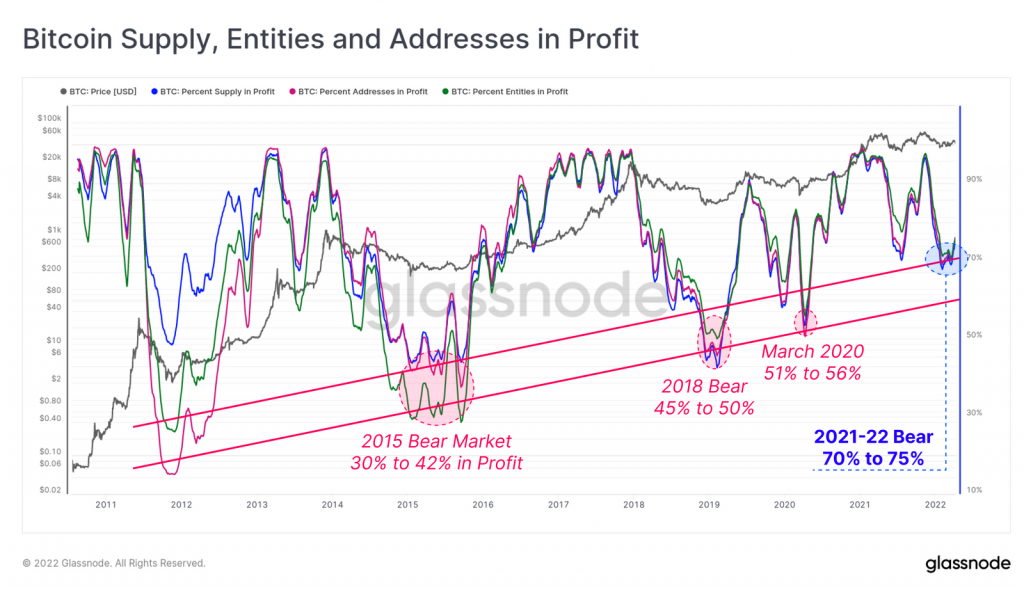

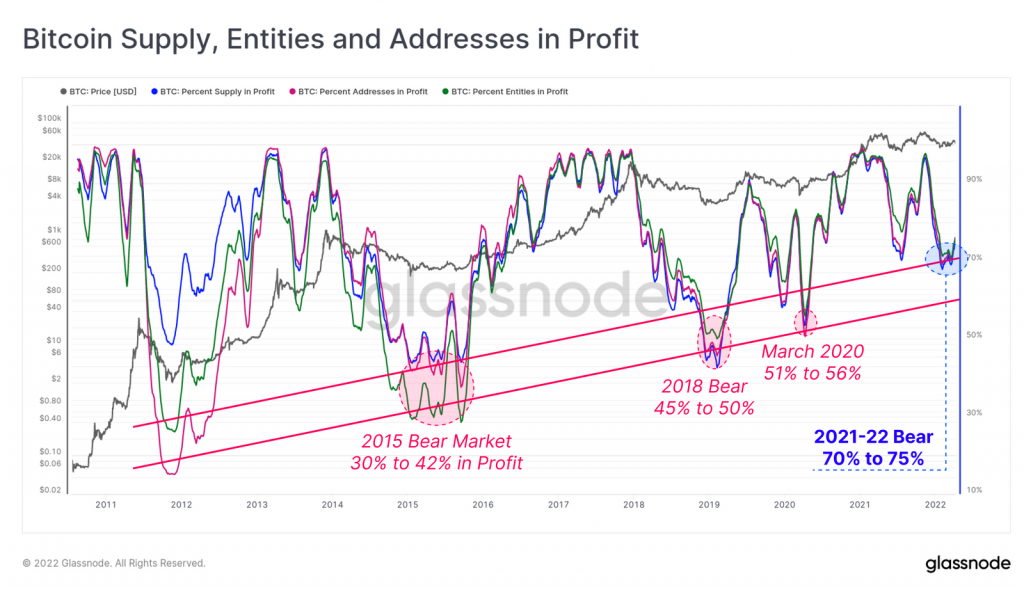

The bullishness associated with cryptocurrencies has officially reduced as the biggest crypto asset, Bitcoin dumped under $40,000. It was not the first time in 2022 that the value of BTC dropped under this crucial level, but this time it did convey a changing trend in the extended crypto market. According to data aggregator Glassnode, the falling price did not have much impact on the holdings of people as 75% of BTC addresses remained in profit.

This was a large value of positive returns holders and can be charted out at various levels of investment on the BTC price chart. The report analyzed the number of Bitcoin wallets that are in profit and noted that around 70% to 75% of addresses are seeing an unrealized profit. To put things in perspective, this value was close to 40% to 50% during the 2018 bear market.

Bitcoin bear weakening?

When we talk about a maturing cryptocurrency market, we often forget to notice the number of people who have gotten in over the past few years. This addition of investors has not only helped in the adoption of Bitcoin but also reduced the highly volatile nature of the cryptocurrency market. Therefore, although the price is not trading even close to its all-time high, the unrealized profits of people have remained much higher.

According to Glassnode analysts, this bear market is not as bad as the investors have witnessed earlier. They added,

“We can see that the current bear market is not as severe as the worst phases of all prior cycles, with just 25% to 30% of the market being at an unrealized loss. It remains to be seen if further sell-side pressure will drive the market lower, and thus pull more of the market into an unrealized loss like prior cycles.”

It further added that the long-term holders of Bitcoin [held BTC for over 155 days], were least likely to be at a loss. The long-term holders, nearly 67.5% of them, currently stood at an unrealized profit, whereas only 7.55% of the short-term holders were calculating profits.

As visible in the TradingView chart of Bitcoin, the asset was currently correcting from almost a 10% drop over the past day. After falling to $39,218 on 11th April, BTC was now trading at $40,154. It was a crucial range for the largest crypto asset as a further drop can push it into the bearish zone, while a move forward could trigger consolidation.

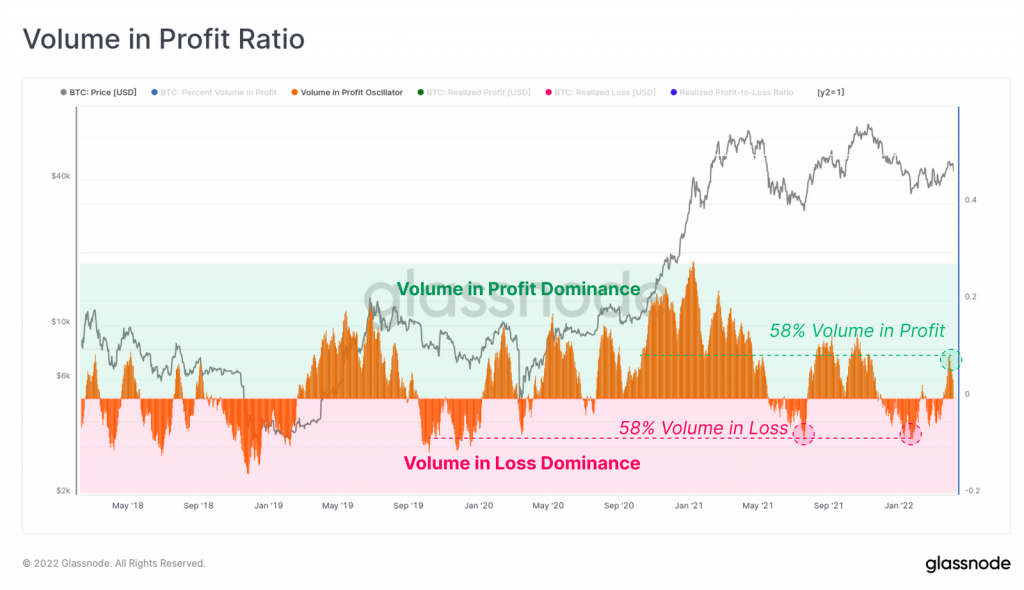

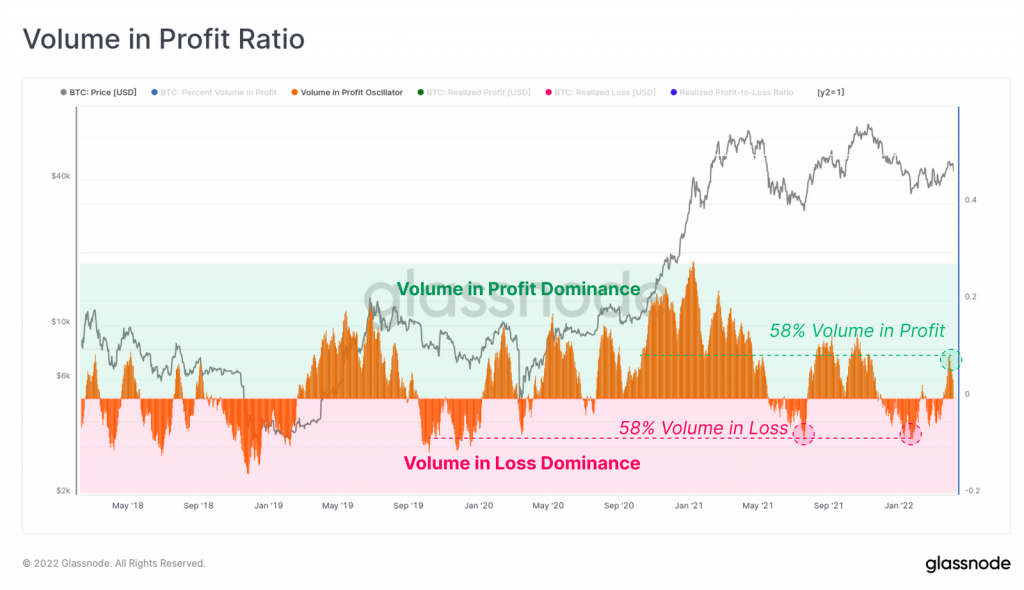

This can be visible in the Volume in Profit Ratio by Glassnode. As per the data, nearly 58% of the volume on the Bitcoin network was in “profit dominance”, which was something unseen since December 2021. Per Glassnode, the bear market typically sees long periods of transaction volume that make a loss. This reversal to profit dominance could be a sign of changing sentiment, with demand for Bitcoin able to buy the sell-side.

Woefully, the falling price is not adding to the maturity of the market or Bitcoin. The demand is lacking momentum, whereas, the sellers were seen taking profits into whatever market strength can be found. However, the daily realized losses have reduced from 20,000 BTC in January to around 8,300 BTC last week. This was a strong sign suggesting investors wanted to hold on and go through the bearish waves before the price can turn around.

According to analysts, we were facing a 2018- 2019 bear-market-like situation as the transactions on the network were close to what was seen then. 225,000 daily transactions are not at all close to the hype cycle observed during the bull market, however, if this was the bear market, it ain’t as bad as before.