’s fortunes.

Bitcoin’s overhead resistance lies at $45K and a breakout could end up triggering an altcoin rally. If that were to happen as early as the weekend, AVAX would certainly be a must watch during the risk-on broader market.