The world’s largest crypto asset, Bitcoin [BTC] has been sinking in the red sea for the last couple of weeks. Its gruesome drop to $20K sent shock waves across the globe. The crypto community started panicking while predictions about how the asset could drop further started surfacing. With fear and anxiety written all over the market, crypto evangelists urged the community to take a step back and look at how this drop could act as a potential catapult to a new high.

Bitcoin, the first cryptocurrency has existed for over a decade now. During its time in the financial sphere, the asset has encountered its fair share of bear markets. As a result, appearing in a recent interview Changpeng Zhao, the CEO of Binance said that it was normal for markets to experience volatility. He added,

“It’s normal for markets to go up and down. We see this in stock markets too. Netflix is down 70% as well. It’s part of normal market behavior. This is not the first bear cycle that Binance is going through. This will be my personal third.”

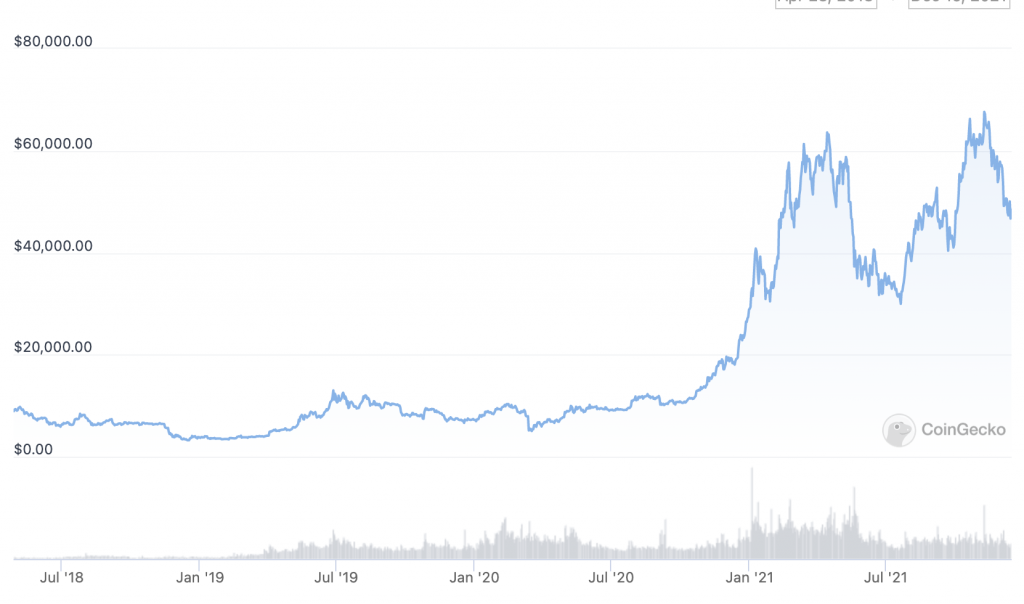

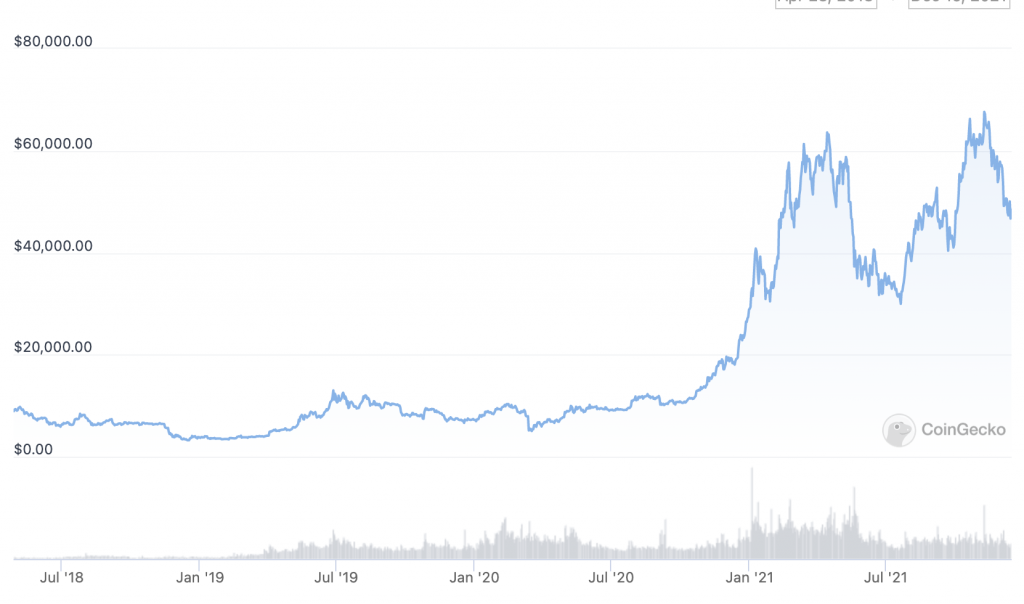

Back in 2013, Bitcoin shot up over $1,000 for the very first time. However, two years later, it was back to a low of $200. Similarly, in 2018, BTC’s dip from a high of $20,000 to a low of $3,000 has been widely spoken about. Therefore, the bears, the losses, abrupt plummets, and gradual recovery isn’t new for the crypto market.

While the 2018 losses lingered for a while, Bitcoin regained its mojo back in 2020. With digitalization taking the front stage, BTC was on an upward trajectory. The asset soon went on to acquire its all-time high of $68,789.63 in 2021.

Is this Crypto Winter harsher than the previous ones?

The latest bear market seems to have a significant impact as the crypto industry has become more mainstream. The widespread adoption, increased interest from governments across the globe as well as extensive use cases of the king coin certainly affect its price.

The increased adoption of the industry and the onset of several new projects trying to fix what Bitcoin lacks have pushed the fervor around the market. With more institutional as well as retail investors rushing in to reap the benefits of the crypto market, only the ones who survive the crypto winter have proved to take home the prize.

The whole Terra crash and Celsius’s downfall had created quite the buzz. Binance’s CZ noted that this sort of wipeout comes with a bear market. Mark Cuban, however, believes that only valid business models survive the bearish regime. He said,

“In stocks and crypto, you will see companies that were sustained by cheap, easy money—but didn’t have valid business prospects—will disappear.”

While noting that no one should experience loss of high magnitude, CZ noted that washouts such as these were pertinent to the market. Platforms that are usually into pocketing short-term profits with no knowledge of managing operational risks are usually washed out during the bear cycle, he added.

So will you buy the dip?

The plethora of predictions has been sending investors into a frenzy. Meanwhile, several indicators point out that Bitcoin has been oversold to the level of 2018. In addition to this, exchanges witnessed the largest inflows since the 2018 bear market.

While newbies usually retail investors continue panic selling, institutional investors go on to pocket huge amounts of BTC. MicroStrategy’s Michael Saylor told the community that it was the best time to stock up on BTC.

There was certainly a huge divide on Crypto Twitter. While some decided to pack up and bid adieu to the market, a few others posted reasons to stay in the crypto-verse.

The entire economy is down. The increased inflation rates have taken a toll on several markets. As CZ mentioned, even the stock market has been down. However, the limited involvement of regulators in the crypto-verse and the abrupt bear market that occurs once in a while has scared off a good part of the industry.

As they say, “Fortune favors the brave.” It looks like only a few would survive the ongoing bear market. Are you brave enough?