It has been a down year for cryptos across the board, including one of the biggest on the market. But could a tried-and-true investment strategy for average-income investors still produce results this month? We break down the Bitcoin dollar-cost averaging strategy’s usefulness in December 2022.

We have one month until 2023 enters the fray, and with the turning of the calendar comes all the potential of a new year. Conversely, with the past few months breeding volatility and uncertainty in the market, planning and preparation are as important now as they have ever been.

Bitcoin Dollar-Cost Averaging

For those who are new to the world of digital assets, dollar-cost averaging may be a foreign concept. It is rather simple, however, as the strategy is utilized throughout the investment sphere. Moreover, its place as a fixture with a lot of investors speaks to its tested nature.

Dollar-cost averaging is simply the process of investing a fixed-dollar amount on a regulated basis regardless of market movement or share price. The strategy is repeated and eliminates the stress and volatility inherent in digital asset investments.

The strategy works best for more people who don’t have the passive income to make bulk investments. Investing a little bit each day or week will more often be more beneficial than attempting to time out a market filled with experienced traders.

Although the strategy will always have its place, the past year for the crypto market makes everything a gamble. This leads to the question; is Bitcoin Dollar-Cost Averaging still a viable strategy in 2022? Despite the difficult year for the market, and Bitcoin specifically, it may just be something to consider.

Bitcoin in December 2022

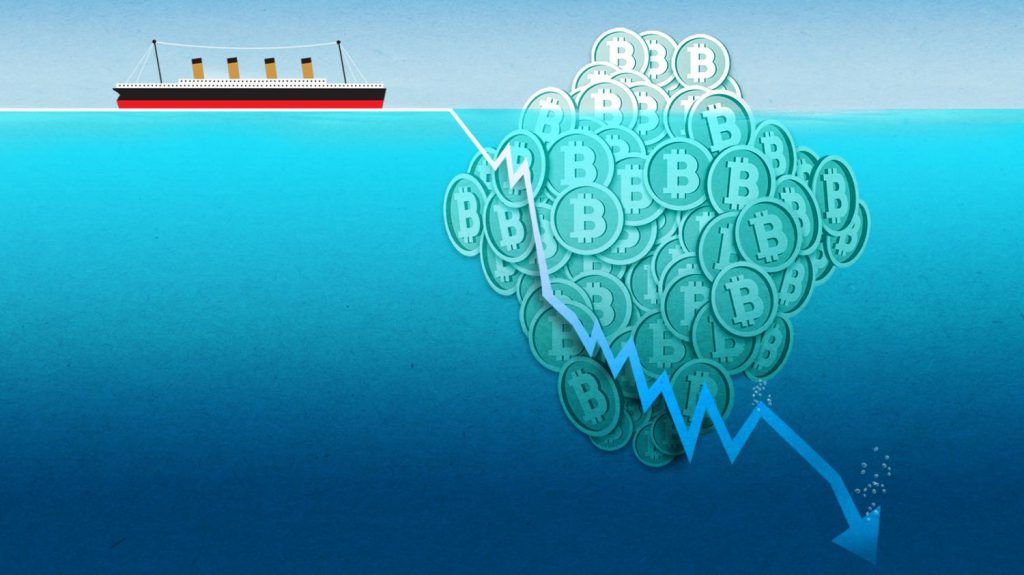

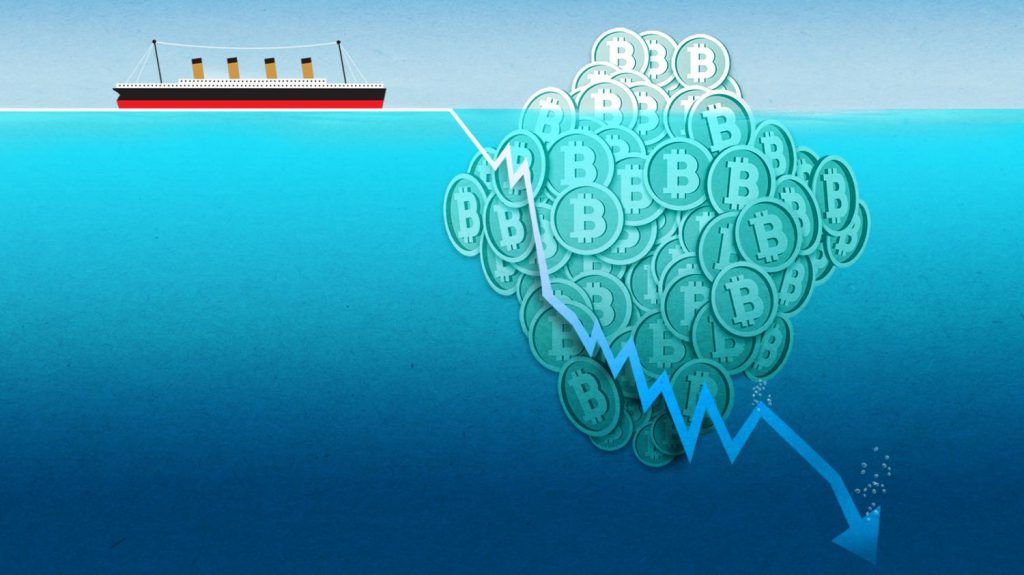

The collapse of FTX, the overall concern, and increased volatility in the market have proven to impact the entire industry. Bitcoin, the most well-known cryptocurrency, is no exception. The data is undeniable; the year has stripped the entity of 60% of its value. Moreover, the surrounding market is down $1.4 trillion.

With rising interest rates, economic fear, and a market suffocating, the question any investor must ask themselves is where it’s all going. The answer is, amidst the fear and failure, crypto has continued to move forward in 2022.

Blockchain developments have continued, and the industry has been better for it. Additionally, Binance and others are still investing in various funds exceeding $1 billion to aid various companies. Thus, assisting the market even more.

In that sense, the falling prices may simply be collateral of an overall economic circumstance. Furthermore, in the context of the dollar-cost averaging strategy, this may be the best time to find a seat at the table.

Bitcoin’s price has tested at the multi-month low of around $15,000. The overall feeling in the market is that the market is primed for a pump. Beincrypto noted a plethora of analysts and crypto market advocates are of the opinion that BTC is available at Black Friday Discounts in price.

Conversely, analyst CryptoKaleo added to that feeling, noting that a solid pump is incoming. The Twitter account noted that Litecoin, a BTC fork, works through periods of slow bleeding, followed by a pump to .02 BTC.

Verdict

Conclusively, there is no certainty in the stock market, even more so in the world of digital assets. Although the youth of crypto makes it difficult to compare to traditional finances, there is one quote that comes to mind. Warren Buffet once said, “Be fearful when others are greedy, be greedy while others are fearful.”

Bitcoin is in a vulnerable position, and the entire market stands there as well. However, the Bitcoin dollar-cost strategy allows you the potential to enter in at a premium price relative to a year ago. We know two things to be true: the cryptocurrency world is not going anywhere, and Bitcoin has been a premier name in the market since the beginning. Subsequently, the fear of the market, and the current price, could make the strategy a potential viability for investors.