Ethereum and altcoins have become quite appealing to institutions of late. The reason is obvious—The Merge. The much-anticipated upgrade of the second largest crypto network is expected to be a milestone event, that also elevates ETH’s price. Altcoins are expected to ride the same wave.

Bitcoin, however, is currently treading on a different path. Consider this: While most coins saw positive flows on the institutional investment product front over the past week, Bitcoin was the only major coin that noted negative flows.

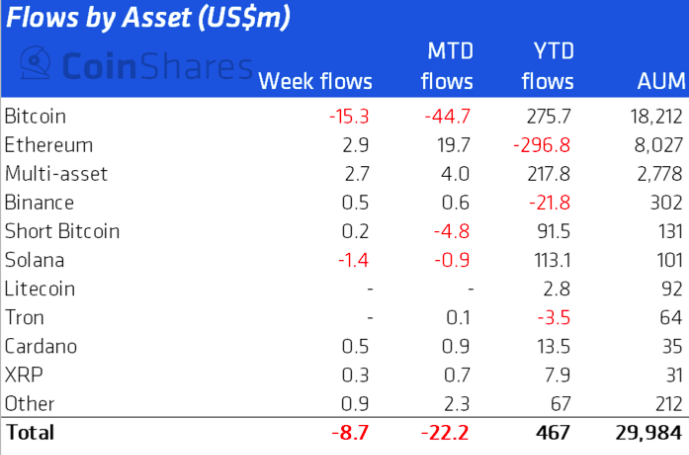

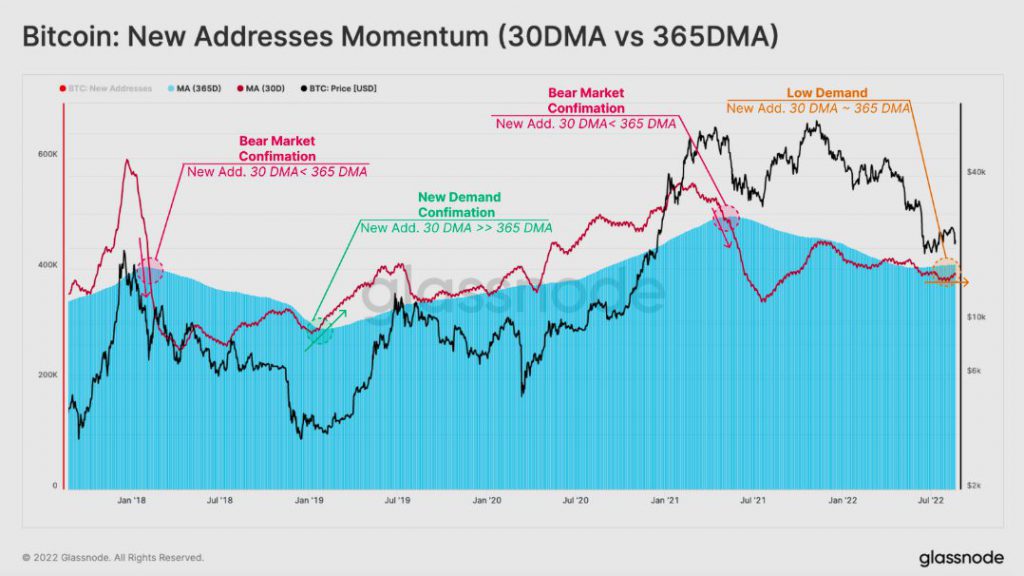

Outlining the same, CoinShares’ latest weekly report noted,

“Bitcoin, where the mild negative sentiment has been focussed, saw a third consecutive week of outflows totaling US$15m.”

On the other hand, since mid-June, there has been improving clarity on the Merge. Resultantly, Ethereum has seen a 9-week run of inflows summing up to $162 million.

Bitcoin’s low-demand

Bitcoin’s demand, to a fair extent, can be tracked via the state of its network activity. Basically, if the supply side is not balanced by new demand and rising network activity, it ain’t an encouraging sign.

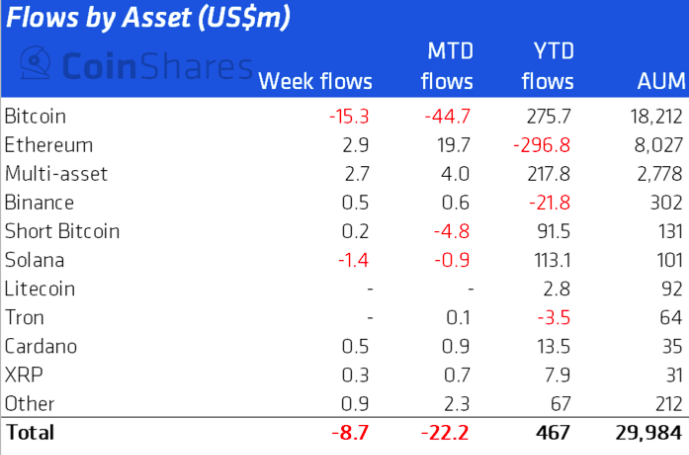

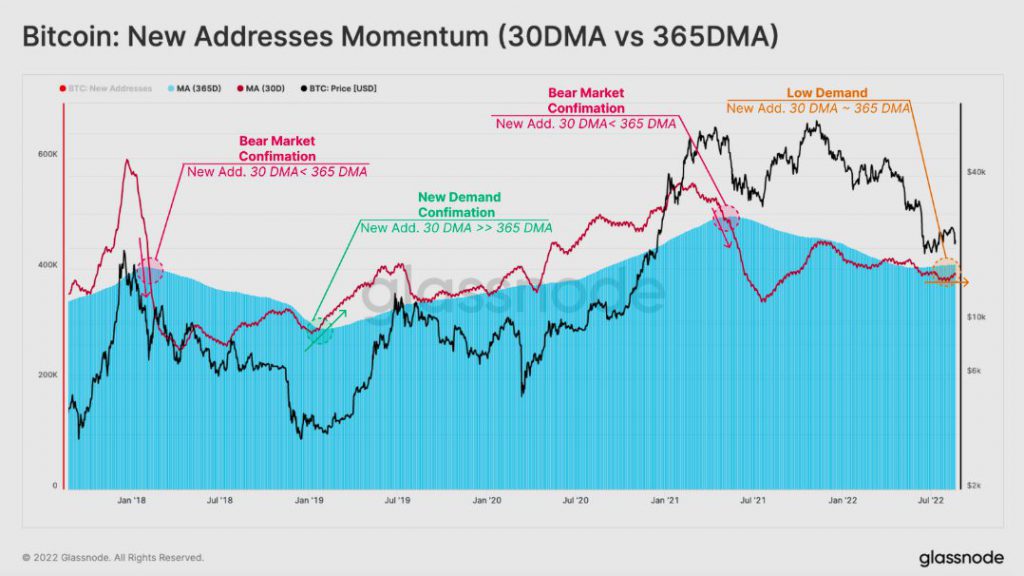

Now, as illustrated below, we got a bear market confirmation earlier this year when the new addresses joining the network fell sharply below the 365 DMA. There has been a slight recovery recently. However, the momentum isn’t that sufficient, for the needle still points towards low demand.

Elaborating on the same, Glassnode’s report noted,

“Examining the recent spot price bounce above realized price shows that the monthly average of New Addresses is still lower than the yearly average. This pattern can be considered a validation of low demand in the market.”

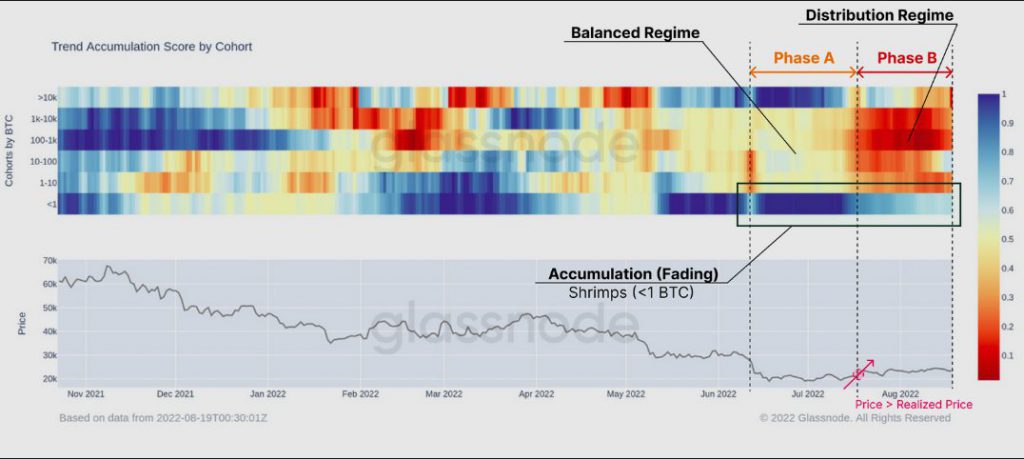

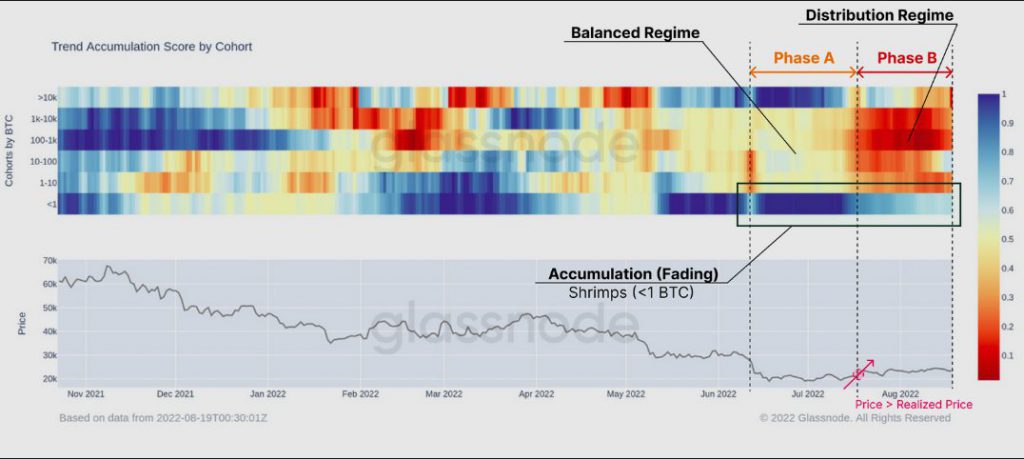

Bitcoin’s accumulation score further confirmed the lack of demand. After crashing below $20k this year, shrimps and whales were net accumulators. Other investing classes, however, showed a Balanced Regime [Phase A].

When Bitcoin reclaimed the realized price [pink], it stepped into its next phase. Per Glassnode, since the onset of this phase, all cohorts seized the opportunity to “distribute” their coins. In fact, shrimps’ persistent accumulation momentum has also weakened. As a result, instead of noting a demand influx, the sell pressure has been intensifying in the market.

Chalking out the same, Glassnode noted,

“Therefore, the recent price appreciation triggered a distribution phase across the board, adding sell pressure to the market.”

So, solely based on the deficient demand and lack of institutional appetite, Bitcoin will find it challenging to organically rally on the price charts. However, with the broader market expected to trade in green as The Merge nears, Bitcoin will likely re-couple. More so, because it shares quite a high correlation with Ethereum [0.94] and other top alts. However, considering the state of the network activity at the moment, it doesn’t seem like the potential uptrend will be sustainable.